$1B in Spot Trade Volumes and Debut Across Cboe, NYSE Arca, and Nasdaq in Historic Market Snapshot

Following the approval of the Bitcoin ETFs by the SEC, trading data from the Cboe BZX Exchange revealed the dynamic market activity of several Bitcoin ETFs as of 2:45 pm UTC on January 11.

Shares of the ARK 21Shares Bitcoin ETF were actively traded at $50.18 under the symbol ARKB, while those from Invesco Galaxy were priced at $49.59 with the ticker BTCO.

WisdomTree‘s Bitcoin ETF, identified as BTCW, traded at $52.13, Fidelity‘s FBTC at $44.40, and Franklin Temple at $28.48 under EZBC. Meanwhile, the VanEck Bitcoin ETF, represented by the symbol HODL, was anticipated to open at $54.92.

Notably, the Valkyrie Bitcoin Fund, trading on the Nasdaq Stock Market with the ticker BRRR, entered the pre-market with an initial value of approximately $20 before settling at $14.10, according to Cointelegraph. The iShares Bitcoin Trust, managed by BlackRock, the world’s largest asset manager, surged immensely. In fact, IBIT has demonstrated impressive pre-market performance, experiencing a notable 25% surge. Bloomberg Intelligence senior ETF analyst Eric Balchunas‘ analyses suggest that BlackRock’s IBIT could capture a substantial share of the expected $4 billion first-day inflow.

Grayscale Investments, a key player in securing SEC approval for spot Bitcoin ETFs, also witnessed the debut of its Bitcoin ETF under the ticker GBTC on the New York Stock Exchange Arca. Starting at $42.25, the shares rose to $42.97, marking a positive response from investors.

Additionally, the Bitwise Bitcoin Trust entered the market at $26.80 under BITB, and the Hashdex Bitcoin Futures ETF, another beneficiary of SEC approval, commenced trading at $60.00 with the ticker DEFI.

What the First 30 Crazy Minutes of Trading Looked Like

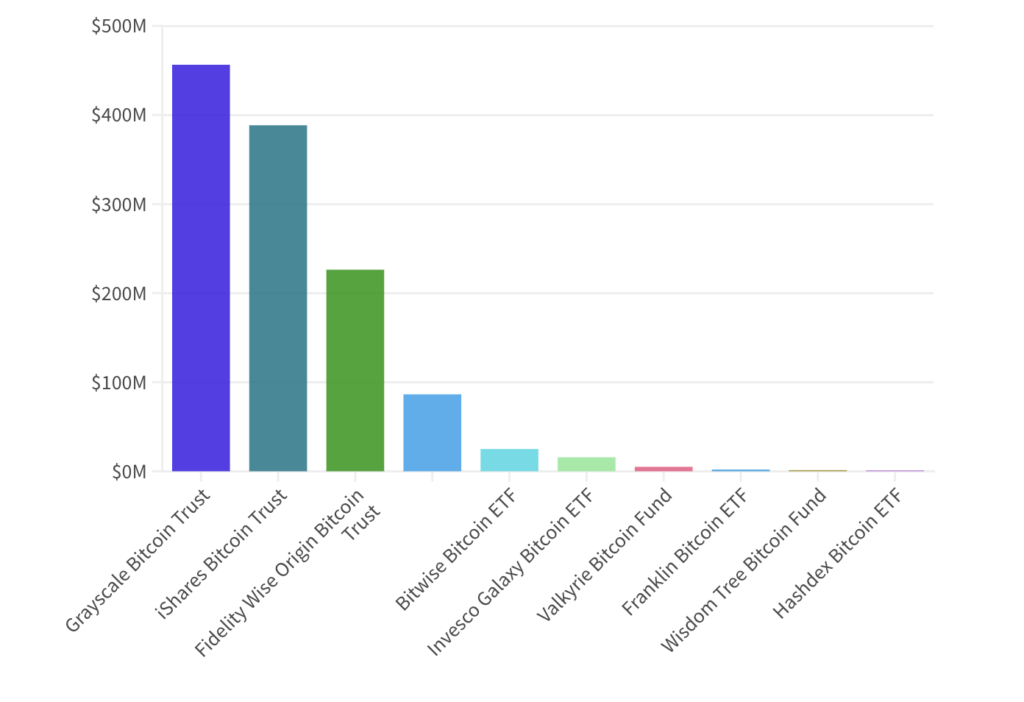

The first 30 minutes of the trading session witnessed an impressive milestone as the combined trading volumes for industry giants BlackRock, Fidelity, and Grayscale products surpassed the $1 billion mark.

Leading the charge in trading volumes was BlackRock’s iShares Bitcoin Trust (IBIT), which experienced a surge with approximately 10 million shares traded within the initial 15 minutes post-bell, as reported by Yahoo Finance. By 10 am ET, investor activity had driven IBIT trading to about 13.5 million shares.

In the same timeframe, the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Grayscale Bitcoin Trust (GBTC), recently converted into an ETF, saw trading volumes of around 5 million and 10.5 million shares, respectively.

The market fervor surrounding these developments positioned Grayscale and BlackRock as potential rivals in the Bitcoin ETF space. This competition contributed to a significant boost in the price of bitcoin itself, surpassing $49,000 for the first time since 2022.

Coinciding with the surge in trading volumes, bitcoin trading volume reached nearly a 10-month high on Thursday morning, reaching $52 billion just after 7 am in New York, according to Blockworks. The positive momentum extended to Ether, which traded around $2,600, reversing its previous loss streak and marking a year-to-date gain of more than 17%.

Reflecting on the broader cryptocurrency market, the first bitcoin futures ETF, ProShares Bitcoin Strategy ETF (BITO), launched in October 2021, saw significant success, achieving approximately $950 million in trading volume on its inaugural day and reaching $1 billion in assets under management within two days. This collective activity underscores the dynamic and impactful nature of the cryptocurrency market during these exciting developments.

This development not only marks a historic moment for the cryptocurrency market but also opens new avenues for investors seeking exposure to Bitcoin through traditional financial instruments.

As the market continues to absorb these changes, experts anticipate further evolution in the landscape of cryptocurrency investments.