Inside the CZ–Schiff Showdown: Bitcoin, Gold, and the Battle for Value

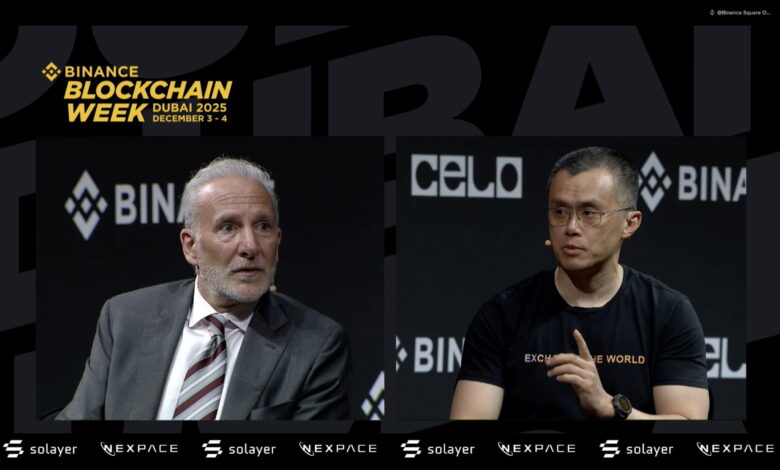

The most anticipated session at Binance Blockchain Week Dubai delivered exactly what the crowd came for: a sharp, unfiltered clash between two leaders who embody opposing monetary philosophies — Binance founder Changpeng “CZ” Zhao and long-time gold advocate Peter Schiff — debating the future of value in the panel titled “Bitcoin vs. Tokenized Gold.”

Across nearly 40 minutes of spirited back-and-forth, the debate became a real-time contrast between adoption-driven digital finance and traditional monetary theory. CZ anchored his arguments in user growth, real-world utility, and infrastructure progress. Schiff countered with classical definitions of money, physical scarcity, and skepticism toward Bitcoin’s intrinsic worth.

The room — overwhelmingly crypto-native — followed the exchange closely, with audience reactions often signaling where momentum lay.

CZ: Bitcoin’s Value Is Proven Through Use

CZ rejected the assumption that assets must be physically tangible to hold real value.

“Most of what we use today is virtual,” he said, pointing to digital platforms, data networks, and software as evidence that physical form is not the determinant of worth. In his view, Bitcoin represents the most secure and transparent financial network ever created, defined by something gold lacks: fully verifiable supply.

“We don’t know how much gold exists globally. With Bitcoin, the supply is fixed, auditable, and final. It is the only absolute finite asset humans have.”

Beyond theory, CZ emphasized the scale of adoption:

- Nearly 300 million Binance users

- Millions globally transacting in Bitcoin and stablecoins

- Expanding merchant access via card rails

- An increasingly mature developer ecosystem

He shared an example from Africa where a Binance user reduced bill payments from three days to three minutes using crypto infrastructure.

“That isn’t speculation — that’s life-changing utility,” he said. “That’s what value looks like.”

Schiff: Bitcoin Is Speculation, Not Money

Schiff remained unconvinced. He repeatedly described Bitcoin as lacking “intrinsic value,” arguing that ownership confers no underlying utility beyond the ability to transfer the asset to another buyer.

“What makes Bitcoin worthless to me isn’t that it’s digital — it’s that you can’t do anything with it,” he said, branding Bitcoin a “speculative digital collectible.”

Instead, he championed tokenized gold, arguing that digital certificates representing physically allocated gold preserve real ownership while modernizing settlement.

“When I send you tokenized gold, I’m transferring real gold — actual physical ownership.”

Schiff also compared Bitcoin trading to a form of mass speculation, labeling Binance “a big casino” and claiming that more users participating didn’t change what he viewed as fundamentally risky behavior.

Payments: A Live Demonstration of Crypto’s Use Case

To rebut claims that crypto lacks utility, CZ demonstrated a Binance Visa card, explaining that users can spend crypto anywhere Visa is accepted — while merchants receive fiat seamlessly in the background.

“Users pay with crypto, merchants get paid in cash. The system just works.”

Schiff dismissed the process as “just selling Bitcoin for dollars,” but CZ argued the distinction was irrelevant:

“The end user is still spending crypto. That’s the real-world bridge.”

Performance and the Long View

Schiff pointed to Bitcoin’s performance in gold terms, asserting it currently buys fewer ounces of gold than it did several years ago — accusing Bitcoin’s market cycle of being driven by promotion, hype waves, ETFs, celebrity endorsements, and the NFT boom rather than fundamentals.

CZ countered by zooming out:

- Bitcoin has outperformed every major asset class over its full lifespan.

- The asset has grown from nothing to a $2 trillion market.

- Institutional participation and real-world integration continue expanding.

“Cherry-picking time frames doesn’t change the broader trajectory,” CZ said. “Long-term adoption is the real signal.”

Saylor, Leverage, and the Casino Argument

Schiff took aim at Michael Saylor, criticizing his leveraged Bitcoin strategy and sky-high price predictions — including Saylor’s suggestion that Bitcoin could one day reach $10 million per coin.

“If that were realistic, markets would already price it in,” Schiff argued, accusing Strategy of amplifying speculative cycles through aggressive debt-funded accumulation.

CZ avoided engaging directly with predictions, instead reiterating that market value follows adoption — not forecasts.

“When hundreds of millions of people participate, it stops being a casino and becomes a global financial network.”

Gold vs. Bitcoin: Scarcity and Community

Schiff suggested that the proliferation of new crypto tokens dilutes Bitcoin’s long-term dominance. CZ reframed the conversation:

“Anyone can launch a token — but you cannot fabricate community or trust. Bitcoin’s value is built on millions of people choosing it.”

To CZ, this social consensus — not code alone — separates Bitcoin from technical imitations.

Generational Divide

Looking ahead, Schiff predicted younger investors would swing back toward gold after facing losses in digital assets.

CZ disagreed sharply: “Digital-native generations already understand virtual value. Bitcoin is global, mobile, censorship-resistant — perfectly built for the world they live in.”

Audience laughter followed Schiff’s claim, signaling which perspective resonated more deeply in the room.

An Unexpected Ending

Despite strong disagreement, the session closed on a surprising note of collaboration. CZ invited Schiff to explore listing or issuing his tokenized gold product on Binance — an offer Schiff welcomed.

CZ concluded diplomatically: “Gold will do well. Bitcoin will do better. Both can coexist — but Bitcoin is the future.”

Final Take: Adoption is Winning the Argument

The CZ vs. Schiff debate captured more than a clash of personalities — it was a live snapshot of how monetary narratives are evolving. Schiff’s arguments were grounded in classical definitions of money and tangible scarcity, while CZ’s case reflected the present reality: money today is increasingly defined by networks, usability, speed, and global reach — not physical form.

Gold’s role as a store of value remains intact, particularly as an inflation hedge. But Bitcoin’s accelerating adoption — across emerging markets, payment systems, institutions, and infrastructure — suggests it is not competing on gold’s old playing field. It is creating an entirely new one.

In Dubai, the future didn’t wait politely for tradition — it spoke in metrics, adoption curves, and real-world necessity.