FinTech in the MENA Region Surpasses $819 Million, 14 Times More Than in 2016

Investments in FinTech across the Middle East and North Africa (MENA) have already surpassed $819 million in the first half of 2022. This is almost 14 times more than in 2016.

The demographic makeup of the MENA area presents a significant window of opportunity. More than 60% of the people are under the age of thirty. Besides, the people living in MENA are sophisticated in tech and eager to adopt emerging digital methods. For example, in the United Arab Emirates (UAE), more than half of the population already uses digital wallets.

Government assistance and fintech-friendly rules are also luring global players. For instance, UAE, Bahrain, Egypt, and Saudi Arabia support the fintech ecosystem with free zones. Moreover, they offer regulatory sandboxes, such as DIFC’s Innovation Testing License (ITL) and Egypt’s fintech sandbox. UAE and Bahrain dominate crypto usage and regulation in the region.

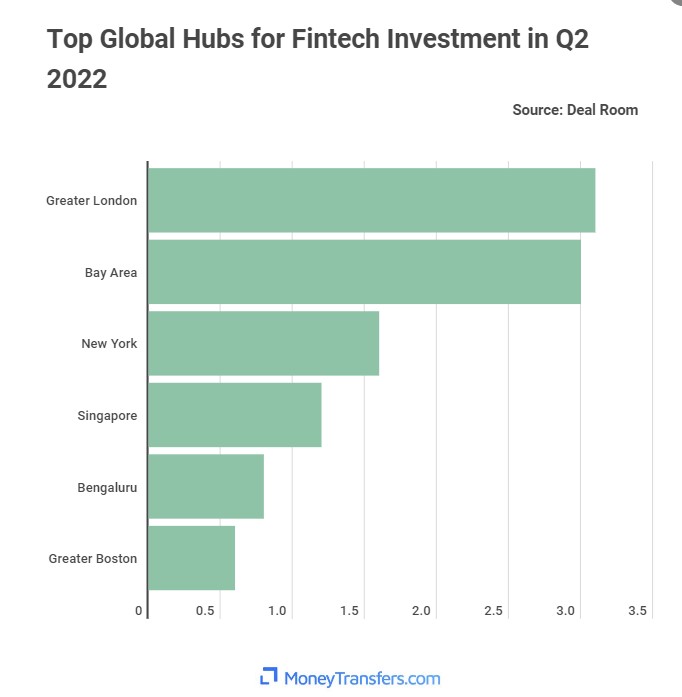

It is also important to note that London has been a leading global hub for fintech investment, as the financial technology sector has been one of the hottest investment areas over the past few years, according to MoneyTransfers.com.

In fact, MoneyTransfers.com reports show that London has successfully attracted the most fintech investment, reaching $3.1 billion in 2022, with more deals and more money raised than any other city.

The success of Fintech in Britain came from challenger banks, which are digital-only banking apps. They work effectively with cloud-based infrastructure, embedded AI, and agile frameworks. Again, they give users more accessible and faster access to banking services and financial products.

Firms such as Revolut and Starling Bank are household names among their tech-savvy consumer base. The firms have targeted millennials and Gen Z customers who are embracing tech. Many of these clients have eschewed traditional retail banking in favor of these more user-friendly banking apps.

Britain is working hard to maintain London at the forefront of the Fintech industry. The government is working on new visa pathways for overseas workers to aid U.K. fintech firms. Also, it is looking into a CBDC and changing its market-listing rules to improve its regulatory environment. In addition, financial authorities and businesses are coming together to promote the use of Fintech.

CEO of MoneyTransfers.com, Jonathan Merry, commented on the report. He said, “The U.K.’s fintech sector is unrivaled in Europe and is continuing to grow at an incredible rate. London is the natural home for many of these businesses due to the city’s deep pool of talent, its global reputation, and the supportive ecosystem that exists here.”

Merry continued, “The U.K. government’s recent decision to provide tax breaks for early-stage businesses will only further fuel the fintech sector’s growth and make the country even more attractive to entrepreneurs and investors.”

Compared to the $3.1 billion raised in London, Bay Area was close behind with $3.0 billion, followed by New York with $1.6 billion. Singapore ($1.2 billion) was fourth, with Bengaluru ($0.8 billion) and the Greater Boston region ($0.6 billion) completing the top six cities.