Silicon Valley Bank in Trouble, Bolsters Capital Base Through $2.25Bn Share Sale

Silicon Valley Bank (SVB) is aiming to raise $2.25bn through a share sale after experiencing significant losses on its portfolio of mortgage-backed securities and US Treasuries.

The bank is struggling with rising interest rates and a cash crunch at many of the US start-ups that it has funded.

SVB plans to offer $1.25bn of its common stock to investors and $500m of mandatory convertible preferred shares, which are less dilutive to existing shareholders.

Private equity firm General Atlantic has agreed to purchase $500m of the bank’s common stock in a separate transaction.

The share sale is expected to help the bank shore up its capital base following a loss of around $1.8bn on the sale of approximately $21bn of its securities, which were categorized as available for sale.

As of the end of 2022, the bank held $26.1bn in available-for-sale securities, primarily in US Treasuries, as well as foreign government debt and mortgage-backed securities, according to The Financial Times.

It also held around $91bn of securities in a held-to-maturity portfolio.

SVB’s deposits had swelled during the recent tech boom years as it accepted cash from VC-funded start-ups, but much of this was invested in long-dated securities, like US Treasuries, which have now decreased in value due to increased rates.

SVB shares fell by 15% in after-hours trading in New York.

The bank’s focus on serving venture capital-backed US tech and life sciences companies led to massive growth in recent years, and its share price doubled from 2018 to the end of 2021, with its market capitalization surpassing $44bn.

However, a slowdown in VC funding, losses on investments made when rates were low, and cash burn at many of its clients have contributed to the bank’s current struggles.

Goldman Sachs and SVB Securities are serving as book-running managers for the share sales.

The real deal

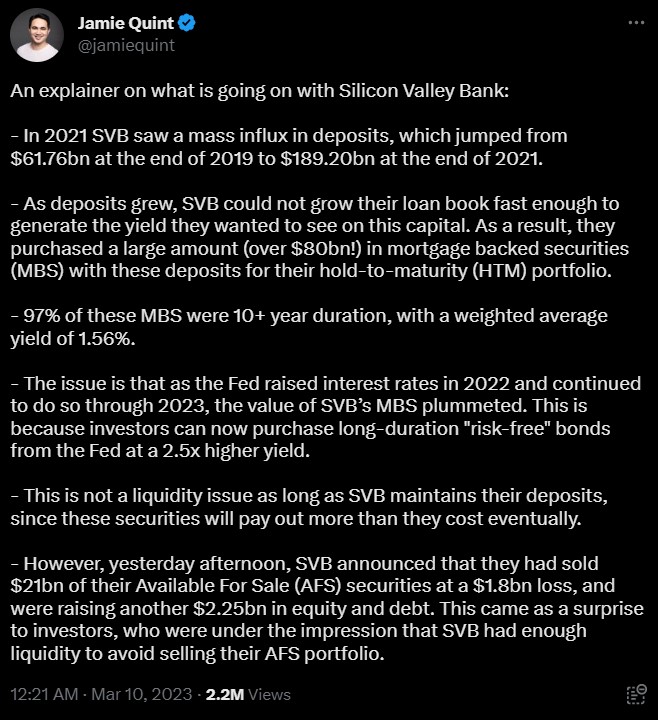

An explanation of what is going on with the bank was provided by Jamie Quint, Partner at Uncommon Capital and commentator on financial markets.

He explained that in 2021, SVB saw a surge in deposits, which grew from $61.76bn at the end of 2019 to $189.20bn at the end of 2021. However, the bank could not increase its loan book quickly enough to generate the desired yield on this capital.

As a result, it purchased over $80bn in mortgage-backed securities (MBS) with these deposits for its hold-to-maturity (HTM) portfolio.

Unfortunately, 97% of these MBS were 10+ year duration, with a weighted average yield of 1.56%.

As the Federal Reserve raised interest rates in 2022 and continued to do so through 2023, the value of SVB’s MBS plummeted.

This was due to investors being able to purchase long-duration “risk-free” bonds from the Fed at a 2.5x higher yield.

While this is not a liquidity issue as long as SVB maintains its deposits, the bank has announced that it had sold $21bn of its Available For Sale (AFS) securities at a $1.8bn loss, and was raising another $2.25bn in equity and debt.

This came as a surprise to investors who believed that SVB had enough liquidity to avoid selling its AFS portfolio.

SVB’s recent troubles have been attributed to a slowdown in VC funding, a cash burn at many of its clients, and losses on investments it made when rates were at rock-bottom levels.

The bank’s niche of serving venture capital-backed US tech and life sciences companies helped it enjoy massive growth in recent years, but the current challenges it faces may signal a shift in the industry, according to Quint.