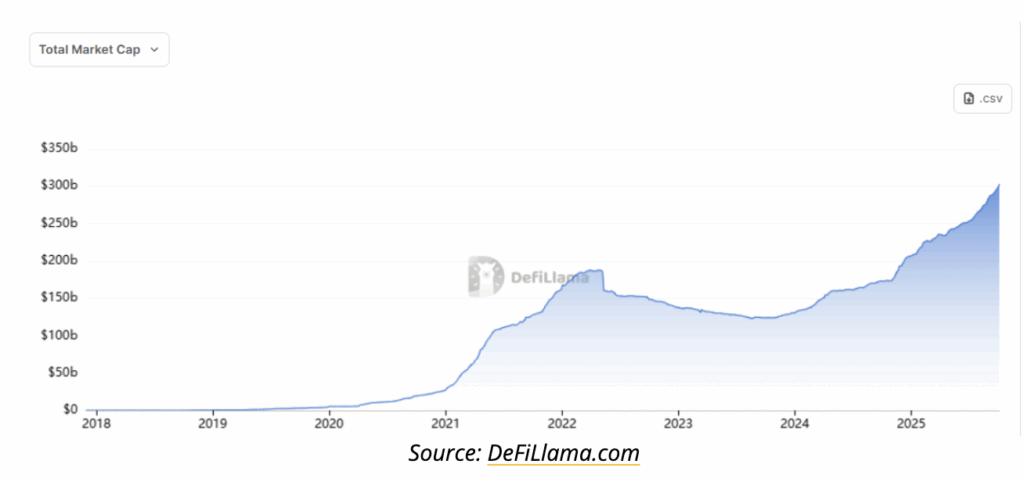

Global Stablecoin Supply Hits Record $300B, Marking New Era of Digital Liquidity

The total value of stablecoins in circulation has surpassed $300 billion, setting a new all-time high and sparking fresh optimism across the cryptocurrency market.

Analysts say the expanding supply could act as “rocket fuel” for digital assets, signaling that more liquidity is ready to flow into Bitcoin and other cryptocurrencies.

According to data from DeFiLlama, the stablecoin market has grown nearly 47% since the start of the year, marking one of its fastest expansion periods on record. The milestone comes just as October begins, a month that has historically favored Bitcoin price rallies, often referred to as “Uptober” by traders.

Liquidity in Motion, Not on the Sidelines

Industry experts emphasize that the surge in supply doesn’t represent idle capital waiting to be deployed but rather active liquidity moving through the crypto economy.

“Stablecoins are not sitting still, they’re being used to settle trades, fund positions, and bridge access to dollars where traditional banking falls short,” explained Andrei Grachev, founding partner at Falcon Finance. “Transfer volumes are in the trillions every month. This is capital in motion, not capital on hold.”

Stablecoins, digital tokens pegged to fiat currencies like the U.S. dollar, have evolved far beyond their role as a trading instrument. They are increasingly used for payments, remittances, and savings, especially in countries facing currency instability such as Nigeria, Turkey, and Argentina.

For instance, in parts of Africa, stablecoins have quietly become an essential part of daily economic life. In cities like Nairobi and Lagos, freelancers, merchants, and families rely on digital dollars to navigate inflation, volatile exchange rates, and costly remittance fees.

Services such as Kotani Pay and Yellow Card allow users to receive or send stablecoins like USDT and USDC and cash out through mobile money platforms such as M-Pesa, a process that now feels as routine as sending a text message.

For many, stablecoins serve as a practical financial lifeline: a faster, cheaper, and more reliable alternative to local currencies and traditional banking systems.

A Signal of Deeper Financial Integration

The latest data suggest that the stablecoin boom is not just a crypto phenomenon but part of a broader convergence between digital assets and global finance.

“The expansion of stablecoin supply is often a sign that new liquidity is entering the ecosystem,” said Ricardo Santos, Chief Technology Officer at Mansa Finance. “Crossing the $300 billion mark shows that stablecoins are becoming a permanent layer of financial infrastructure. They are the bridge connecting crypto with the real economy.”

Major financial players like Visa have already begun integrating stablecoin payments into their systems, highlighting their growing role in mainstream finance.

Capital Rotation on the Horizon

Market analysts expect the surge in stablecoin issuance to eventually flow into crypto assets.

In the past month alone, blockchain data show that Circle minted more than $8 billion in USDC on Solana, including $750 million in a single day.

“Capital doesn’t stay idle for long,” said technical analyst Kyle Doops. “Once confidence returns, this liquidity can quickly rotate into Bitcoin, Ethereum, and other assets, accelerating the next market cycle.”