Crypto Is Not Only Self-Trading — It’s Sophisticated Finance

For years, crypto was shaped by a culture of self-trading — a world where investors managed their own custody, execution, and risk. That era introduced millions to digital assets, but it also cemented a perception of the industry as speculative and chaotic. Today, that perception is changing. A new phase of sophisticated crypto finance is emerging, one built on structured products, institutional frameworks, and regulated access.

This shift is especially visible in the United Arab Emirates, a global hub where DIFC, ADGM, and VARA have created a purpose-built environment that bridges traditional finance and digital innovation. The UAE already leads in structured TradFi products; now it is extending that expertise into the digital asset space, empowering firms to build engineered and risk-managed alternatives on blockchain rails.

From Self-Trading to Sophisticated Crypto Finance

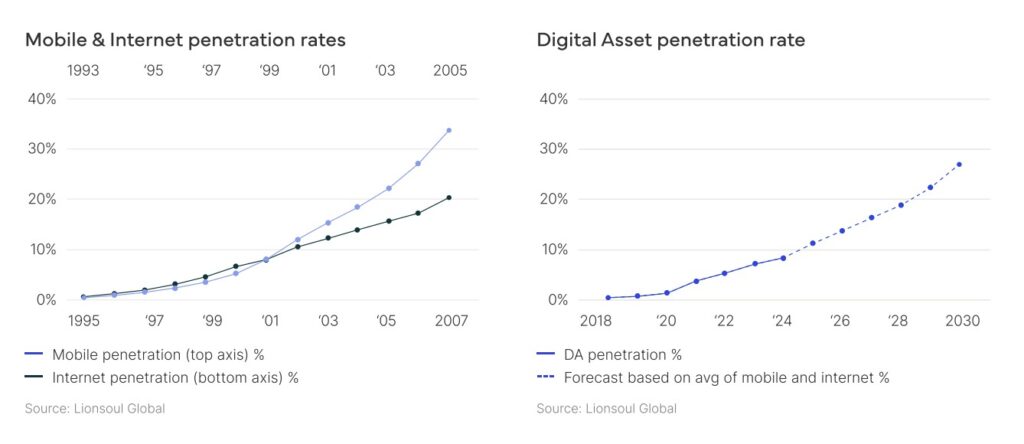

As the digital asset market matures, trading is no longer the center of gravity. Instead, the future belongs to product engineering: creating diversified, risk-adjusted digital asset portfolios that mirror the discipline of traditional multi-manager funds.

This is where Lionsoul Global enters the story.

Unlike exchanges or VASPs, Lionsoul operates as a product engineering firm, designing institutional-grade strategies — such as the Bitcoin Alpha Fund of Funds and the Market Neutral Fund of Funds — and executing them exclusively through regulated partners. Their model brings traditional standards of due diligence, diversification, and risk management into a market that is rapidly institutionalizing.

According to Georges Mouawad, General Manager of Lionsoul ME: “VARA and the broader UAE ecosystem created a clear, efficient framework focused on what the market needed most: safe on- and off-ramps and institutional-grade access. As the asset class matures, investors will shift from speculative exposure to risk-adjusted returns — and that’s exactly where Lionsoul comes in.”

This perspective reflects a critical evolution: digital assets are no longer an isolated alternative — they are becoming a strategic component of sophisticated portfolios.

The UAE: A Launchpad for Structured Digital Products

The UAE’s regulatory clarity is enabling something unique: a separation of responsibilities between product engineers, licensed VASPs, and regulated custodians.

This mirrors global financial markets and gives institutional investors a familiar, trustworthy framework for entering digital assets — without the operational exposures of self-trading.

Insights From Lionsoul’s Family Offices Report

Lionsoul’s Family Office Investment Trends 2024 report reinforces this shift toward institutional crypto investing. Their research shows that even modest allocations of 5–10% in digital assets can:

- enhance portfolio diversification

- improve Sharpe ratios

- reduce long-term concentration risk

- align with modern macroeconomic realities

The report demonstrates that family offices are no longer dabbling in crypto. They are analyzing digital assets using the same frameworks applied to commodities, private markets, and emerging economies.

This is no longer a speculative conversation — it is portfolio construction.

From Speculation to Allocation

As Mouawad explains, the macro environment is accelerating this transition: “We are witnessing one of the biggest macro shifts of our generation — a global fiat debasement trade. Investors need to stop thinking in terms of ‘crypto trading’ and start thinking in terms of portfolio allocation, risk budgets, and long-term macro themes.”

This new mindset is driven by two developments:

1. Digital assets are becoming global infrastructure

Stablecoins, now the strongest product-market fit in the entire ecosystem, are reshaping liquidity flows, settlement, and value transfer. This is not speculation — it is financial infrastructure.

2. Digital assets are now structured, risk-managed, and institutionally accessible

The future is not about trading tokens but about allocating smartly into engineered digital asset products that fit within existing risk frameworks.

A New Definition of Sophistication

The UAE is showing how traditional financial discipline and digital asset innovation can co-exist.

Crypto’s early phase empowered individuals to trade.

This next phase — defined by sophisticated crypto finance — will empower institutions to allocate, diversify, and manage digital exposure with professional rigor.

As product engineers supported by regulated VASPs, Lionsoul exemplifies this transition. Their work reflects where digital assets truly belong: inside structured, risk-adjusted, institutional portfolios. Crypto is no longer only self-trading. It is becoming sophisticated finance — designed with discipline, delivered through regulation, and shaped by the macro realities of a changing global system.