Grayscale Carves Out AI’s Crypto Frontier with New Sector Launch

Grayscale Investments has officially launched a new Artificial Intelligence Crypto Sector, recognizing the rapid expansion of decentralized AI and its growing importance in the blockchain industry. The move reflects the firm’s ongoing commitment to offering investors structured access to emerging technologies through its proprietary Crypto Sectors framework, developed in partnership with FTSE Russell.

“Artificial intelligence could be the most consequential technology of the 21st century. But centralized control raises growing concerns. Decentralized AI development offers a promising alternative,” states Grayscale in its latest research report.

AI: A Transformative Force in Crypto

In its latest report, Grayscale Research emphasized that artificial intelligence (AI) could be the most impactful technology of the 21st century. However, concerns about the centralized control of AI by a few major corporations have prompted demand for decentralized alternatives. Grayscale highlights that blockchain-based AI offers a transparent, democratized model for development and access, positioning it as a major emerging segment in the crypto asset class.

Sixth Crypto Sector: Artificial Intelligence

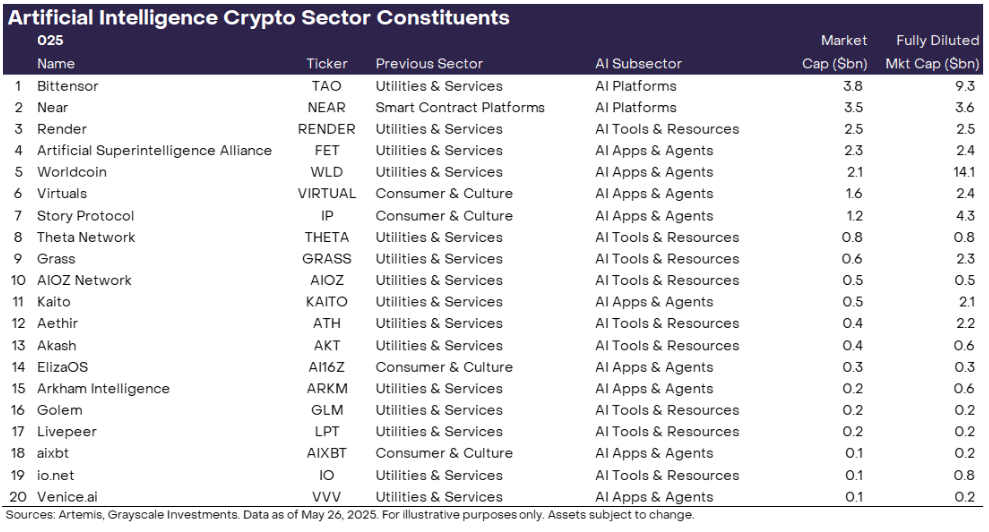

The newly created Artificial Intelligence Crypto Sector joins Grayscale’s existing five sectors — Currencies, Smart Contract Platforms, Financials, Consumer & Culture, and Utilities & Services. The new sector currently includes 20 tokens with a combined market capitalization of $21 billion, up from just $4.5 billion in Q1 2023.

This sector consists of three core subsectors:

- AI Platforms: Networks like Bittensor (TAO) and Near that support diverse AI applications.

- AI Tools & Resources: Projects like Grass (data scraping) and Akash (compute marketplaces).

- AI Apps & Agents: End-user applications including Virtuals, ElizaOS, and sentiment analysis platform Kaito.

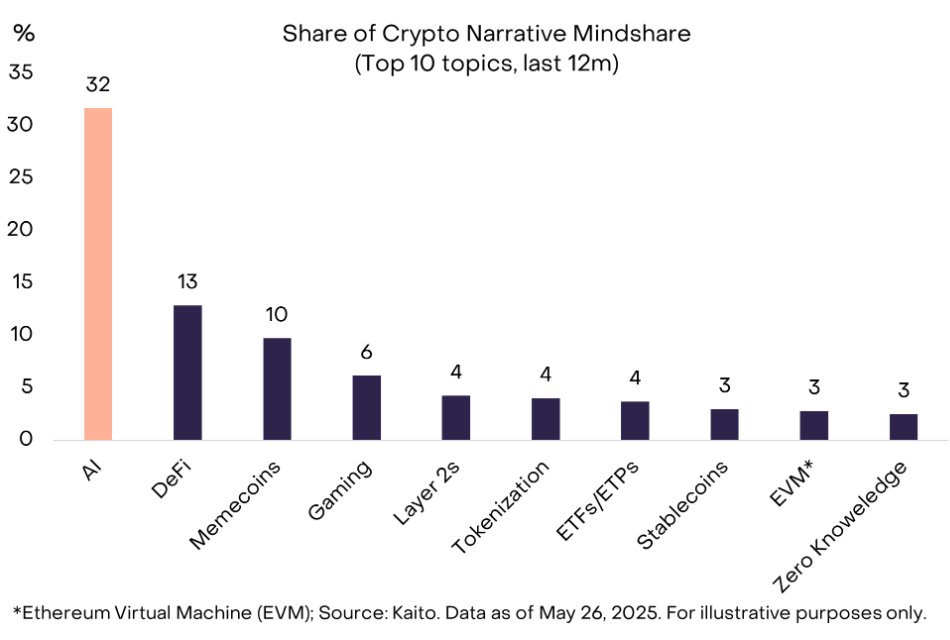

AI Dominates Crypto “Mindshare”

According to data from Kaito, decentralized AI has led crypto-related social media discourse over the past year. While some projects have existed for years, others like Bittensor have recently seen strong adoption and subnet growth.

The AI sector’s total value is still a small fraction (0.67%) of the broader crypto market, which Grayscale views as a sign of early-stage growth potential. The firm believes the sector will expand significantly as more AI tokens launch and new use cases mature.

Bittensor (TAO): Leading the Sector

The largest project in the new sector is Bittensor, a decentralized AI development platform with a fixed supply cap of 21 million tokens. Bittensor’s upcoming halving event and increasing adoption of “subnets” for AI applications are key areas to watch. Since its dTAO upgrade in February 2025, subnet activity has surged, signaling growing developer interest and utility.

Revenue Growth & Innovation

Grayscale’s research identifies strong signals of growth and adoption in the decentralized AI space:

- Grass is generating tens of millions in annualized revenue from selling data to AI labs.

- Virtuals earns approximately $30 million annually from trading fees tied to AI agents.

- Emerging projects like Prime Intellect and Nous Research are pioneering distributed AI model training, leveraging idle global compute power to reduce barriers and costs.

Stablecoins and AI Agents: A Powerful Synergy

Grayscale also notes that AI agents — autonomous software powered by AI — are uniquely positioned to benefit from crypto-native infrastructure. With stablecoin adoption on the rise, including moves from Meta, Stripe, and Coinbase, AI agents could power microtransactions and programmable payments in real-time, redefining internet value exchange.

Regulatory Outlook

Upcoming legislation, including the GENIUS stablecoin bill and broader crypto market structure reforms, could catalyze further adoption of decentralized AI and blockchain-based payment systems. These changes may accelerate the sector’s evolution and attract greater institutional interest.

A Major Milestone for the Crypto Market

Grayscale’s introduction of the AI Crypto Sector mirrors historical precedents in financial indexing, such as the creation of the Real Estate sector in the GICS taxonomy. As blockchain and AI converge, this strategic reclassification underscores Grayscale’s vision of crypto as a multi-sector ecosystem with increasing relevance to global technological and economic trends.

“AI deserved its own Crypto Sector,” the report asserts, highlighting AI’s dominance in crypto-related online discourse and its potential to transform traditional AI development models through decentralization.