Solana Foundation Disagrees and Responds to SEC’s Security Classification of SOL

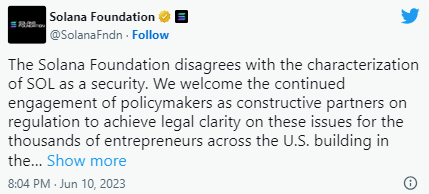

In a recent tweet, the Solana Foundation expressed its response to the United States Securities and Exchange Commission‘s classification of their native cryptocurrency, SOL, as a security.

This announcement caused a decline in the value of SOL, with its price dropping to $15.

The foundation clearly stated its disagreement with the SEC’s classification, emphasizing that they believe SOL should not be considered a security.

They also expressed their willingness to collaborate with policymakers in order to establish legal clarity within the realm of digital assets.

Solana’s native token, launched publicly in March 2020, serves both as a utility and native cryptocurrency. Holders of SOL stake their tokens to validate transactions through the network’s consensus mechanism. Furthermore, the token can be used for various purposes such as receiving rewards, paying transaction fees, and participating in governance activities.

The SEC has recently filed two separate lawsuits against major cryptocurrency exchanges, Binance and Coinbase, classifying the SOL token as a security.

This classification is based on various factors, including the expectation of profits derived from the efforts of others, as well as the usage and marketing strategies associated with the tokens.

The Solana Foundation acknowledged the significance of this classification as it subjects Solana and related activities to a different set of regulations and compliance requirements.

The foundation stated its commitment to engaging with legal experts and having ongoing communication with the SEC to better understand and address their concerns.

In addition to SOL, the SEC included nine other cryptocurrencies in the securities classification in the lawsuit against Binance, including BNB, BUSD, Cardano, Polygon, Cosmos, The Sandbox, Decentraland, Axie Infinity, and COTI.

The SEC’s lawsuit against Coinbase named a total of 13 cryptocurrencies, including the previously classified tokens and adding Chiliz, Flow, Internet Computer, Near, Voyager Token, and Nexo.

According to the SEC, the term “security” encompasses an “investment contract” and other instruments such as stocks, bonds, and transferable shares.

The regulator’s guidance emphasizes the need to analyze digital assets to determine if they possess characteristics that meet the definition of a “security” under federal securities laws.

Over the past few years, the Solana Foundation conducted private token sales, wherein it offered securities to institutional investors and venture firms. These private sales reportedly involved the issuance of simple agreements for future tokens (SAFTs), which are used to transfer digital tokens from cryptocurrency developers to investors in a secure manner.

During these SAFT-based token sales, Solana also submitted private offering forms to the SEC, and investors were subjected to lockup periods.

In March 2020, Solana conducted an initial coin offering (ICO) that included a public sale of SOL tokens. This ICO allocated 8 million tokens, which accounted for 1.6% of the initial token supply, to the general public. The sale price of each token was $0.22, resulting in the Solana Foundation raising $1.76 million from this public sale.

In an opinion piece discussing the recent developments, legal expert and Bloomberg contributor Matt Levine highlighted that the previous offering of securities in the form of SOL tokens should not automatically classify the token as a security at present.

Levine pointed out that while the SEC may view the current public trading of these tokens, which may involve lesser disclosure and investor safeguards than desired by the SEC, as unfortunate, it is not necessarily Solana’s fault. Rather, Solana operated within legal boundaries when conducting its previous offerings.