Crypto Companies Rush to File IPOs as U.S. Market Heats Up Ahead of September

Crypto firms are fast-tracking their initial public offering (IPO) plans with U.S. regulators, aiming to capitalize on favorable market conditions before the September 1 Labor Day holiday.

According to Bloomberg, high-profile digital asset companies preparing filings include Gemini Space Station Inc., founded by Cameron and Tyler Winklevoss, and blockchain lending platform Figure Technology Solutions Inc.

$15 Billion Crypto IPO Pipeline on Wall Street

Wall Street banks estimate that crypto IPOs and tech listings could generate more than $15 billion by year-end. Excluding SPACs, total IPO proceeds in 2024 may approach $40 billion.

- Goldman Sachs co-head of equity capital markets Will Connolly confirmed that companies are accelerating their schedules, with some requesting earlier listing dates.

- JPMorgan Chase’s Keith Canton revealed the bank is managing around 10 IPOs (filed publicly or confidentially) and another 15–20 firms testing market waters.

This surge marks a recovery for the U.S. IPO market after sluggish years post-2021’s record-breaking boom.

Circle and Bullish Spark IPO Momentum

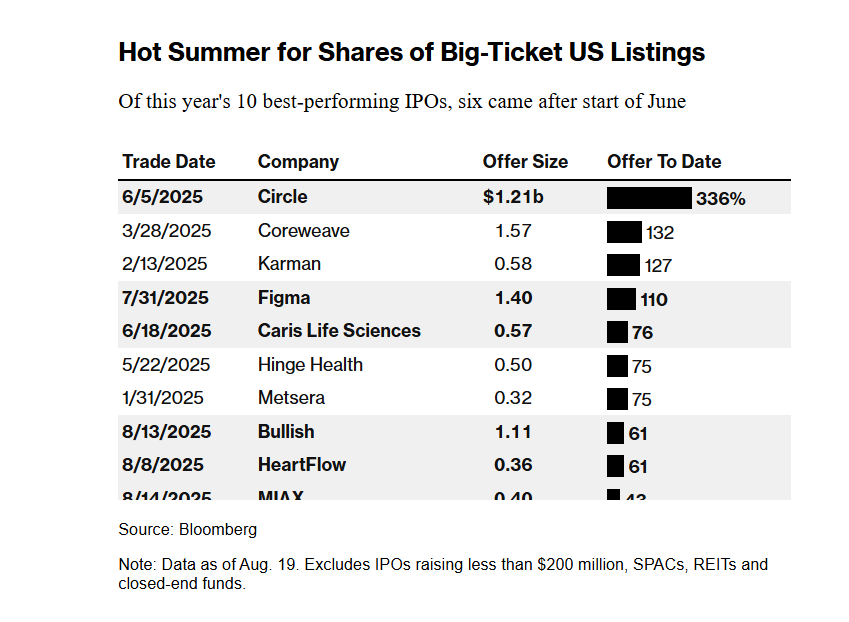

The success of Circle Internet Group Inc., which more than doubled in value after listing, has reignited optimism in crypto-related IPOs. Circle’s debut became one of the top-performing IPOs of 2025, delivering a 336% return.

Another major milestone was Bullish’s $1.15 billion IPO on the New York Stock Exchange, backed by billionaire Peter Thiel. Notably, Bullish became the first U.S.-listed firm to raise funds entirely through stablecoins, pricing shares at $37 and reaching a $5.4 billion valuation with a 66% investor return.

Bloomberg’s 2025 IPO rankings also highlighted CoreWeave (+132%) and Figma (+110%) alongside crypto leaders.

Gemini and Figure File for IPOs

Among the upcoming listings:

- Figure Technology Solutions — a blockchain-based lending platform co-founded by ex-SoFi CEO Mike Cagney. It publicly filed its IPO this week, following its $200 million funding round in 2021 that valued the company at $3.2 billion.

- Gemini Exchange — backed by Ripple, which extended a $75 million credit facility (expandable to $150 million). Gemini plans to trade on Nasdaq under ticker GEMI, becoming the third U.S.-listed crypto exchange after Coinbase (2021) and Bullish (2025).

A Favorable Regulatory Landscape

The IPO push comes amid a friendlier regulatory environment under the Trump administration. Since January, the SEC has dismissed most cases against crypto firms, while new initiatives are being rolled out to support the digital assets sector.

Outlook: Crypto IPO Wave to Continue

With more companies lining up, analysts expect crypto IPOs to remain a strong theme through late 2024 and into 2025, riding both market momentum and regulatory support.

As investors eye the next wave, all eyes are on Gemini’s IPO and how it could shape the future of digital asset listings on Wall Street.