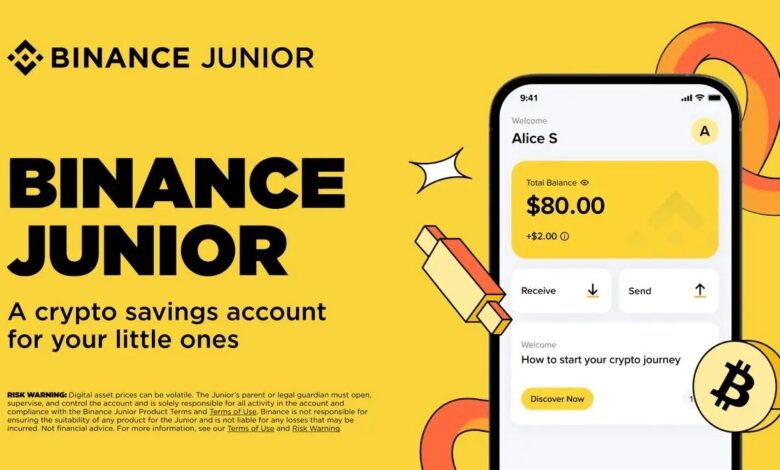

Binance Launches “Binance Junior” App to Introduce Crypto Savings for Children

Cryptocurrency exchange Binance has launched Binance Junior, a new mobile application designed to help parents introduce children and teenagers to digital assets in a controlled and educational way. The announcement was made on Wednesday during Binance Blockchain Week, signaling a major step toward family-focused crypto adoption and youth financial literacy.

The standalone app allows parents with a verified Binance account to open a crypto savings account for children aged 6 to 17, deposit digital assets on their behalf, and maintain full parental oversight. Adults retain control over spending permissions, transfer limits, and safety features, while the app also provides access to crypto “earn” products for minors where regulations permit.

Children aged 13 and older can initiate transactions independently within the app, subject to regional compliance rules and daily spending caps set by parents. Binance said this structure aims to balance hands-on learning with robust risk management and adult supervision.

Building Financial Literacy Through Digital Assets

Binance Co-Founder Yi He addressed the launch at Binance Blockchain Week, framing the app as part of a broader effort to promote financial responsibility in a changing monetary landscape.

“We not only nurture children in their early development, but also with long-term growth, responsibility and wisdom,” Yi said. “Helping children face real-life challenges independently means that financial health and literacy are key to preparing them for the future, especially as money is evolving.”

While crypto education for young audiences can be a sensitive topic, data suggests growing interest among younger demographics. A recent survey by Gemini found that 51% of Gen Z respondents globally either currently own or have previously owned cryptocurrency. In the United States specifically, crypto ownership among Gen Z slightly outpaces Millennials, with 51% versus 49%, highlighting a generational shift toward digital asset adoption.

Binance Junior aims to support this trend by offering families a regulated environment to learn about digital assets firsthand rather than through unmonitored platforms or informal channels.

Teaching Children About Crypto: Trend Gains Momentum

Industry voices have largely welcomed the move as part of a wider educational push. Henri Arslanian, co-founder of Nine Blocks Capital and author of children’s crypto books, said the concept builds naturally on traditional approaches to teaching financial awareness.

“Children used to have penny banks to keep fiat in, but now we have hard assets like Bitcoin, and there is a huge learning element there that becomes critical,” Arslanian said.

He noted that Binance Junior aligns with the growing market of crypto-focused educational content for kids. Titles such as Decoding Crypto (by Arslanian), B is for Bitcoin by Graeme Moore, and Goodnight Crypto by Scott Blair aim to explain blockchain and digital finance concepts through age-appropriate storytelling. Binance itself has also published its own children’s educational guide, ABC’s of Crypto, introducing core concepts including blockchain, security, and different types of cryptocurrencies.

Balancing Education With Caution

Despite the enthusiasm surrounding these initiatives, experts emphasize the importance of maintaining realistic expectations. Volatility remains inherent to digital assets, and educators recommend that parents shift the focus away from rapid price gains toward fundamentals such as saving, diversification, long-term planning, and risk management.

Teaching crypto responsibly means grounding discussions in financial literacy rather than speculation, helping children understand both the opportunities and the risks involved in digital markets.

Preparing the Next Generation for Crypto Adoption

Introducing children to crypto through tightly controlled, educational platforms like Binance Junior could be a constructive step toward financial literacy—if handled responsibly. The real value lies not in early access to speculative assets, but in teaching core principles: saving consistently, understanding risk, and thinking long-term. Crypto may be the tool, but the lesson should remain about disciplined money management rather than market hype.