Consensys recently published an Ethereum DeFi report covering the decentralized finance ecosystem on Ethereum. It looked at the second quarter of 2021. DeFi came to solve the glaring contradictions that decentralized money should also come with decentralized services.

Ethereum addresses

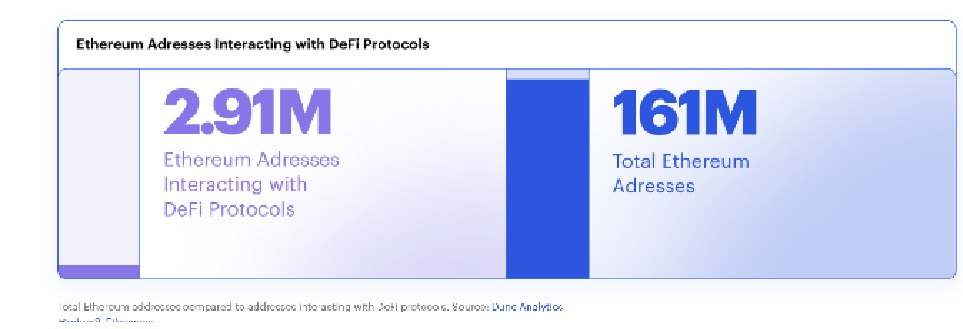

Given that Ethereum has long been the platform of choice for DeFi, it was important that the report cover the number of Ethereum addresses and active DeFi addresses. As per the report, as of July 1st 2021 there were 161 million unique Ethereum addresses, a 10 percent increase from the end of Q1 2021. Out of those 161 million Ethereum addresses, 2.91 million used at least one DeFi protocol. This is a 65 percent growth from Q1 2021. Active DeFi addresses represent only 1.81 percent of all Ethereum addresses.

Non-Custodial Wallets

Another metric used in the report to gauge DeFi usage is the number of monthly active users on MetaMask, which the non-custodial wallet on Ethereum. By June 1, 2021, MetaMask monthly active users surpassed 8 million.

Stablecoins as Indicator

Stablecoin supply continued to grow at a rapid pace in Q2 2021, representing a total issuance of nearly $65 billion USD, up more than 60% since the end of Q1 2021. At the advent of stablecoins on Ethereum, USDT (issued by Tether) represented the largest proportion of stablecoins on Ethereum. Tether now represents 48% of the total stablecoin market on Ethereum, decreasing from approximately 58% of the total supply at the end of Q1 2021.

DeFi lending protocols like MakerDAO, Compound, and Aave now hold about 23% of the USDC supply. Stablecoins, like MakerDAO’s DAI or Centre’s USDC, are not only one of the great early foundations for DeFi but also are a way to hedge against volatility in crypto markets. Swaps between ETH and other ERC-20 tokens and stablecoins are one of the most frequent trading pairs that users access through MetaMask Swaps.

Beyond hedging against volatility without having to convert ETH and other tokens into fiat currency on a centralized exchange, stablecoins are a fundamental building block for other DeFi primitives, like borrowing and lending. Outstanding DeFi debt increased from $10 billion USD to an all-time high of $18 billion USD in mid-May until asset prices of ETH and other ERC-20s crashed, causing a record $362 million USD in liquidations on May 18th.

Decentralized Exchanges (DEXs)

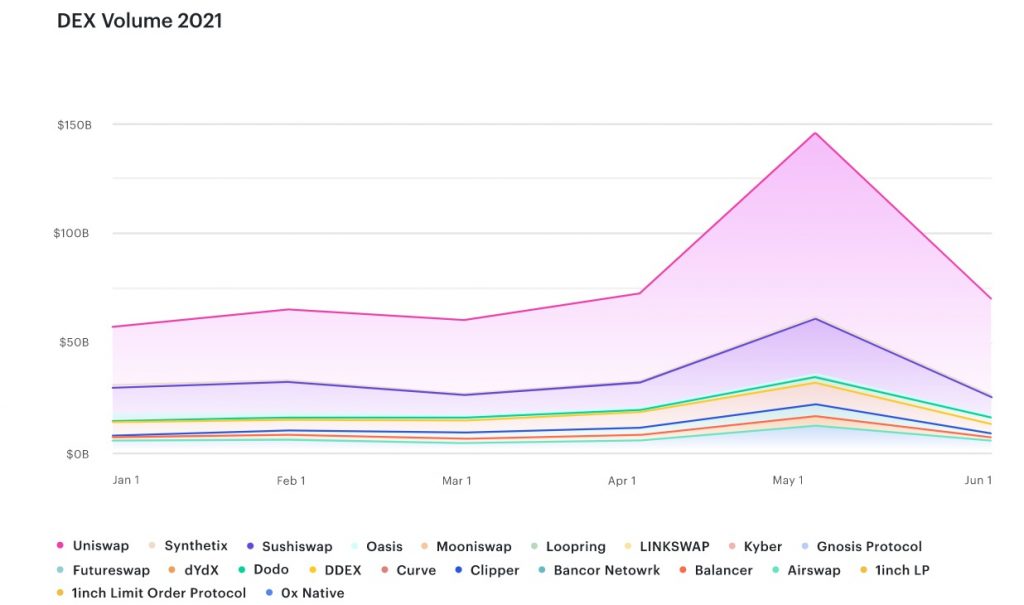

In Q2 2021, DEXs saw the highest ever volume, with May alone witnessing a whopping $173 billion USD in volume, and Q2 total of $343 billion USD. This surpassed Coinbase’s total trading volume of $335 billion in Q1 2021. This is notable because DEXs enable trading only for EVM-compatible assets, whereas 58% of Coinbase’s trading is Bitcoin.

One of the significant moments for DEXs in Q2 was Uniswap’s deployment of its third version, Uniswap V3. Uniswap’s market share of DEX volume increased from 60% to 74% throughout Q2. The major change for Uniswap V3 is improving its capital efficiency, or concentrating funds at the price range where an asset is most likely traded.

From the data and analysis presented, it’s not hyperbole to claim that the entire financial system is being rebuilt from first principles with more security, transparency, and composability across protocols.

Institutional Investors interest in DeFi

As per the report more regulated institutional investors are now stepping into DeFi. They are driven to take advantage of the exceptional investment returns, but also able to do so from a regulatory and compliance perspective. PWC reports 47% of traditional hedge fund managers, representing $180 billion of AUM, are looking at investing in crypto. An Intertrust survey found hedge funds are expected to hold 7% of their assets, equating to $312 billion in cryptocurrency in 5 years. Investment firms will no doubt lead the adoption of DeFi.

The requirements of institutional finance can be mapped using the capital allocation cycle — from research, pre-trade compliance and best execution to monitoring, reporting, and custody. Over the last 6 months, there has been an explosion in products and services in all these categories. Capital has been flooding in to build the necessary DeFi infrastructure.

It’s not just the tooling and infrastructure around DeFi that is being built. DeFi itself is also innovating to provide access to institutional finance. One example is private lending pools that ensure only verified participants (KYC laws) have access to on-chain asset management, such as Aave’s permissioned pools. Compound Finance recently launched the Compound Treasury, a new product that will allow institutions to earn a fixed interest of 4% a year.