The Merge: the How and Why

When a topic turns into the talk of the town- or probably the globe- that is when you know the blockchain and crypto space is getting down to real business.

Ethereum’s transition journey from PoW to PoS could take up to years, as it began with the launch of the Beacon Chain in December 2020, and has seen several delays on the way.

Nevertheless, Ethereum Foundation member Tim Beiko suggested September 19, as the provisional launch date for the Merge, which will see the world’s biggest smart contract blockchain transition from the high energy consumption proof-of-work consensus mechanism to a more environment-friendly proof-of-stake mechanism.

History of Ethereum

Ethereum’s co-founder, Vitalik Buterin, was introduced and intrigued by blockchain technology when he got involved in Bitcoin as a 17-year-old programmer in 2011 and co-founded Bitcoin Magazine. He started imagining a platform that went beyond the financial use cases allowed by Bitcoin and released a white paper in 2013 describing what would ultimately become Ethereum using a general scripting language.

The key differentiator from Bitcoin was the platform’s ability to trade more than just cryptocurrency.

In 2014, Buterin and the other co-founders of Ethereum launched a crowdsourcing campaign where they sold participants Ether (Ethereum tokens) to get their vision off the ground and raised more than $18 million. The first live release of Ethereum known as Frontier was launched in 2015. Since then, the platform has grown rapidly and today there are hundreds of developers involved.

Ultimately, Buterin hopes Ethereum will be the solution for all use cases of blockchain that don’t have a specialized system to turn to.

Ethereum is still experiencing growing pains and suffers from some of the same issues that Bitcoin does primarily in its scalability. In 2016, $50 million in Ether was stolen by an anonymous hacker, which resulted in questions about the platform’s security. This caused a split within the Ethereum community and it broke off into two blockchains: Ethereum (ETH) and Ethereum Classic (ETC).

There have been dramatic fluctuations in the price of Ether, but the Ethereum currency grew more than 13,000% in 2017. This drastic growth is attractive to many investors, but the volatility makes other investors cautious.

It is still a young platform, but its potential and applications could be limitless. Ethereum’s infrastructure was enhanced over the last few years when it was challenged with security issues and since it’s less monopolistic than Bitcoin, it is more open to reform measures that might ultimately make it a superior solution to Bitcoin.

The phases of the upgrade

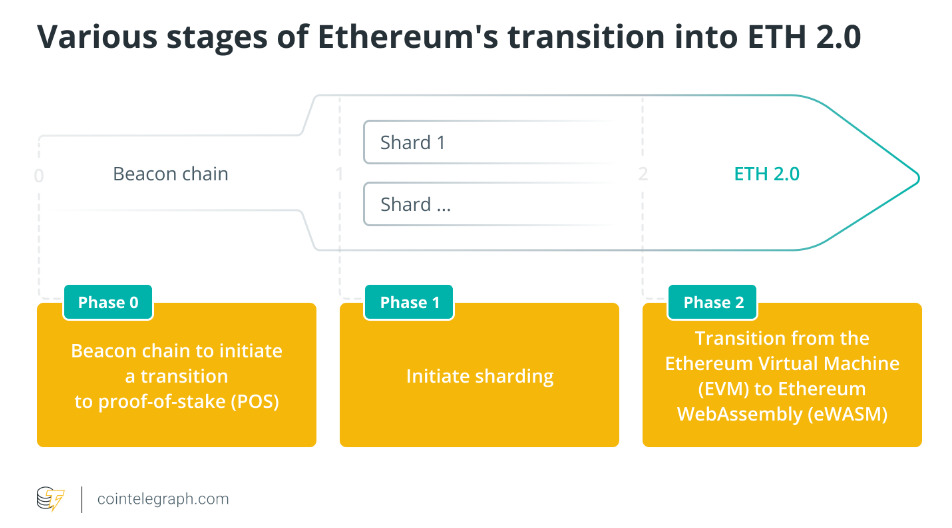

The Merge is only one part of the Ethereum 2.0 upgrade. The entire plan consists of three main phases.

First is the launch of the Beacon Chain. This is a PoS blockchain that the Ethereum network will switch to when it transitions out of PoW. The Beacon Chain went live in December 2020 and runs parallel to the main Ethereum chain called Mainnet.

The second phase is the Merge, where the Mainnet and the Beacon Chain will combine, and the Ethereum network will begin operating as PoS. Testing for the Merge has already begun.

The final phase of the upgrade is called ‘sharding’, which is expected to eliminate data congestion, high gas (transaction) fees, and support the next generation of layer 2 scaling systems.

Phase 1- The Beacon chain

The Beacon Chain, which went live on December 1st, 2020, was the fundamental piece of the new platform, setting up the stage for a smooth transition to a Proof of Stake (PoS) network. It is a ledger of accounts that conducts and coordinates the network of stakers. It isn’t quite like the Ethereum Mainnet of today, as it does not process transactions or handle smart contract interactions.

However, it is a new consensus engine (or “consensus layer”) that will soon take the place of proof-of-work mining, bringing many significant improvements with it. The Beacon Chain’s role will change over time, but it’s a foundational component for the secure, environmentally friendly and scalable Ethereum the company is working towards.

Staking vs. mining

The Beacon Chain introduced proof-of-stake to Ethereum. This is a new way for you to help keep Ethereum secure. Think of it like a public good that will make Ethereum healthier and earn you more ETH in the process. In practice, staking involves you staking ETH in order to activate validator software. As a staker, you’ll run node software that processes transactions and creates new blocks in the chain.

Staking serves a similar purpose to mining, but is different in many ways. Mining requires large up-front expenditures in the form of powerful hardware and energy consumption, resulting in economies of scale, and promoting centralization.

Mining also does not come with any requirement to lock up assets as collateral, limiting the protocol’s ability to punish bad actors after an attack.

The transition to proof-of-stake will make Ethereum significantly more secure and decentralized by comparison. The more people that participate in the network, the more decentralized and safe from attacks it becomes.

Difficulty bomb

The difficulty bomb is an update built into the protocol that will be a measure to disincentivize Ether mining operations from keeping their physical mining devices running as the network transitions from proof-of-work (PoW) to proof-of-stake (PoS).

It dramatically increases the difficulty for miners to verify transactions on the network, thus reducing profitability for PoW miners. Eventually, it will become impossible for physical miners to validate a block. The difficulty bomb is a feature of the network that was added to the code in 2016, as plans for the Merge to become the Consensus Layer (formerly known as Eth2) were being formed.

In other words, as explained by EthHub, Ethereum’s Difficulty Bomb refers to a mechanism that, at a predefined block number, increases the difficulty level of puzzles in the proof-of-work mining algorithm, resulting in longer-than-normal block times, and thus, less ETH rewards for miners.

Phase 2- The merge: why and how?

Essentially, Ethereum is changing the method it uses to process transactions. Like Bitcoin, it uses a consensus mechanism called proof-of-work (PoW), which requires users to solve complex mathematical problems to validate transactions and secure the network.

Although this method is effective, it isn’t very efficient. People who solve these problems, known as miners, must invest massive amounts of energy and equipment to have a chance at mining the transaction blocks and earning rewards.

Companies with huge computing power can take control over half of the validator nodes, leading to much higher security threats to Ethereum. By definition, a decentralized blockchain can’t afford to have central points of failure. The Ethereum founders realized this and included a transition to another consensus mechanism called proof-of-stake (PoS).

PoS replaces the process of block mining that PoW employs by using validation to maintain the network. Here is how it works:

Users commit their ETH by setting it aside, or ‘staking it’, to win the right to create a block. Based on their stake, one of the users is chosen to be the validator. Once a participant has validated a block of transactions, other contributors can attest (or confirm) that the block is valid.

When enough attestations are made, the network adds a new block, and rewards are distributed in the blockchain’s native currency, ETH, in proportion to each validator’s stake. However, if a user attests a malicious block, they risk losing their entire stake through a process known as ‘slashing’.

Despite the technical expertise required to become a validator, anyone can join if they meet the minimum requirement of having 32 ETH. Nevertheless, those who can’t meet the threshold can still contribute by staking their ETH in a pool to receive a portion of the rewards.

Overall, PoS eliminates the need for expensive equipment and cheap electricity, making it easier for the average user to participate. Furthermore, the environmental toll that the PoW governance system uses often ends up being one of the main criticisms of cryptocurrencies. Comparatively, the move to PoS is predicted to reduce the energy consumption of the Ethereum network by 99.95 percent, a number worth taking into consideration.

In other words, the Merge is the much anticipated Ethereum upgrade that will “merge” the Beacon Chain and the Mainnet, removing the mining process once and for all.

Phase 3- Sharding

Expected to be introduced sometime in 2023, as the first two phases of The Merge won’t solve all problems, sharding will see the main Ethereum blockchain broken up into several smaller chains for different parts of the data set. When that happens, Ethereum will be able to handle thousands of transactions per second – compared to the 7-15 transactions per second it can handle now.

This will solve the network’s scalability problem, putting it on par with centralized payment processors like Visa. It will also lower the entry barrier, as validators will only store or run data for a subset of the entire blockchain. This will make it possible to run the Ethereum node from a laptop or a phone, making it even more decentralized and secure.

As the merge approaches, the blockchain and crypto space is gearing up, impatiently waiting to see whether this step will take Ethereum to new heights or bury it underground. Nevertheless, Ethereum remains an open-source blockchain that has redefined this technology, and is always on the lookout for new ways to advance and improve its consumer experience and assets.

Stay updated on The Merge with an exceptional analytical piece that will be published by UNLOCK Blockchain later this week.