Investment Flows Return to the Market: A Sign of Recovery from the Crisis

According to the latest weekly report by CoinShares on financial flows in asset and digital currency funds, digital assets experienced positive inflows of $117 million last week, which is the highest since July 2022. The total assets under management (AuM) increased to $28 billion, a growth of 43% from its lowest level recorded in November 2022, due to the turmoil faced by the crypto sector over the past year.

The report shows that the majority of the inflows were received by Bitcoin, amounting to $116 million, despite a few negative inflows.

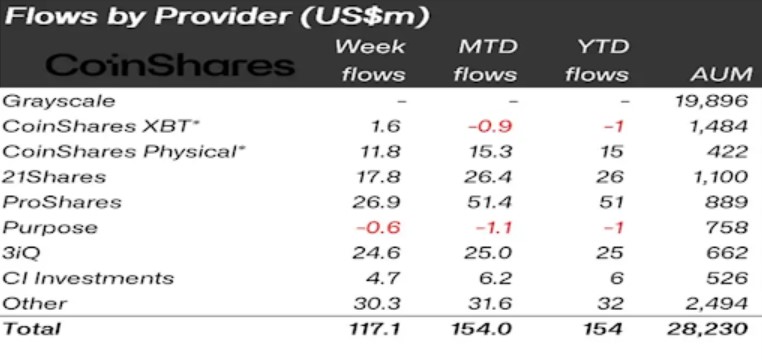

The volume of flows, as determined by the offering firms

The table which lists the most significant investment funds in digital assets globally reveals that ProShares holds the record for the highest amount of positive flows in digital assets, totaling $26.9 million.

Meanwhile, CoinShares XBT recorded the lowest with a value of $1.6 million.

The report also mentions that Purpose was the only fund among the largest that recorded a negative flow ($-0.6 million).

The report indicates that investment product volumes are improving, with $1.3 billion traded during the week, which represents a 17% increase compared to the average since the start of the year.

Additionally, the broader digital asset market saw an increase in its average weekly volume by 11%.

It is worth mentioning that investment products still only make up 1.4% of the total volumes on trusted cryptocurrency exchanges.

Bitcoin: Investors’ Preferred Asset

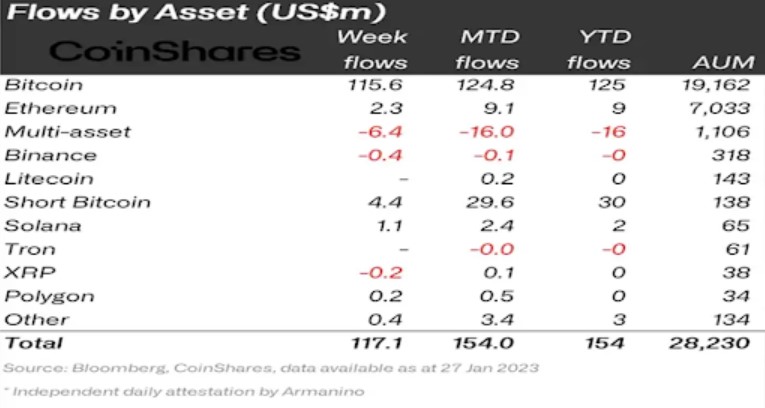

Among all cryptocurrencies, Bitcoin had the highest positive weekly inflow and was the most sought-after asset by investors. Investments worth $115.6 million were recorded for Bitcoin out of the total weekly inflows of all cryptocurrencies, which were reported to be $117.1 million (approximately 98%).

The remaining $1.5 million is distributed among the others, including Ethereum, which recorded positive flows of $2.3 million.

According to the CoinShares report, multi-asset investment products experienced negative inflows for the ninth consecutive week, totaling $6.4 million. This suggests that investors are opting for more selective investments. As a matter of fact, this trend can be seen in the altcoin table, where Solana, Cardano, and Polygon all recorded positive inflows, while Stellar and Uniswap saw slight negative inflows.

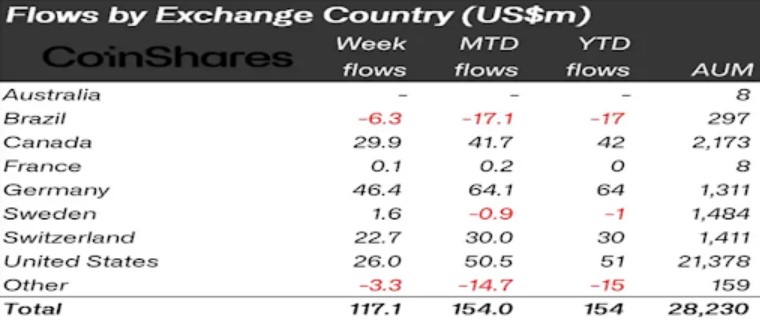

The volume of digital asset flows by country

In January, digital asset investment flows were minimal in Australia and France, but Germany was the focus of the week with 40% of all positive inflows, totaling $46.4 million.

Canada, the United States, and Switzerland followed with a total of $29.9 million, $26 million, and $27.7 million, respectively.

Statistics also show that Brazil recorded a negative flow of investments, with a value of -$6.3 million.

Overall, despite the major setbacks in the crypto sector in 2022, it appears that the indicators for digital asset flows at the end of January for the new year are positive.

This has led the crypto community to believe that 2023 will bring positive developments in the field of digital currencies. It remains to be seen if these flows will continue to be positive for the rest of the year.