Crypto MiningFeaturedMENA NewsSecurity TokensTokenization

How Energy Sector is using Blockchain and tokenization to Benefit the Environment

Acording to a recent article published in the The National Newspaper in the UAE, as the world grapples with the challenges of reaching net-zero by 2050 and mitigating energy poverty, a unique intersection of blockchain and economic development is looking to solve many developmental challenges. Around 940 million people, equivalent to 13 per cent of the world’s population, have no access to electricity. Nearly 3 billion people, or 40 per cent of the population, do not have access to clean cooking fuel.

Mentioned in the article, companies like Libra Project, which is based in Abu Dhabi Global Markets, are looking to divert capital away from the developed economies and democratise ownership of sustainable assets for those living in the developing world. They are using tokenisation, where a company issues a blockchain token, that provides tradeable partial ownership of a real tangible asset. These tokens also promise sufficient liquidity and can be traded on the secondary market.

“We wanted to make a system where people got paid not on the amount of profit but on the amount of impact that has been delivered,” says James Spence, co-founder and director at Libra Project. “So, back in 2017, that’s when everyone was doing their ICO [initial coin offering], blockchain was just coming in, and we didn’t want to go down that road, because we looked at ICOs [and] thought these were illegal.” The company, which started in 2016, is looking at tokenising small projects in the developing world, with total valuations of $10 to $15 million. The token gives owners shareholder rights, providing transparent and highly democratised decision making, says Mr Spence.

The nascent global tokenisation market is expected to grow to $4.8 billion by 2025, at a 19.5 per cent compounded annual growth rate, from $1.9bn currently, according to Markets and Markets.

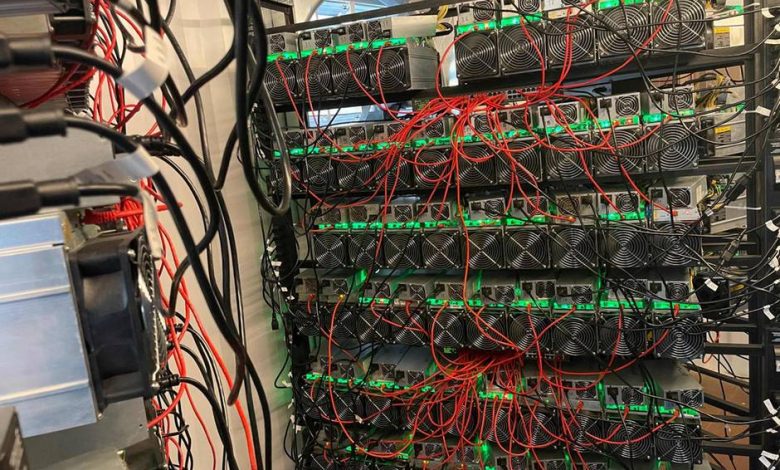

Tokenisation can help investors pitch in to fund stranded assets such as an isolated patch of the North American shale basin, which is economically unviable to develop. Gas from these assets can then be used to power Bitcoin data centres, which have a high energy impact. These data centres offset natural gas flared into the open by channelling them into mining for digital currencies instead.

Tokenisation can play a big role in improving the energy efficiency of big oil producers, such as the US, which wastes more than 50 per cent of the energy it produces because of inefficiencies. Iraq, Opec’s second-largest producer, could also reap the benefits of using technology to develop assets, particularly as the country faces a massive gas flaring problem, resulting in billions of dollars in lost revenue to the economy. Tokenisation could also mobilise investment in energy efficiency, especially as funding for the sector was projected to have fallen by 9 per cent in 2020.

While tokenisation is being embraced widely by the art world, allowing for efficient transfer and ownership of assets, it is also being increasingly used in developing energy projects, notably renewables and sustainable infrastructure.

Libra Project scours the developing world for projects where they can make the highest social impact. The company uses the United Nations Sustainable Development Goals as the yardstick to base their investment decisions. The UNSDGs aim to rid the world of poverty, hunger, gender inequality, lack of access to water and sanitation and polluting fuels, among others, by 2030.

“Now energy is just the first scope so, because it’s all based on blockchain, we can then consider multiple votes, as we start to build out,” says Mr Spence. “We look at building renewable energy projects. And then off the back of that [and] once that’s built, 10 per cent of the profits flow into the next vertical, so that’s water,” he adds. The company then mobilises the tokenised funds into building water projects, focusing on sanitation, reducing plastic bottled water, waterborne diseases as well as on food, health care and education. The yields for investors holding these tokens can be as high as 14.75 per cent, Mr Spence says. Libra Project is currently in the process of trying to lower the threshold for investment to $100, allowing all kinds of investors, particularly those living in the communities themselves to invest.

“The typical timescale of a power plant is 12 years. What we’re doing now is adding liquidity into this,” says Mr Spence. Currently, the company is looking to raise funds from accredited and institutional investors who have a minimum buy-in of $100,000. “We call [this the] private equity stage of tokenisation,” says Mr Spence. “Now, as we take this from where we are now to what we want to the call public space, it’s going to take about 12 months to get to that regulatory process and we want to be dropping this down to an entry level of $100.”

PermianChain, a natural resources tokenisation platform, allows investors to buy into stranded assets and use them as an energy source to mine cryptocurrency. The company specialises in communities that are currently undergoing transition away from fossil fuels, but may have an asset or two that remain stranded, making them unviable for commercial extraction.

The company is also looking to limit the flaring of gas across North American shale basins and channel that into crypto-mining. “Maybe, [there is] a lack of infrastructure to take that gas to the sales market, or a lack of capital or market incentive to even deploy the gas,” says Mohammed El Masri, founder and chief executive at PermianChain.

“So, in that case tokenising stranded gas is a perfect opportunity because you know it’s gas that’s not being used at the moment, and it can be put to better use in some other forms or ways on-site without even transporting it anywhere,” he adds.

The company channels the gas to power the cryptocurrency mining sector, which is in search of lower-cost, more sustainable energy to generate Bitcoin.

Tokenisation of energy assets is also gaining ground in the solar photovoltaic sector in the Middle East, where companies are encouraging consumers to buy into panels and take ownership of assets.

However, tech-savvy investors are also optimising blockchain to create value and opportunities in trendier assets such as Tesla superchargers.

Bahrain-based Fasset, which calls itself a platform for ethical financing of sustainable infrastructure, piloted the tokenisation of a Tesla Supercharger in the kingdom earlier this month.

The company partnered with NEC Payments to issue 10 tokens, which allow the users to own part of the supercharger, while also allowing them to use the tokens to charge their Teslas.

“Once you buy into this network, you get discounted rates for using it, so that’s why all of our initial users are Tesla drivers,” says Mohammed Raafi Hossain, chief executive at Fasset.

“The token itself is you can say, a key card or an access point to leveraging the supercharger itself,” he adds. “A typical share on Nasdaq doesn’t give you all of these rights but a tokenised effort combines all of these things. It becomes an asset, becomes a utility, it becomes a key card, all in one.”