Tumbling Countries in the MENA Region Emerge as Leaders in Crypto Adoption

Global adoption of cryptocurrency has slowed down, but less than expected

There is no doubt that the crypto space has seen better days, for the harsh crypto winter has been blowing its cold wind all year long. However, Chainalysis report entitled ‘The 2022 Geography of Cryptocurrency Report’, revealed that the global adoption of cryptocurrency has slowed down less than expected. In fact, global adoption of cryptocurrency reached its current all-time high in Q2 2021. Since then, adoption has moved in waves – it fell in Q3, which saw crypto price declines, rebounded in Q4 when we saw prices rebound to new all-time highs, and has fallen in each of the last two quarters as we’ve entered a bear market.

Nevertheless, even with the bear market and the undeniable decline of major cryptocurrencies, as well as the recent collapse of several high-profile projects such as TerraUSD and lender Celsius, adoption still exceeds pre–bull market 2019 levels.

The data suggests that many of those attracted by rising prices in 2020 and 2021 stuck around, and continue to invest a significant chunk of their assets in digital assets. This also aligns with Chainalysis’ previous research, showing that cryptocurrency markets have been surprisingly resilient through recent declines. Big, long-term cryptocurrency holders have continued to hold through the bear market, and so while their portfolios have lost value, those losses aren’t locked in yet because they haven’t sold— the on-chain data suggests those holders are optimistic the market will bounce back, which keeps market fundamentals relatively healthy.

According to Kim Grauer, Director of research at Chainalysis, this year’s index doesn’t demonstrate substantial changes from 2021, but conveys the different ways people are using cryptocurrency.

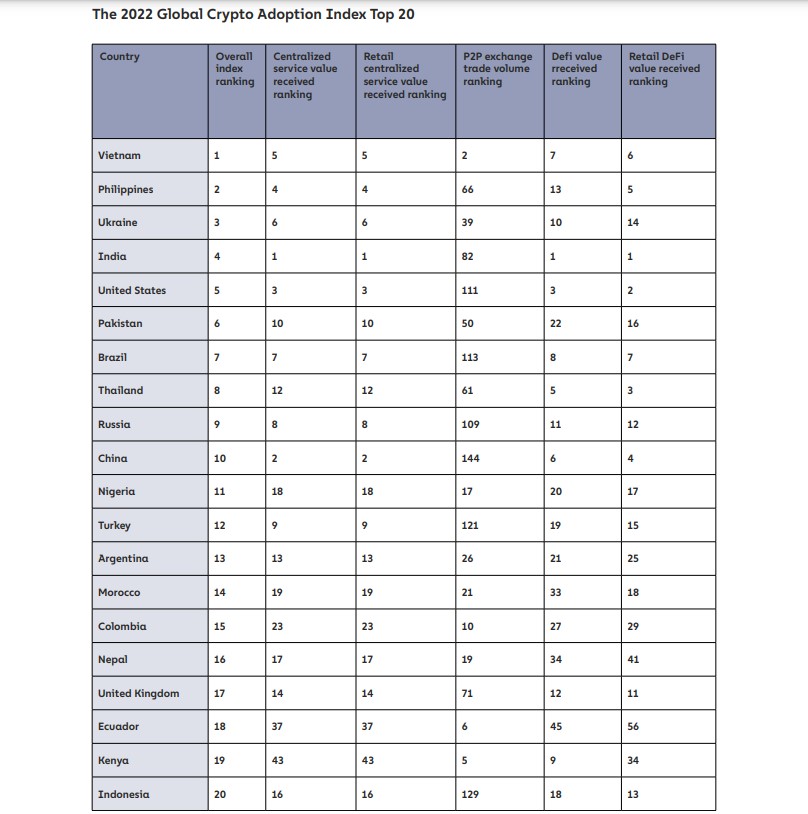

The report ranks 154 countries according to key trading metrics measured through centralized exchanges, DeFi protocols, and peer-to-peer trading volume, analyzing what Chainalysis calls ‘grass-roots adoption’—where people are putting the biggest share of their money into crypto.

As seen below, Vietnam ranks first, followed by The Philippines, Ukraine, India and the United States, respectively.

However, in this piece, we will be covering the Middle East & North Africa (MENA) region, as it is our main point of focus.

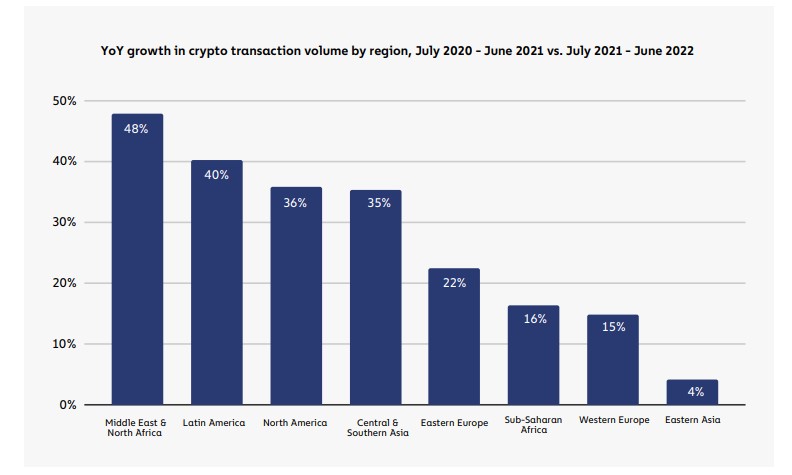

As mentioned in the report, the MENA region may be one of the smaller crypto markets in the 2022 Global Crypto Adoption Index, but it’s also the fastest growing.

MENA-based users received $566 billion in cryptocurrency from July 2021 to June 2022, 48% more than they received the year prior. In addition to that, MENA is also home to three of the top thirty countries in this year’s index: Turkey (12), Egypt (14), and Morocco (24). Use cases around savings preservation and remittance payments as well as increasingly permissive crypto regulations help explain why.

Tumbling countries leading the way

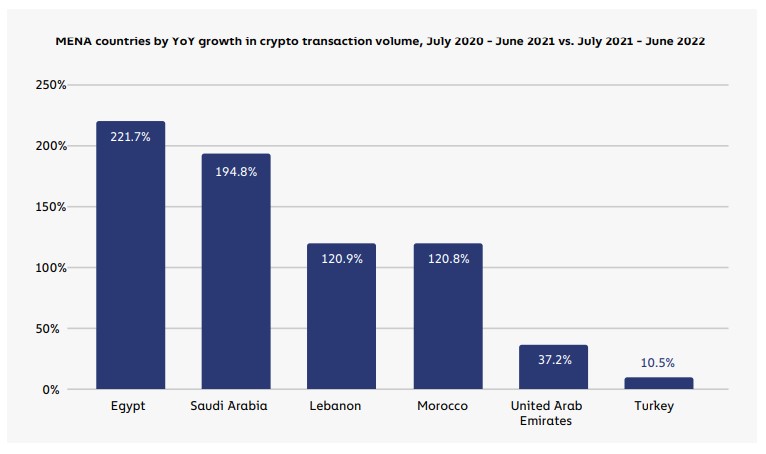

As seen above, Egypt, Lebanon, Morocco and Turkey, are all leading countries in cryptocurrency adoption. Nonetheless, it is not the case in other sectors and spaces, as such countries are suffering from major economic crises.

For instance, in Lebanon, Turkey and Egypt, fluctuating cryptocurrency prices have coincided with rapid fiat currency devaluations, strengthening the appeal of crypto for savings preservation.

In Lebanon, cryptocurrency seems to have gained the trust of Lebanese people more than the Central Bank and traditional banks have, as the economic crisis lives on. In addition to that, sellers of mining machines in the country have become more popular through Tiktok, Telegram and WhatsApp. Many had to rent warehouses to store the machines as demand continues to surge. And despite Lebanon’s lack of electricity, many citizens are still willing to invest in those machines to mine Bitcoin and other digital cryptocurrencies.

The Turkish Lira has inflated by 80.5% in the last year; the Egyptian Pound has weakened by 13.5%. Also significant, however, is Egypt’s remittance market. Remittance payments account for about 8% of Egypt’s GDP, and the country’s national bank has already begun a project to build a crypto-based remittance corridor between Egypt and the UAE, where many Egyptian natives work.

Egypt’s position at the intersection of growing crypto remittances and increased inflationary pressures help explain why it’s the fastest growing crypto market in all of MENA this year. Between July 2021 and June 2022, transaction volume in Egypt tripled compared to the preceding year. Turkey, meanwhile, remains the largest cryptocurrency market in the region, its citizens having received $192 billion from July 2021 to June 2022, but has seen much slower YoY growth.

This being said, one can notice that countries that are currently suffering from unstable currencies are taking the leap, meaning that such populations are leaning more towards crypto instead of holding and receiving fiat money.

Knowing that the blockchain and crypto space continues to grow by the day, this is being reflected on its adoption, as more and more people, especially in countries like Lebanon, Egypt and Turkey, are gradually believing and rooting even more for cryptocurrencies and the Blockchain technology as a whole.

The UAE- a blockchain and crypto-friendly environment like no other

The UAE, and Dubai in specific, remains the melting pot of the Blockchain and crypto space in the region. With hundreds of companies, ideas, funds and projects launching every day, one can say that the space is safe and will eventually bounce back.

Also, regulators including VARA and ADGM, have been doing a great job with licensing companies and regulating the space, which gives the UAE an even bigger value and advantage over other countries in the MENA region. This is thanks to the Blockchain and crypto-friendly environment that it provides.

In addition to that, projects including the biggest mining farm on the planet that is being built in Abu Dhabi is what attracts like-minded investors and talents, and events, such as GITEX/ The Future Blockchain Summit, allow thousands of people to connect and share ideas and thoughts through panel discussions, networking events, booths and much more.

Even though the UAE is fifth in the MENA region, one can notice that the effort the Government and the enterprises have been putting in this space is undeniable, which is why it is a leading hub for Blockchain and crypto worldwide.

What will drive the next wave of adoption?

Chainalysis data shows that growing transaction volume for centralized services and the explosive growth of DeFi are driving cryptocurrency usage in the developed world and in countries that already had substantial adoption, while P2P platforms are driving new adoption in emerging markets.

Our biggest question for the next twelve months is how much adoption will continue on those platform categories compared to new and emerging models we haven’t seen yet. The clear takeaway though is this: cryptocurrency adoption has skyrocketed in the last twelve months, and the variation in the countries contributing to that show that it is a truly global phenomenon.