The Ripple Effect: Analyzing the Impact of Crypto-Friendly Bank Failures on the Cryptocurrency Industry

Being “the bank in crypto”, Silvergate once counted some of the giant crypto firms as its clients. As a matter of fact, almost 90% of the bank’s deposits belonged to digital asset firms. So, certainly, its failure sent a bad signal for the rest of the industry, and gave regulators a key example of what could happen if the banking industry comes near crypto.

This kept people wondering about the fate of the rest of banks that are exposed to these currencies.

The primary concern for crypto companies is the need to find alternative banks to conduct their business. This process may prove simpler for certain firms, especially the well-established giants of the crypto sector, while others may face greater challenges.

Companies with a track record of clean operations and no major issues are less likely to encounter difficulties, as they can likely persuade a bank that the failures of Silvergate and Signature Bank were not due to their own actions.

Due to recent warnings from Federal regulators cautioning financial institutions to exercise greater care when dealing with crypto customers and potentially requiring permission, new startups in the sector may face greater challenges in obtaining banking services.

As for crypto, the failure of banks had a significant negative impact on some of them, especially stablecoins.

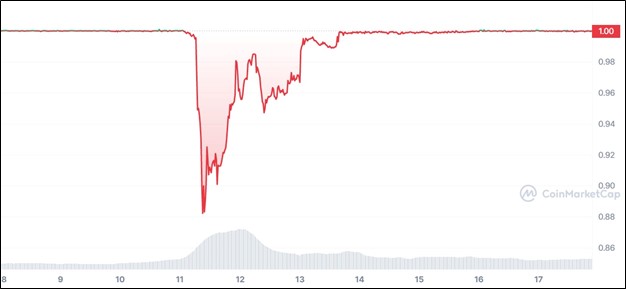

The value of the USD coin (USDC) issued by Circle Internet Financial Ltd. declined sharply after the firm revealed that it had $3.3 billion tied up in Silicon Valley Bank (svb). After shocked investors cashed out more than $2 billion worth of USDC, the stablecoin fell below 87 cents on Saturday (March 11).

In unison, DAI, the dollar pegged cryptocurrency that is pegged to the US dollar and backed by Ethereum and a number of other Ethereum-based cryptocurrencies, also fell to 90 cents on Saturday (March 11). On that day, traders started to exchange USDC and DAI to the Tether stablecoin, as they considered it to be a safer option since Tether’s issuing firms had no exposure to svb.

Nevertheless, on March 12th (Sunday), shortly after the US government intervened and provided assurance for all deposits held by svb and Signature Bank, and after Circle announced its intention to utilize its corporate resources to cover any deficits and recommence redemptions on March 12th (Monday), both USDC and DAI quickly regained their value and returned to their one-dollar equivalent.

Circle did not waste time and soon, after the svb collapse, collaborated with a new banking partner, Cross River Bank, to handle the minting and redemption of USDC.

Although some cryptocurrencies have declined in value following the bank failures, these failures have seemingly fashioned an ad for Bitcoin self-custody.

Specifically, the failure of svb was seen by some observers as a blessing for Bitcoin, as it underlined flaws in the fractional reserve system of traditional banking and featured the decentralized, immutable coin as a hedge against traditional centralized banking.

With this in mind, many blamed crypto for svb’s failure. Nevertheless, it had nothing to do with crypto. It was clearly a combination of the bank’s risk mismanagement and the sharp interest rate hikes after a decade of extremely low borrowing costs.

In fact, the collapse of svb unleashed Treasury volatility. In the latest edition of The Bitcoin Layer newsletter, researcher Nik Bhatia and market analyst Joe Consorti, said, “Within the banking industry, the issuance of Treasuries has resulted in the generation of billions of dollars in unrealized losses. This serves as another instance that in a fractional reserve banking system, individuals who deposit funds are essentially acting as lenders rather than depositors.”

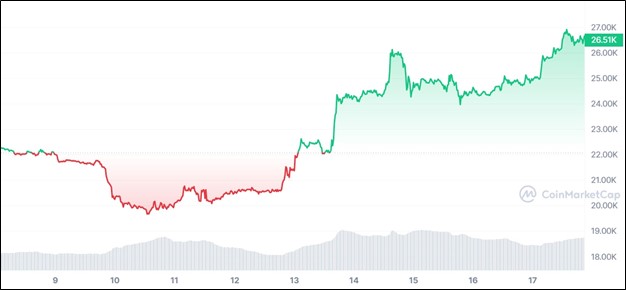

Technically, the collapse of svb should be highly bullish for Bitcoin as the latter literally fixes the issue of fractional reserve system. But, Bitcoin’s price initially dropped following the collapse of the bank and could barely rally 2% over the weekend due to a decrease in liquidity.

However, Bitcoin then surged to reach a high of $22,500 (recording a 15% increase from a two-months low of $19,500) on Monday 13, as money was moving from banks and stablecoins to Bitcoin since traders were hesitant about the counterparty risk associated with bank accounts and stablecoins.

After one day, on March 14, Bitcoin sharply increased to hit $26,000 and is currently swiveling around $27,500.

Source: CoinMarketCap

Binance, the largest crypto exchange by volume, also took part in the rise of Bitcoin and other crypto prices as it exchanged $1 billion worth of its stablecoin Binance USD (BUSD) to Bitcoin, Ether and other cryptocurrencies on March 13. Binance’s action also encouraged other people to sell their BUSD for Bitcoin.

The failure of svb continues to resonate, hitting bank stocks and spilling over to Credit Suisse, while disclosing hidden stress. Again, we find ourselves in the midst of a banking crisis that is meant to be solved by the old-fashioned story of debasing the currency and printing money.

The bank collapses and repossessions by authorities highlight the continuous risks and uncertainties that still threaten traditional markets. As the flaws of the current banking system become more and more noticeable, market participants are starting to recognize the value of a financial network that is decentralized, secure, and data-driven.

As such, the banking crisis is expected to result in a wider adoption of crypto assets and encourage investors to seek asset diversification options that are not dependent on banks.

Do we need Crypto-friendly banks?

While major cryptocurrencies have stabilized after the Fed’s interventions, it is still disheartening to watch the three largest crypto-friendly banks fail.

“There are very few options now for crypto firms and the industry will be strapped for liquidity until new banks step in,” Nic Carter of Castle Island Ventures told CNBC.

According to Mike Bucella, an investor and executive in the crypto space, many crypto firms are turning to Mercury and Axos, which are banks that lend to startups.

Also, Circle has publicly revealed that it is moving its assets to Bank of New York Mellon (BNY Mellon) after Signature Bank was closed.

Regulators are expected to continue warning about the danger tied to crypto, but we hope that the contagion risk will not spillover to other banks holding such deposits, as these banks are meanwhile crucial for the evolution of the crypto industry.

On one hand, unlike other traditional banks, crypto-friendly banks facilitate on ramp and off ramp operations, increasing the inflow of capital to the crypto market and facilitating crypto trading and transactions by providing easier access to fiat currency. This makes it easier for individuals and corporations to engage in the crypto economy.

On the other hand, relative to a lot of stablecoin issuers and crypto exchanges, crypto-friendly banks are safer as they are regulated by the U.S. government, and so, are subject to capital regulations and have public audited financial statements.

Although this may not prevent their failure, authorities will not easily allow a ripple effect to occur even if they had to print money from thin air, as we have seen lately.

Without the support of crypto-friendly banks, as a mechanism, it would be difficult for the crypto industry to operate and attain a sustainable growth, at least for the time being!