3AC’s Enigmatic Auction: Sotheby’s NFT Event Shatters Expectations and Secrets, Raking in $11 Million

Following the acquisition of a highly sought-after Dmitri Cherniak NFT by the founders of bankrupt cryptocurrency firm Three Arrows Capital for $5.8 million in August 2021, they stored a printed copy of the digital artwork in their Singapore offices.

It was placed behind the billiards table and slightly to the left of the coffee creamer, reflecting their casual approach.

This nonchalant attitude seemed to extend to the hedge fund’s doomed portfolio, which became apparent when Three Arrows Capital declared bankruptcy the previous year.

The founders, Kyle Davies and Su Zhu, fled to Bali, where extradition requests from the United States hold little power, leaving creditors with a demand for nearly $3.5 billion. The company’s liquidator, a consultancy called Teneo, decided to sell off all assets, including the NFTs, to alleviate some of the deficit.

On Thursday evening, Sotheby’s held the second part of their “Grails” sale, featuring around 40 digital artworks owned by Three Arrows Capital.

Surpassing the estimated value of $4.8 million, the sale ultimately raised just under $11 million, including buyers’ fees.

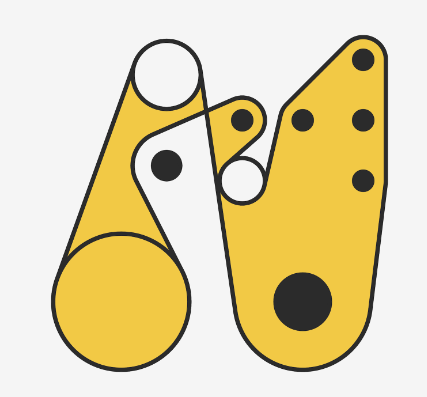

The highlight of the auction was Cherniak‘s prized artwork, titled “Ringers #879 (The Goose),” which was now elegantly displayed on a gallery wall instead of being placed on a countertop next to a Nespresso machine.

After an intense bidding session lasting nearly 10 minutes, the artwork, which defies the randomized logic of its algorithm by resembling a bird, was sold for $6.2 million to the 6529 NFT fund owned by @punk6529, a well-known buyer of high-value NFTs who maintains anonymity through a Twitter handle.

Sotheby’s staff noted that the salesroom was filled with the youngest audience they had ever seen, with many first-time bidders in their 20s and 30s raising their paddles to compete for artworks ranging from a few thousand dollars to six figures.

One buyer participated in the auction for Kjetil Golid’s “Archetype #46” and ultimately secured the artwork for $30,480.

Dealers who attended the auction to gauge its popularity left feeling content. Ariel Hudes, head of Pace Verso, expressed her satisfaction, describing the vibrant atmosphere in the room and noting the evident presence of a younger market.

It has been over a year since Sotheby’s last conducted a significant NFT auction. The previous attempt was a disastrous $30 million sale of CryptoPunks, resulting in confusion, blame games, and a disappointing event. However, the memory of that failure faded into the background as collectors flocked to a fire sale reminiscent of when Elon Musk famously sold the furniture from Twitter HQ’s offices in January.

Nostalgia appeared to be a driving force behind the sales, with collectors seeking tokens of the once booming $3 trillion crypto supercycle that has since lost a significant portion of its value due to economic challenges, regulatory pressures, and its associations with organized crime. Even the auction’s subtitle seemed to mock the crypto catastrophe. Was the collection considered “iconic” because of the valuable artworks it featured, or was it “iconic” due to the scandalous downfall of its corporate sponsor?

Michael Bouhanna, the head of digital art and NFTs at Sotheby’s, emphasized that the auction focused on quality. He stated that the opportunity to acquire these works was exceptionally rare, although he acknowledged the role of provenance in their appeal.

The notorious histories associated with these NFTs undoubtedly fascinated the crypto whales, eager to spend their remaining coins on CryptoPunk collectibles and generative artworks by artists like Tyler Hobbs, Erick Calderon, and Jeff Davis. Bouhanna mentioned that there were numerous advanced bids even before the auction started, and most lots surpassed or fell well within their estimated values.

One might speculate whether the auction was strategically designed to exceed expectations, especially considering the relatively quiet market and the presence of many serious collectors at Art Basel in Switzerland, indulging in aperitifs and enjoying the art scene.

Evidence obtained through an emulation technique, which involved inspecting elements of Sotheby’s bidding system on their website, revealed that the top lot of the auction, titled “The Goose,” had already been posted with a bid of $2.7 million even before the bidding officially began.

This amount, only a few hundred thousand dollars shy of the item’s high estimate, practically ensured the success of the evening right from the start, but it may not necessarily indicate genuine market demand. An anonymous source familiar with the auction shared this information with ARTnews, although a spokesperson from Sotheby’s dismissed the significance of the number.

Michael Bouhanna, unfazed by the absence of in-person attendees, expressed confidence in the success of the auction, stating that those interested had already participated online. He reassured that the auction would be well-supported by the 20 registered bidders in the room, as well as the audience present to observe.

The saleroom witnessed a considerable amount of active bidding, surpassing the levels seen during the large modern and contemporary art sales of the spring season, where collectors have been favoring phone transactions. As an example, a couple from Texas traveled to Manhattan to bid in person, ultimately spending nearly $610,000 on a piece titled “Fidenza #216” by generative artist Tyler Hobbs.

Sotheby’s spokesperson confirmed that artists would receive royalties from the sales, and several artists personally attended the auction. Dmitri Cherniak, the artist behind “The Goose,” was seated toward the back, witnessing the artwork’s value climb into the millions.

Although the NFT had opened doors for the Canadian artist after its original sale to Three Arrows Capital in 2021, leading to meetings with museum directors and the opportunity to quit his day job, Cherniak expressed some dissatisfaction with seeing his artwork featured in an auction alongside CryptoPunks and other collectibles that were not closely related to the generative art he creates. He remarked on his criticism of projects that attempt to lump everything together, emphasizing his preference that “The Goose” would never be sold but rather enjoyed or donated to a museum.

However, the NFT had ultimately fallen into the hands of the liquidator and the auctioneer. Cherniak acknowledged that this was the reality of how society operates, even though it may not align with his ideal circumstances.