The Treasury Company Bubble

The era of treasury companies is upon us. Today over 150 publicly listed companies around the world have declared themselves Bitcoin treasury companies and are deploying all means necessary to raise capital for the sole purpose of buying more Bitcoin, sweeping on average $300M of Bitcoin out of the market every day. This has been occurring at such a rapid rate that treasury companies now hold 5% of the total Bitcoin supply ($111B). But it’s not just Bitcoin. The trend has caught on for Ethereum (3.4% of supply), and a swathe of other altcoins like Ethena (ENA) and Tensor (TAO). How did we get here? Why are dozens of companies going all-in on Bitcoin every month? How far can the era of treasury companies go?

THE STRATEGY SUCCESS STORY

MicroStrategy (now “Strategy”, ticker: MSTR) adopted Bitcoin in August 2020. At first it was a means for fighting the immense amount of inflation that was being caused by the US printing trillions of dollars to fill the Covid hole. Very quickly, Michael Saylor (Strategy’s CEO) went all-in. Pursuing all means necessary to raise capital via debt and equity issuance with the sole purpose of just buying Bitcoin. Not long later, Strategy’s original business (technology dashboards) fell off the front page of the website and became a distant sideshow to their new just-buy-Bitcoin model. As Bitcoin shot up from $10K to $60K in late 2020, MSTR saw its share price rocket 800%. Saylor was raising billions, effectively arbitraging the traditional financial market’s low cost of capital, and leveraging into the highest returning asset of our generation, Bitcoin.

SAYLOR’S LORE

Michael Saylor, whose tech company had languished since the Dot Com bubble, shot to stardom in the Bitcoin ecosystem for his high conviction views, witty takes and uncanny ability to break down complex subject matter and describe the Bitcoin value proposition in bite-size digestible chunks. He became the poster child of Bitcoin. Some of his famous soundbites include “It’s going up forever, Laura.” (2021) and “How many chairs are you sitting on right now? Are you all‑in on the chair? (2023) arguing for his conviction in Bitcoin and why there was no need to diversify.By 2025 Saylor has entered meme status. He posts daily AI generated pictures of himself spanning all space-time and history on X.com. He’s even depicted himself as a levitating monk.

While amusing, Saylor’s meme status is an important factor behind Strategy’s success. We live in a world where valueless tokens and stocks can skyrocket under community driven movements, often centered on memes. Think Gamestop (2020: +2000%), Dogecoin (2021: +10000%), AMC (2021: +300%), Shiba (2021: millions%), Pepecoin (2023: 20000%) and dozens more. Today there are over 4000 memecoins with a combined market cap of $66B, these coins have nothing behind them but an image and a community. People love communities and a reason to rally behind an idea.

In a digital world that sees 10% annualized monetary inflation, is this really surprising?

If an idea is engaging and persistent, it can draw billions of dollars in capital with impressive speed. Michael Saylor’s cult like conviction and caricatures check a lot of these boxes.

Saylor’s meme status is an important factor behind his ability to draw capital and instill conviction and confidence in masses, but it is only a small part of his bigger $100B Strategy machine. How has he done it?

HOW STRATEGY DID IT

At the end of the day it’s arbitrage. Bitcoin has on average a 30-50% annualized return and the debt and equity Saylor is using to acquire Bitcoin typically costs 0-5% p.a. His debt instrument time to maturity is typically 5 years, so provided Bitcoin maintains a high growth rate and provided Saylor doesn’t over leverage, he can withstand the gruesome Bitcoin bear markets and arbitrage a winning strategy over the long-term. He has used just about all methods possible to raise capital including; issuing equities, debt, convertibles and warrants, concocting various deals to acquire capital at low cost. Saylor also uniquely met a market need by satisfying yield hungry fixed income markets and providing them some access to juicy Bitcoin returns.

Apart from developing a meme-cult like investor following, Michael has proved several things over the past 5 years:

- His conviction is unwavering: unlike many in this industry, Michael has clearly projected and (so far) stood by his word to “never sell” Bitcoin. Over the years he has given investors confidence in Strategy, its roadmap and expected future actions. This has built trust in the investment industry and eliminated a lot of uncertainty, unlocking him billions in capital.

- He can weather the storm: Michael withstood the brutal 2022 80% bear market, multiple industry frauds and bankruptcies. Strategy was underwater on their Bitcoin position but Saylor didn’t waver, sell or “get liquidated”, as many suspected he might. Saylor proved he can take the punches that Bitcoin throws. He proved he can manage risk and run his Bitcoin strategy long-term. This test of survival added a lot of credibility to Strategy and Saylor’s innovative Bitcoin treasury model.

I have respect for Michael Saylor. When he started his Bitcoin strategy in 2020, I remember walking with my wife (fiance at the time) around Boxhagener Platz, Berlin and saying it was a genius move that would pay off big for MicroStrategy. Especially as Bitcoin was deeply undervalued then and we were amidst the biggest monetary inflation of all time.

Fast forward 5 years, Strategy has outperformed the S&P 500, every asset class and every Magnificent 7 stock since, including the infamous Nvidia.

Given the great success of Strategy, and Saylor’s rise to fame, it’s not surprising that many copy cats have entered the scene. Where success goes, imitation follows. In the wake of the 2008 financial crisis, Warren Buffett made a poignant comment which could be a good warning for the crypto industry today: “First come the innovators. Then come the imitators. Last come the idiots…people don’t get smarter about things as basic as greed.”

A STORY WHOSE TIME HAD COME

Strategy was the success story and the motivation. But a series of other events put Bitcoin treasury companies center stage and fueled their meteoric rise, two specific elements can’t be ignored here; (1) rising global liquidity and (2) significant policy and regulatory enablers.

1. Rising Global Liquidity

Bitcoin runs when Net Liquidity is positive. Capriole’s Net Liquidity nets off the year-on-year growth in global broad M3 money supply with the cost of capital (10 year interest rates) to gauge when global markets are seeing liquidity expansion vs contraction. Simply put; when more money is being injected into the system, and it is outpacing the cost of debt capital, market participants tend to pump that fiat into assets like equities, Bitcoin, gold and real-estate. All of Bitcoin’s historic bear markets have occurred while this metric was declining, with the depths of all of Bitcoin’s deep bear markets occurring while this metric was less than zero (red). All of Bitcoin’s historic exponential price appreciation occurred during Net Liquidity expansion phases (green).

After several years largely in the red zone Net Liquidity entered growth in mid 2024 and again at a higher rate in Q1 2025. This net growth in money supply is firepower for Bitcoin and it started right before the Bitcoin treasury company model started to take off.

2. Significant Policy and Regulatory Enablers

With the inauguration of Trump, we transitioned from an anti-Bitcoin to a pro-Bitcoin US regime. Under the prior administration US banking rails into crypto businesses and funds were effectively shuttered under Operation Choke Point 2.0 in 2023 and 2024. However, gradually over the last year we have seen a dramatic and positive shift to a pro-Bitcoin and digital asset regime which has given confidence to institutions to invest in Bitcoin and treasury companies:

- January 2024: SEC approves all 11 US Bitcoin ETFs

- January 2025: Anti-crypto SEC chair Gensler resigns

- March 2025: Trump establishes the US Strategic Bitcoin Reserve

- March 2025: The White House officially ended Choke Point 2.0, re-opening US crypto banking rails

- May 2025: The SEC retreats from its anti-crypto lawsuits including against Ripple and Binance

- July 2025: The GENIUS Act provides a robust stablecoin regulatory framework

- August 2025: 401Ks approved to buy Bitcoin opening a $10T market to now consider digital assets

All of the above provided the regulatory rigour that banks, institutional allocators and investors were looking for. These collective actions de-risked the industry and have enabled capital to flow into Bitcoin and digital assets at lightning speed in 2025, launching the 2025 take off in Bitcoin treasury companies.

FUEL SET, SPARK LIT

The last 6 months has seen rising global liquidity, policy green lights and a proven corporate playbook synchronize. This has created a reflexive flywheel for digital asset treasury companies to take off. For these reasons investors have bid up treasury stocks. Capital markets have opened their doors. Higher prices have created higher treasury company multiples; which have in turn allowed for more equity issuance and Bitcoin (and other digital asset) purchasing.

A ferocious flywheel of accelerated digital asset treasury company adoption has emerged.

THE MOST IMPORTANT CHART

If we had to choose just one data point to track the impact that Bitcoin treasury companies are having, it would be the below chart of Institutional Buying as a percentage of Bitcoin’s market capitalization. Today, institutions are buying over 400% of Bitcoin’s daily supply creation from mining. When demand outstrips supply like this, Bitcoin has historically surged over the coming months. In fact, each time this has happened in Bitcoin’s history (5 occurrences), price has shot up by 135% on average.

This is an important metric not only for forecasting the Bitcoin price going forward, but also to monitor for potential risks to changing market sentiment towards digital asset treasury companies themselves.

A HOUSE OF CARDS

Digital asset treasury companies are not without risks. Two significant risks are worth exploring here to understand where this market may go next.

1. A Leverage Unwind

The most obvious risk to treasury companies is overleverage via excessive use of debt. Bitcoin is renowned for its historically large volatility and 80% drawdowns every 3-4 years. While we expect Bitcoin’s volatility to continue to reduce in future years (as it has each year to date), treasury companies must structure debt and collateral requirements to allow for the worst case scenario.

Even if only a relatively small portion of treasury companies overleverage, it puts the entire asset class at risk. For example, imagine just 5-10% of the treasury companies over leverage themselves in order to compete by delivering more aggressive Bitcoin Yield to their investors. Let’s call this group “The Gamblers”. If the Gamblers are required to liquidate their loans on say a 40-50% Bitcoin drawdown, they would be forced to sell their Bitcoin to cover their debt obligations, which would further drive down the Bitcoin price and subsequently initiate further selling of their stock and further Bitcoin selling. It’s the treasury company flywheel effect in reverse. What results is often called a “liquidation cascade” in crypto (we’ve seen many across futures markets over the years). In such a scenario, while the majority of treasury companies may technically be safe from liquidation, the investor exodus would likely kill the entire treasury company ecosystem for years. It’s for this reason Capriole has integrated debt data and multiples into our charts at Capriole and are monitoring this risk actively.

2. The Silent Killer: mNAV Compression

A second critical risk lies in the premium-to-NAV dynamic. This risk is more hidden, but equally significant.

The most popular treasury company metric is “mNAV”, it represents the value of a company to its Bitcoin holdings. When a treasury company trades at a premium to the value of its Bitcoin holdings (mNAV > 1), issuing new shares is Bitcoin accretive, companies can issue shares and grow the Bitcoin per share for their investors. Win-win. But if the mNAV premium evaporates and the stock slides below NAV (mNAV < 1), problems arise. Now, issuing shares is dilutive, destroying value, this discourages fundraising. Firms in this position may be pressured (by internal governance, activist shareholders, or market forces) to liquidate digital asset holdings to buy back discounted stock, hoping to create a positive “Bitcoin yield” and drive mNAV back up. But that tactic shrinks the treasury and kills investor confidence. Treasury company selling would also drive the crypto market down with it, creating the negative reverse flywheel effect described above. In essence, sustaining an above-NAV valuation is crucial; once the narrative breaks and mNAV collapses, these firms lose their primary mechanism to expand—and extended periods of their shrinking will in unison shrink the entire digital asset market with it.

There are many reasons mNAVs can drop. The cause could simply be capital market exhaustion; too much Bitcoin treasury company supply meeting too little institutional demand. As NYDIG notes: “There’s no fundamental reason these premiums must persist. This “trade” reminds us a lot of the “GBTC arb”, the trade that famously blew up, taking down with it nearly the entire crypto industry. Our gut is that these premiums to NAV seem to be positively correlated to price. If crypto were to undergo a price correction, we guess that these premiums would collapse as well.”

While the individual risks of a treasury company collapse may be low, problems arise when you multiply the risk out by 100s of treasury companies and add in the competitive spirit required by each company to stand out. With time, these companies are incentivized to move out the risk curve to sell dazzling Bitcoin yield multiples and share price returns to their investors. It’s here we recall the above Buffett quote on imitators and greed.

The Speculative Investment Trust Collapse

The rise of Bitcoin treasury companies echoes another chapter in history, the rise of speculative investment trusts in the 1920s. These trusts allowed people to pool their funds into an entity and the proceeds were then invested as management saw fit in a portfolio of common stocks on leverage. “By 1929, new trusts were launching every day, at valuations of 2-3X their underlying assets. Both the 1920s trusts and Bitcoin treasury companies featured large mNAV premiums and embraced leverage.” (BeWater).

We all know what followed in 1929. The stock market crashed 90% on the back of rampant stock market speculation and high leverage, exacerbated by the investment trusts.

The Investment Company Act of 1940 (ICA) was largely a response to the abuses of the 1920s investment trusts and imposed strict regulation on entities that were “in the business of investing, reinvesting, or trading in securities”, requiring them to register with the SEC and meet certain regulatory and leverage constraints.

Digital asset treasury companies today are exempt from the ICA because digital assets are not considered “securities”. So while the activities treasury companies undertake are largely the same as the speculative trusts, they are exempt from regulation.

“History doesn’t repeat itself, but It often rhymes” – Mark Twain

THE END GAME

At some point, the current Bitcoin treasury company hype cycle will reach saturation which will likely result in a volatile unwind. It’s hard to say when this will happen, but some of the metrics and data highlighted above will be key to managing that risk accordingly. If you want to read more, this article highlights 8 important metrics for monitoring the treasury company unwind risk.

While the treasury company flywheel is the biggest driver of upside Bitcoin price expansion this cycle, it also poses the biggest downside risk. The industry’s fate here is to a large extent in the hands of the 150+ public treasury companies.

But will that be the end of it, or will treasury companies thrive in the long-term?

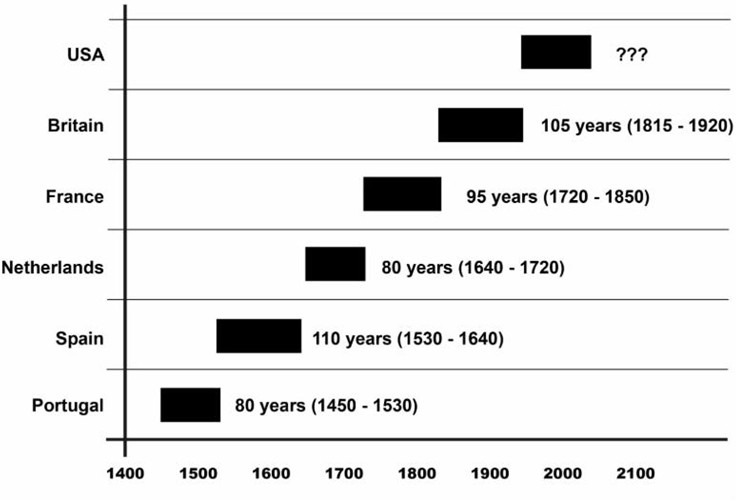

The answer to that question largely comes down to whether or not you think Bitcoin will succeed in its ultimate mission to become Satoshi’s “digital peer-to-peer electronic cash”. Today Bitcoin is a $2T asset, closing in on Gold’s $22T market cap. Beyond that global fiat money is valued at US $113T and growing at 9% a year from central bank printing. At its core, Bitcoin is a better gold. Instantaneous, decentralized, fungible, programmable and all with a lower inflation rate than Gold (0.4% p.a. and falling). This makes Bitcoin the ultimate store of value and inflation hedge. Gold used to be the world’s currency and every 100 years, the world reserve currency changes. So why shouldn’t Bitcoin go further?

With the gold backing removed in 1971, the coming decade is prime time for the next reserve asset to step up.

Will Bitcoin be the next contender for a world reserve asset in a digital, AI driven world? It’s a philosophical question we all need to answer. I know where my bets are placed. The pathway will be volatile, but if Bitcoin is successful, every company in the world will one day be a Bitcoin treasury company, whether they call themselves that or not.