Deloitte Blockchain report 2021 bullish reviews on digitalassets

76 percent of respondents believe digital assets will serve as a strong alternative to, or outright replacement for, fiat currencies in the next 5–10 years.

Deloitte has released its annual “Global Blockchain Survey” Blockchain report. Findings from the Deloitte Blockchain report shows that the financial services industry (FSI) are bullish on digital assets, cryptocurrencies and Blockchain.

Findings from the Deloitte Blockchain report showed that 73% of respondents fear their organizations will lose competitive advantage if they fail to adopt blockchain and digital assets, and 76% believe that the end of physical money is near, with digital assets replacing fiat currencies in the next five to 10 years. Despite these challenges, there is shared optimism about future revenue opportunities from blockchain, digital assets and cryptocurrency solutions. FSI pioneer respondents offer the greatest confidence, with 93% strongly or somewhat agreeing and 80% each for FSI overall and all survey respondents.

“In the last year, we’ve seen a significant shift in how the global financial ecosystem is thinking about new business models fueled by digital assets, and how this is playing a meaningful role in financial infrastructure,” said Linda Pawczuk, principal, Deloitte Consulting LLP, and global and U.S. blockchain and digital assets leader. “The Deloitte 2021 ‘Global Blockchain Survey’ shows that the foundation of banking has been fundamentally outlived and financial services industry players must redefine themselves and find innovative ways to create economic growth in the future of money.”

Key survey findings

The “2021 Global Blockchain Survey” finds that global FSI leaders see digital assets and their underlying blockchain technologies as a strategic priority now and in the near future. Nearly 80% of overall respondents say that digital assets will be very/somewhat important to their respective industries in the next 24 months. Eighty-one percent strongly agree that blockchain technology is broadly scalable and has achieved mainstream adoption.

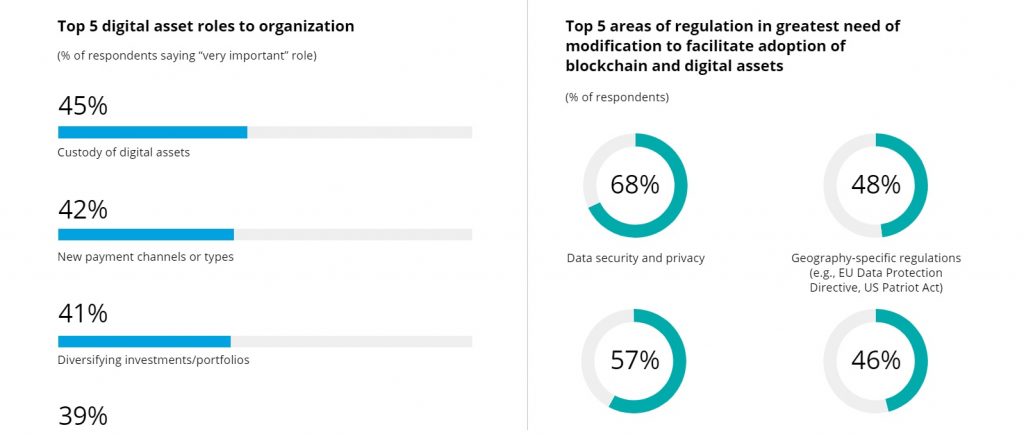

As this shift to digital continues to accelerate industry-wide transformation, financial services organizations must find new business models. Custody (45%), new payment channels (42%) and diversification of investments/portfolios (41%) stand apart as leaders among potential use cases for overall survey respondents. Just as with safekeeping and transacting money, lending and capital formation are in for an upgrade, as new approaches address a growing appetite for more efficient ways to secure funding. With this, 36% of overall respondents say that access to funding sources will serve as the largest area of digital asset impact to their respective organization.

In addition, the survey’s findings also support the use of digital assets to simplify payments which is currently a very fragmented and complex process. Some 43% of FSI respondents say that new payment options represent a “very important” role for digital assets in their organizations. Among FSI pioneers, that figure jumps to 63% — virtually tied for first within that group.

The shared optimism over the potential of blockchain, digital assets and cryptocurrency solutions is not without obstacles, however. Approximately 6 in 10 overall survey respondents — and seven in 10 FSI pioneers — identified regulatory barriers among the biggest obstacle to acceptance of digital assets. Security concerns also rise to the top of the list: Nearly 70% of overall survey respondents identified the regulation of data security as needing the greatest modification, and 71% of overall survey respondents identified cybersecurity among the biggest obstacles to acceptance.

“As digital asset disruption rapidly changes the marketplace, global financial services are striving to reinvent themselves, creating businesses to generate new sources of revenue,” said Richard Walker, principal, Deloitte Consulting LLP, and U.S. financial services industry blockchain leader. “Opportunities for real change in several areas of the global financial markets exist for those players that explore new ways to harness the power of blockchain technology and digital assets to reimagine their business models.”

Survey methodology

Deloitte conducted the “2021 Global Blockchain Survey” between March 24 and April 10, 2021, with a sample of 1,280 senior executives and practitioners in 10 locations: Brazil, mainland China, Germany, Hong Kong special administrative region, Japan, Singapore, South Africa, United Arab Emirates, United Kingdom, and United States.