Trump’s WLFI Token: Billions in Family Gains, Millions in Investor Losses

When World Liberty Financial (WLFI), the crypto token tied to President Donald Trump, began trading on September 1, it immediately became one of the most politically charged launches in digital assets. Hype translated into nearly $1 billion of trading volume in the first hour, as investors across major exchanges rushed to buy into what some framed as the “Trump coin” experiment. Within hours, however, the volatility left a stark divide: the Trump family saw billions in paper gains, while retail investors absorbed hundreds of millions in losses.

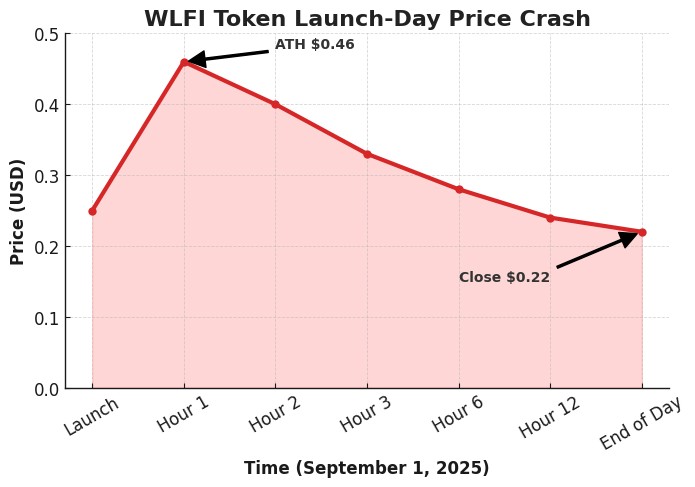

According to CoinMarketCap and CoinGecko, WLFI peaked between $0.33 (global average) and $0.46 on Binance, before crashing back to around $0.22 by the end of the first day. This swing—more than 40 percent from peak to trough—defined the early trading frenzy.

A Trading Frenzy Across Exchanges

WLFI did not launch quietly. Major global exchanges including Binance, OKX, Upbit, Coinbase, Bybit, MEXC, Bitget, Gate, and KuCoin listed the token. Volumes surged: Binance alone saw more than $240 million in WLFI/USDT trades in the first 24 hours, with OKX and Upbit each exceeding $100 million. Across all venues, CoinMarketCap reported over $1.1 billion in total trading volume on day one.

The Guardian described the debut as “one of the most extraordinary political forays into crypto,” noting that $1 billion changed hands within the first hour of trading. Such volumes placed WLFI among the most actively traded new tokens of the year, even as its fundamentals remain unclear.

Billions in Paper Gains for the Trump Family

For the Trump family, WLFI’s debut was immensely lucrative—at least on paper. According to the Financial Times, Donald Trump personally held 15.75 billion WLFI tokens, worth approximately $3.6 billion on the first day of trading. Axios reported that the family collectively controls around 25 percent of the total WLFI supply, equivalent to a paper fortune of $5 billion.

Reuters took a more conservative view, suggesting that the family had so far realized around $500 million from structured token sales. Regardless of the accounting, the numbers underscored a stark reality: insiders reaped immediate windfalls while retail buyers faced a much different outcome.

In our earlier Unlock Blockchain article, “The Trump Crypto Experiment: When Financial Engineering Meets Political Power”, we explained how WLFI’s very structure favored insiders from the outset, with strategic allocations and financial maneuvers securing vast paper wealth for the Trump family. The market debut only amplified that dynamic: while trading activity expanded the token’s visibility, it also exposed retail participants to the steep downside of a politically branded financial product.

WLFI Token Crash Leaves Retail Investors With Hundreds of Millions in Losses

The retail side of WLFI’s debut was brutal. Prices that touched $0.46 on Binance quickly collapsed toward $0.22, leaving late buyers facing losses of 40 to 50 percent in less than 24 hours. New York Magazine described it as one of the fastest collapses in recent token launches.

Unlock Blockchain’s analysis of exchange data shows that if just half of the first-hour trading volume (~$500 million) was concentrated near the peak, investors collectively lost between $220 million and $260 million in unrealized value by the end of day one. If a greater share of the frenzy took place at peak levels, losses could have approached $500 million across all exchanges.

This makes WLFI not only a political experiment but also one of the costliest early token crashes for retail traders in recent memory.

Winners and Losers Behind the Ticker

The distribution of gains and losses was stark. On-chain monitors show that eight of the ten largest individual holders sold part or all of their allocations within hours, while the top holder retained most of a one-billion-token stake still worth hundreds of millions at prevailing prices. At the same time, derivatives funding and open-interest dynamics favored shorts during the drop, and late OTC buyers were left holding higher-priced inventory as spot retreated.

Not the First Time

The pattern is familiar. Both Donald Trump and Melania Trump have been linked to earlier digital asset projects, from NFTs to smaller meme-style tokens. Those, too, saw explosive initial trading followed by rapid declines that left buyers holding devalued assets. The difference with WLFI is scale: with billions of dollars in notional trading, the stakes for investors were exponentially higher.

Can WLFI Recover?

Unlike pure meme coins, WLFI is backed by a corporate entity—World Liberty Financial—that has pledged to develop a financial ecosystem around the token. This structure gives holders at least a theoretical path to recover some of their investment if the company delivers real products, partnerships, and utility.

For now, however, the numbers tell a clear story. On launch day, the Trump family walked away with billions in paper wealth. Ordinary investors, meanwhile, were left nursing hundreds of millions of dollars in paper losses. Whether WLFI evolves into a genuine financial platform—or remains a cautionary tale of politically branded hype—remains an open question.