When Financial Engineering Meets Political Power: The Trump Crypto Experiment

The Trump family has redefined its business empire, shifting from real estate to cryptocurrency in a series of deals that blur the lines between finance and politics. At the center of this transformation is World Liberty Financial, the flagship Trump venture that recently engineered a transaction as unusual as it is lucrative.

Through a circular structure, World Liberty sold its newly minted WLFI tokens to Alt5 Sigma, a publicly listed firm that raised $750 million from outside investors for the purchase. The result: a half-billion-dollar payday for the Trump family, which retains the right to a large share of WLFI revenues. The family also holds billions more in WLFI tokens, giving it a paper fortune that rivals the wealth of its old real-estate empire.

What makes this more than just another crypto windfall is the political overlay. The Trump administration has signaled a lighter regulatory touch on digital assets, even as the president and his family are among the largest beneficiaries of that policy shift. The transaction illustrates what happens when financial engineering meets political power, creating ventures that some investors see as “too political to fail.”

From Real Estate to Tokens

For decades, the Trump brand was synonymous with towers, golf courses, and hotels. That narrative has now shifted. Crypto has become the family’s dominant business interest, eclipsing the real-estate empire that once defined it.

World Liberty Financial, launched last year with much fanfare, represents the culmination of this pivot. The company positions itself as a vehicle for payments innovation, but its first major transaction was less about technology than financial structuring. By selling WLFI to Alt5 Sigma — a firm that then instantly booked the tokens as assets purchased with fresh investor capital — World Liberty turned a self-issued digital currency into a cash machine.

Former regulators describe the deal as unusual but not necessarily unlawful. As long as the insider connections were disclosed, investors were free to weigh the risks. What distinguishes this case is that those insiders are also political leaders, with influence over the very regulatory environment shaping the sector.

The New Asset Class: Political Tokens

The Trump family now holds more than $6 billion worth of WLFI tokens on paper, with President Trump himself controlling two-thirds. Only a fraction of the total supply will begin trading publicly, but the family’s reserves represent a vast overhang that could generate further billions if demand holds.

This is not the first Trump-branded crypto venture. Earlier this year, the launch of the $TRUMP memecoin drew significant retail interest before its value fell sharply. Melania Trump also introduced her own digital token, which became mired in controversy after liquidity was drained by an insider. Eric Trump has pursued Bitcoin mining through his American Bitcoin venture and has taken advisory roles with international firms building crypto treasuries.

Taken together, these ventures amount to a sprawling crypto empire that fuses personal brand, political visibility, and speculative digital assets. For supporters, it is proof that the Trump family is embracing financial innovation. For critics, it is evidence of monetizing political office through private markets.

Too Political to Fail?

In traditional finance, investors sometimes believe that certain banks or corporations are too big to fail, assuming governments will step in to prevent collapse. A similar logic now surrounds Trump-linked crypto projects.

Investors may calculate that as long as the Trump administration remains in power, these ventures will enjoy protection, favorable regulation, and political legitimacy. The Nasdaq bell-ringing ceremony for World Liberty’s deal with Alt5 Sigma, featuring Donald Trump Jr. and Eric Trump, underscored the political imprimatur behind the tokens.

This perception adds a layer of value beyond utility or adoption. WLFI is not just another token competing for market share; it is symbolically tethered to the presidency itself. In that sense, it may be seen by some as “too political to fail,” regardless of fundamentals.

WLFI Hits Public Markets

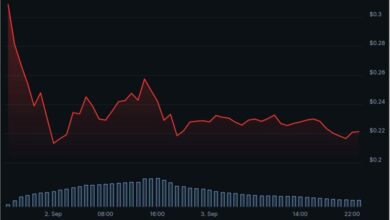

On September 1, WLFI began trading publicly, marking the transition from private structuring to open market speculation. Binance became the first major exchange to list the token, opening WLFI spot trading against USDT, USDC, and TRY. The listing came with a “Seed Tag,” Binance’s designation for early-stage, high-risk tokens, requiring traders to pass a risk disclosure quiz before participating.

At the same time, derivatives markets have sprung to life. OKX and Binance both launched WLFI perpetual futures, with open interest approaching $1 billion within hours. Trading volumes across exchanges surged past $4 billion, underscoring the appetite for exposure to a token closely tied to the Trump brand.

The debut underscores the unique positioning of WLFI: more than a financial product, it is a political asset whose value is partly derived from its association with the presidency. For some investors, this very connection makes WLFI appear “too political to fail.”

Fragile Fortunes

Still, history suggests caution. Previous Trump-branded tokens spiked in value before plunging, leaving retail investors exposed. The sheer scale of WLFI supply raises questions about liquidity: if insiders try to cash out significant amounts, prices could fall sharply.

Cashing in paper wealth is always harder than it looks. The Trump family’s multi-billion-dollar holdings may be impossible to fully monetize without overwhelming the market. Even a small wave of selling could trigger losses, as has happened with countless tokens in the past.

There is also reputational risk. If the token collapses, or if investors perceive the structure as primarily enriching the family at their expense, the backlash could be severe. What is currently framed as political innovation could quickly turn into accusations of exploitation.

The Bigger Question

The Trump crypto experiment highlights a deeper question: what happens when political office itself becomes an asset class? Investors are no longer only pricing in technology, utility, or market demand. They are also pricing in political capital, regulatory discretion, and the prestige of proximity to power.

This is not just financial engineering; it is political engineering of markets. Whether it succeeds or fails, the Trump family has introduced a new model for how politics and crypto can merge. For some, it represents the ultimate validation of digital assets. For others, it is a warning that when power and markets intertwine too closely, the risks extend far beyond financial losses.