Stablecoins: A Roulette for the Future of the Cryptocurrency Market

The stability of stablecoins was a major issue in the cryptocurrency space in 2022, particularly after the collapse of TerraUSD and the deviation of Tether from its USD peg.

At the time this article was written, the market capitalization of stablecoins was approximately 139.3 billion USD, distributed among USDT (66.3 billion), USDC (44.5 billion), BUSD (16.7 billion), DAI (5.8 billion), and 130 other stablecoins listed on CoinMarketCap.

The biggest chunk is for off-chain collateralized stablecoins

Off-chain collateralized stablecoins, such as USDT and USDC, make up the largest portion of the market, accounting for 78% of the market capitalization. These stablecoins typically promise to redeem their tokens 1:1 for a real-world asset, such as the USD, on demand. However, redemptions are often subject to minimum transaction sizes, fees, processing delays, or other requirements.

A variety of events can trigger a loss of confidence in a stablecoin’s ability to maintain its peg, including a drop in the price of the collateral assets or a lack of trust in the custodian of those assets, as well as a sudden lack of confidence in the stablecoin itself.

The rapid growth of stablecoins, particularly Tether, into a critical role in the cryptocurrency market as a place to store wealth between investments has raised concerns about their stability and the potential for negative consequences if investors lose confidence in them.

DAI losing ground

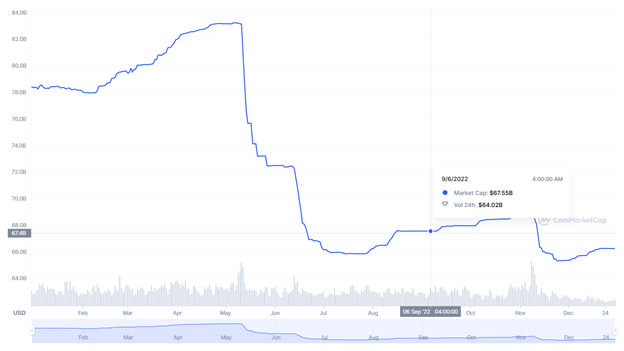

In 2022, DAI lost 45% of its market capitalization, falling from 10.37 billion to 5.76 billion USD. While the token held up well during various challenging times, particularly when USDT and USDC lost their pegs for a short time, the Terra event in May had a significant impact on DAI.

A profitable business for centralized exchanges

Stablecoins play a crucial role as a medium of exchange within the digital asset ecosystem, and over 80% of trade volume on major centralized cryptocurrency exchanges involves stablecoins as part of the traded pair.

Tether was particularly popular on FTX, which reportedly accounted for nearly a third of all USDT trading volume.

In response to the stability issues with Tether, Coinbase has encouraged its customers to switch to USDC stablecoins, which the exchange helped to found, and is offering to do the swap for free.

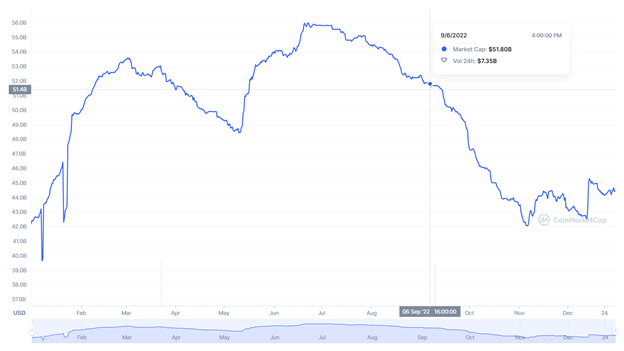

Binance, on the other hand, has begun automatically transferring its users’ stablecoins to BUSD, a stablecoin developed by the company, on September 6, 2022. This initiative excludes Tether.

It remains to be seen whether the ongoing consolidation of stablecoins will make it easier for cryptocurrency exchanges to account for their finances.

Regulators are on it now

Although the cryptocurrency market is still relatively small, regulators are now paying attention to stablecoins. The collapse of UST and FTX is likely to lead to increased calls for regulation of stablecoins. In the US, Committee Chair Maxine Waters and ranking Republican Patrick McHenry of North Carolina are negotiating a bill that would give banks the ability to issue their own stablecoins and subject nonbank issuers to the oversight of the Federal Reserve.

The biggest risk remains the potential for a stablecoin run, which could lead to significant losses for investors and potentially destabilize the cryptocurrency market.