ARK Invest Shifts Strategy, Sells $49.2M Coinbase Shares

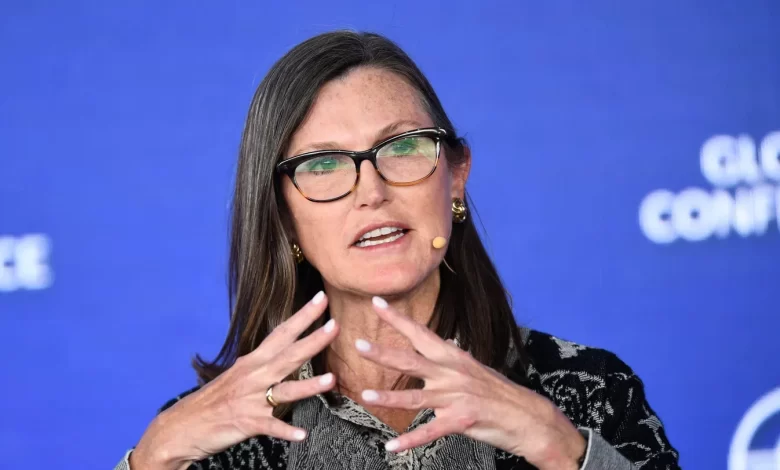

ARK Invest, led by renowned investor Cathie Wood, executed a substantial sell-off of 335,860 Coinbase shares, amounting to $49.2 million.

This decision raised eyebrows across the investment community, marking the largest sale by ARK since July.

Reports indicate that the sale was driven by ARK’s strategy to cap individual stock exposure at 10%, a measure triggered by Coinbase’s rapid surge that pushed its share value beyond this limit.

This strategic maneuver from ARK has ignited varied reactions within the market. Some view it as a prudent risk management strategy, while others question its timing and potential impact on ARK’s investment performance, particularly in the volatile crypto market.

The crypto market seems to be operating with calculated precision, and the decisions being made under Cathie Wood’s leadership at ARK Invest are far from typical.

Capitalizing on Coinbase’s Momentum

Remarkably, Coinbase concluded Friday’s trading at $146.62, marking a single-day increase of 7.7% and an outstanding year-to-date growth of 300%, according to CoinPedia.

Despite this surge, it’s essential to note that the stock still sits 57% below its all-time high of $342.98 from November 2021 during the previous crypto market bull run.

ARK’s New Move: Analyzing the Significance

This move echoes previous actions by ARK, notably in July and November, when substantial volumes of Coinbase equities were sold, totaling millions. In July alone, 480,000 shares valued at $50.5 million were sold, making this recent sell-off one of the most significant in months. However, it’s crucial to understand that ARK’s actions do not indicate a lack of trust in Bitcoin; in fact, they have actively accumulated crypto shares.

It is worth noting that ARK Invest manages its ETFs with a strategic approach to maintain specific weightings of individual holdings within their funds. The recent surge in Coinbase’s stock pushed its weightage well beyond the desired percentage in ARK’s Innovation, Next Generation, and Fintech Innovation ETFs.

Coinbase holdings now represent over 11% of ARKK and ARKW, and more than 13% of ARKF. In addition to Coinbase, ARK divested 102,672 shares in the Grayscale Bitcoin Trust (GBTC), approximately valued at $3.6 million, constituting 8.33% of ARKW’s portfolio.

Cathie Wood’s recent moves have left many puzzled. Understanding why she’s offloading shares in Coinbase and GBTC—entities seemingly flourishing presently—becomes crucial.

ARK’s sales on Friday coincided with Bitcoin’s surge above $44,000. Although Bitcoin experienced a subsequent 10% dip, it boasts a 1.6% increase over the past week and an impressive 165% surge year-to-date.