What is happening in the crypto markets?

Bear markets are tough, we know, because this is our third one.

This is business as usual for crypto though, it moves in cycles every four years. I’m sure many of you are wondering: is it different this time? Is crypto dead? The short answer is no, but there are some slight differences this time around.

Remember six months ago when the markets were booming across all asset classes, and bitcoin was at an all-time high of $69,420? Back then, everyone wished that they had bought crypto when it was cheaper. But now that the market is down and crypto is cheaper, those same people are afraid to invest, and that’s totally understandable given the current state of the market. Markets are a reflection of the people. Our decisions are driven by emotion more than rational thinking. When there is a bull market, greed takes over. When there is a bear market, the fear takes over. This is how it’s always been and always will be.

To understand why asset prices are dropping across the board, including crypto, we must start with the macroeconomic conditions.

The Era of Cheap Money

In response to the COVID-19 pandemic, central bankers across the world increased money supply at an unprecedented rate. The United States Federal Reserve increased the money supply (M1) five-fold (from roughly 4 trillion to 20 trillion dollars) and kept interest rates near-zero. The European Economic Area followed suit, increasing its M1 from 9 trillion euros to 11.5 trillion euros, as did the UK, Japan, Indonesia, and a wide range of governments across the globe.

This massive injection of capital into the market resulted in a historic bull market for asset prices, particularly “risk-on” assets. In a world of excess capital, investors tend to bet on higher-risk, longer-term investments – such as TSLA, GME, and of course, BTC and other cryptocurrencies. When this happens, these assets act as an “inflationary battery,” storing excess capital. This excess capital helped propel the US stock market to all-time highs, at a time when the economy was at a complete standstill, and we were all locked down at home.

As this new money supply worked its way through the system, we started to see a sharp increase in the Consumer Price Index (CPI), the most popular metric for measuring inflation. CPI reached a 40-year high of 8.6% – a maddening figure considering CPI is criticized by many as underestimating true inflation. As a result of rising prices, the Federal Reserve had to take action. They announced that they would be reversing course and implementing quantitative tightening measures, as well as gradually raising the federal funding rate. While not in full swing, the announcement of tapering measures began to weigh on an economy still suffering from supply-chain issues and the “inflationary battery” began to unwind. This was further exacerbated by war in Eastern Europe and the implied geopolitical risks to the rest of the world.

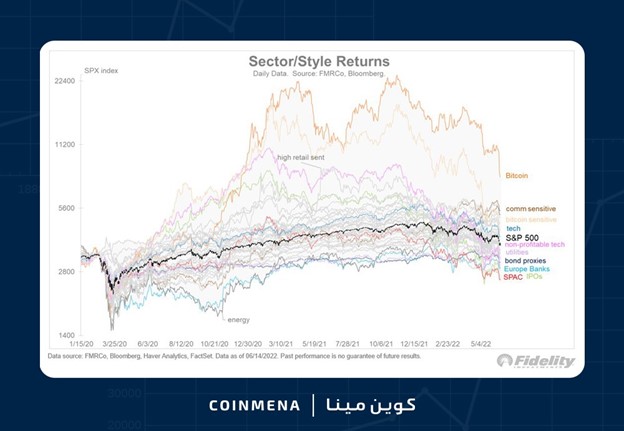

As the era of cheap money ended, so did the epoch of eye-watering returns for “risk-on” assets. While most consider Bitcoin to be an inflation hedge, the reality is it still moves in tandem with other risk-on assets, such as the Nasdaq (technology/growth equities). Inflation hedge assets tend to be psychological (e.g., Gold). It’s clear that Bitcoin has a long way to go in this regard, as during this downturn, it maintained its correlation with traditional markets, particularly technology stocks.

It’s quite easy to predict what happens to these assets during periods of high inflation and macroeconomic uncertainty. In the battle between food, water, and fuel vs. TSLA, BTC, and ETH, the former will win every time. This is why we describe these assets as “inflationary batteries,” as they store the inflationary potential of an economy and unleash that inflation when the conditions that propped them up, change.

While the Fed’s intention has been to curb inflation, they indirectly caused these assets to deflate into the traditional economy, further worsening inflation. This is the same phenomenon witnessed during the stagflation era of the 1970s in the United States, and the post-WWI hyperinflationary era of the Weimar Republic.

The Bitcoin Implications

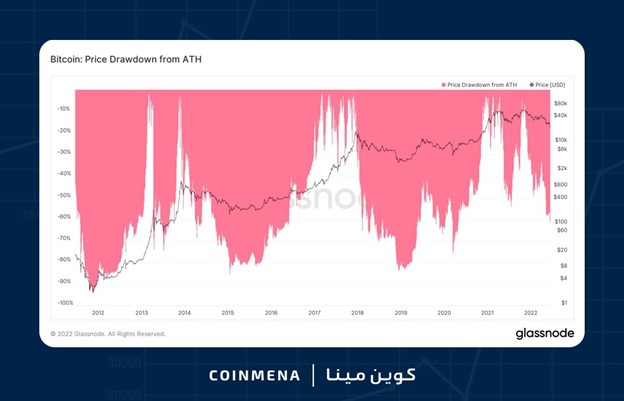

Now that we’ve established the macroeconomic backdrop, we can dive deeper into what is happening in crypto, more specifically, with bitcoin. BTC accounts for almost 50% of the total crypto market capitalization and is generally an indicator of overall crypto-market health. This is bitcoin’s 4th cycle. In 2012 prices dropped around 90%, then in 2015 and 2019 dropped over 80%. In this cycle, we are currently at a 69% drawdown from the all-time high price. However, notice that black line on the graph, the price of bitcoin is clearly trending upwards.

These drawdowns have historically represented generational buying opportunities. Based on the data, this is business as usual for bitcoin. While that doesn’t make going through these price drops any easier, it does give us some additional perspective. If this is your first cycle, now you know why HOLDing is hard. If it was that easy, everyone would do it.

This time is different, or is it?

So is there anything different this time around? The answer is yes and no. While the adoption and infrastructure build-out undertaken provides a lot to be optimistic about, it does well to remember that Bitcoin was born during the last bear market and has yet to witness a global macroeconomic recession. That being said, examining the leading blue-chip stocks, the last six months have seen Wall Street darling Shopify lose 75%, Netflix is down over 70%, META (Facebook) is down 50%, and TESLA and Amazon are down 40%. The list goes on and on. Yet, through all this carnage, Bitcoin remains the best-performing asset in the world since the Covid-19 pandemic, growing by over 300%.

Where do we go from here?

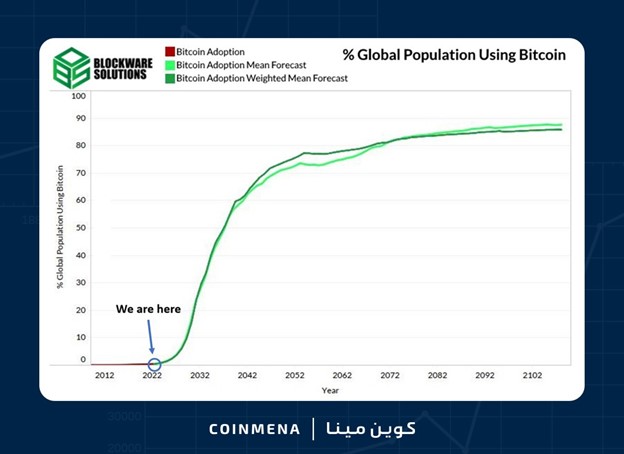

I will end this letter with some hopeium and context about the larger value proposition for bitcoin. Bitcoin is a disruptive technology and monetary network that is growing exponentially. All disruptive technologies such as the internet and smartphones go through an S-shaped adoption curve, reaching their main growth phase after roughly crossing the 10% threshold. Based on a recent market research report by Blockware Solutions and ARK Invest, it is estimated that less than 1% of the global population are users of the Bitcoin monetary network. If we plot that on the technology adoption S curve graph, it looks like this:

As you can see, Bitcoin is still in the very early stages of adoption. The fundamentals and the value proposition have not changed. Ask yourselves, in the future do you expect digital money like bitcoin and crypto to be more or less widely used? If we have begun to displace paper, a technology used for thousands of years, would it not be sensible to assume we can do the same for something as prevalent as gold?

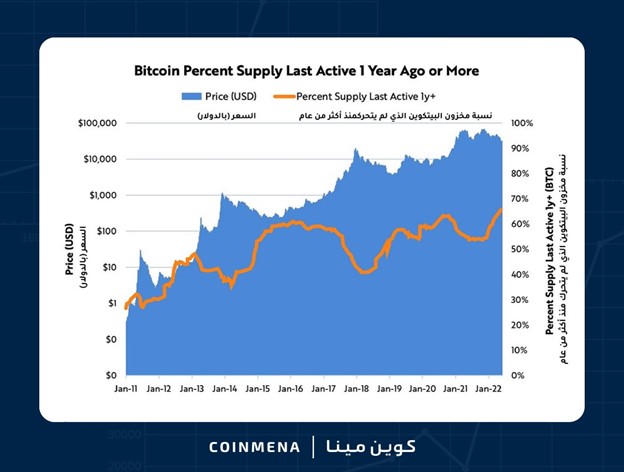

In addition, long-term HODLers of bitcoin have never been more resilient. Even with the current price drawdown, 66% of bitcoin has not moved in over a year, an all-time high.

This behavior mimics the 2017-2019 drawdown, where Bitcoin went from almost $20,000 to $3000”. During this period, 86% of those that owned it at $17,000 never sold. This is what encouraged billionaire hedge-fund manager Stanley Druckenmiller to look at Bitcoin as “something with a finite supply” where “86% of the owners are religious zealots”. While his language may be a tad extreme, these statistics bode well for Bitcoin’s long-term growth and adoption.

While bitcoin price drops are not fun, the fundamentals and the long-term outlook for bitcoin are telling a different story.

I hope this gives you some perspective and context to what is happening in the market. Will prices continue to fall? In the short term, maybe, especially as inflation in the US is still at a 40-year high, and 50% of holders are still in the money.

The Federal Reserve is expected to continue hiking interest rates, but in the long term, I strongly feel that the value proposition of bitcoin and some other cryptocurrencies are strong. The good thing about cycles is that, as the name suggests, they are cyclical, so eventually, they will turn around. This too shall pass.

So what to do now? For us who have experienced these cycles before, we continue to do what we have been doing for years; dollar-cost averaging into bitcoin periodically, regardless of price. I buy a small amount of Bitcoin every Thursday evening. It has helped me remove emotion from the equation and has helped me sleep soundly at night.

As the old adage goes, “time in the market, not timing the market.”