Binance State of the Blockchain 2025: Key Highlights on Regulation, Liquidity, and Crypto Adoption

Binance’s State of the Blockchain 2025 year-in-review report outlines major trends and metrics across regulation, liquidity, Web3 discovery, institutional adoption, user protection, and everyday crypto usage. The report underscores how the exchange is increasingly seen as critical financial infrastructure, reflecting both scale and resilience in 2025.

Milestones in 2025: ADGM Authorization and 300M Users

Two milestones marked the end of 2025 for Binance:

ADGM FSRA Authorization – Binance became the first crypto exchange to secure full authorization under Abu Dhabi Global Market’s rigorous regulatory framework, enabling fully regulated global trading.

Global Community Growth – The platform surpassed 300 million registered users, highlighting the expanding reach and adoption of its ecosystem.

These milestones illustrate growing expectations for governance, risk management, and user protection alongside liquidity and scale.

Trust as Infrastructure: Regulatory Compliance and Resilience

Binance emphasizes measurable outcomes in trust and resilience:

- 96% reduction in direct exposure to major illicit funds since 2023.

- $6.69 billion in potential fraud and scam losses prevented in 2025 for 5.4 million users.

- Supported 71,000+ law enforcement requests, including confiscations totaling $131 million and 160+ law enforcement training sessions.

Enhanced Due Diligence processes were redesigned to simplify compliance while maintaining strong user protection standards.

Liquidity, Trading Depth, and Web3 Discovery

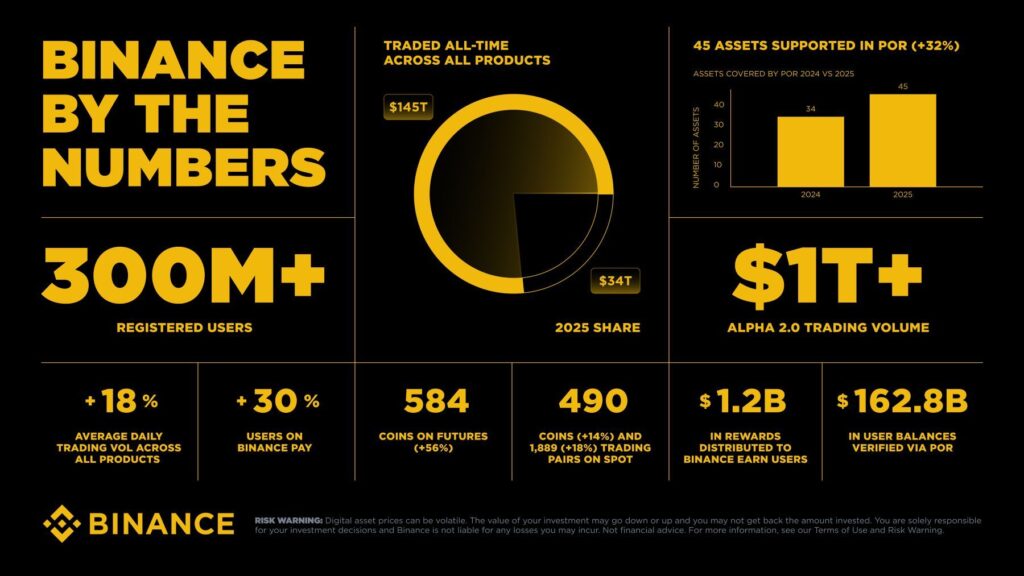

Liquidity remains at the core of Binance’s growth, with the platform processing $34 trillion in total trading volume across all products in 2025, including $7.1 trillion in spot trading alone. Spot markets expanded to nearly 490 coins and 1,889 trading pairs, while futures markets grew to cover 584 coins. Binance also enhanced user engagement through Alpha 2.0, a discovery platform that processed over $1 trillion in trading volume, onboarded 17 million users, and distributed $782 million in rewards while blocking over 270,000 dishonest participants. These initiatives underscore a shift toward structured participation and responsible user growth.

Demo Trading and Smart Money tools enabled users to test strategies and learn market behaviors without risking capital, promoting structured participation.

Institutional Adoption Moves From Pilots to Full Integration

Institutional adoption continued to accelerate, moving beyond pilot programs to full operational integration. Institutional trading volumes rose 21% year-over-year, while OTC fiat trading surged 210%. Tokenized funds are increasingly being used as eligible off-exchange collateral, and modular offerings such as Crypto-as-a-Service allow regulated firms to offer digital assets without building entire exchange infrastructure from scratch. Account structures like Fund Accounts, Binance Wealth, and Binance Prestige mirror traditional financial models, supporting managed strategies and entity onboarding.

Everyday Crypto: Payments, Local Rails, and Rewards

Beyond trading, the report highlights the importance of everyday crypto adoption. Fiat and P2P volumes grew 38%, Binance Pay usage increased 30%, and the payment solution expanded to more than 20 million merchants. Binance Earn distributed $1.2 billion in user rewards, reflecting a growing ecosystem of products designed to enhance participation and usability.

Scale Requires Resilience and Regulation

Binance’s 2025 report makes clear that scale alone is not enough. Sustainable growth requires robust regulatory frameworks, resilience against illicit activity, strong user protections, and product design that balances usability with security. As digital finance becomes increasingly standards-driven, Binance is positioning itself as a leader in building trust and reliability within the global crypto ecosystem.

The full report provides deeper breakdowns of product updates, infrastructure initiatives, and user engagement metrics.