How the UAE Is Driving the Stablecoin Evolution: From Payments to Financial Infrastructure

Stablecoins are one of the most dynamic sectors in digital assets and a leading application of blockchain technology. Primarily pegged to the US dollar and acting as a bridge between volatile crypto assets and the stability of fiat currencies, these digital tokens are a faster and more cost-effective alternative to traditional payment systems.

The rise of stablecoins is shaping conversations across both policy and investment circles and their varied global adoption reflects diverse needs, from facilitating remittances to building new financial payment rails. Government policy towards stablecoins often serves as a proxy for a nation’s broader embrace of blockchain and cryptocurrency and the UAE has positioned itself as one of the global leaders.

Stablecoins’ Global Impact

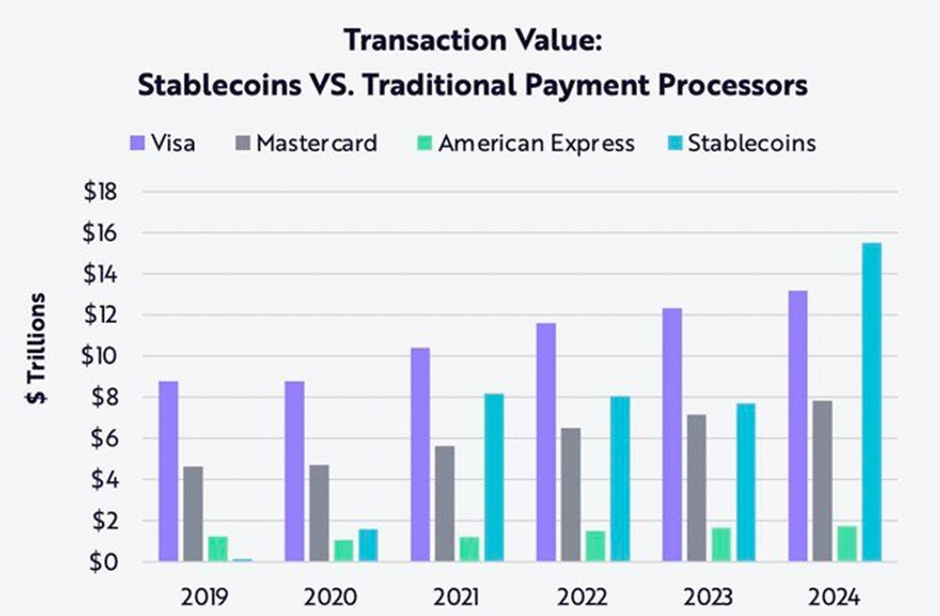

In 2024, stablecoins achieved a historic milestone, processing over $14 trillion in transactions, outpacing the traditional payment networks such as Visa ($12.3 trillion) and Mastercard ($9.1 trillion) for the first time.

Over the past 18 months, many blue-chip financial institutions and payment infrastructure providers have significantly increased their adoption of stablecoins. In April 2025, digital payments giant PayPal launched fee-free purchases for its PYUSD stablecoin, offering a 3.7% yield. This development is notable not only for integrating Coinbase’s yield infrastructure with PayPal’s trusted user experience, but also for signalling traditional payment providers’ efforts to capture market share from crypto-native stablecoins Tether and Circle.

The traditional payment networks are also following suit, as evidenced by Mastercard’s recent move to ramp up its crypto integrations. In the past two months, they have inked new partnerships with OKX and Nuvei for direct global stablecoin transactions at 150 million locations and launched a self-custody crypto card for direct spending from user wallets.

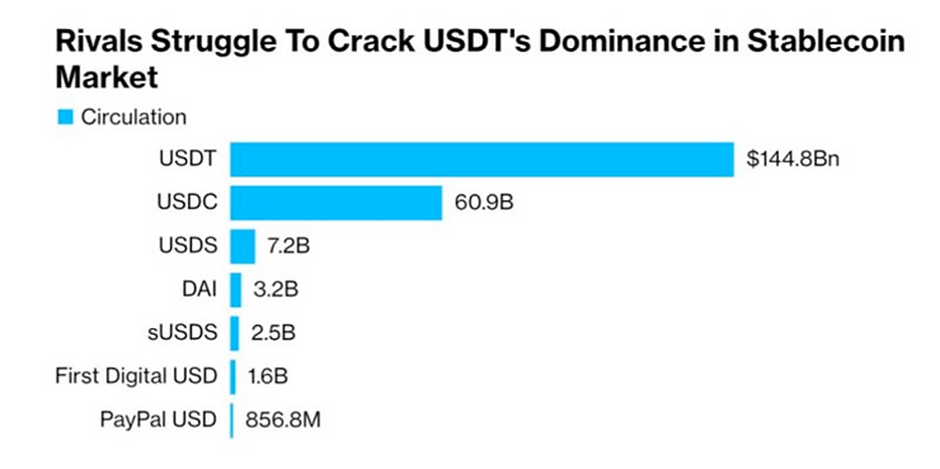

The adoption signal is equally strong among financial institutions, with Fidelity and Blackrock advancing innovative applications. Fidelity announced a USD-backed stablecoin in March to rival Tether’s USDT and Ripple’s RLUSD, while Blackrock’s BUIDL stablecoin expanded in 2025, reaching a $1.2 billion market cap as of May.

Contrasting Regulatory Approaches to Digital Assets

While business model pivoting and advances in the payments tech stack have been key for stablecoin adoption, regulatory advances are also an important driver.

For example, US legislative efforts such as the GENIUS Act are not only an important step in the legislative conversation around stablecoins, but also reflect how the current administration has embraced them. They see the potential to expand the US dollar’s digital footprint beyond its borders.

Despite this, compared with Europe, Canada and the Middle East, the US has generally lagged in establishing clear regulatory frameworks for stablecoins and digital assets more broadly, as seen with the previous administration’s “regulation by enforcement” which stifled innovation.

In contrast, the UAE has adopted a progressive regulatory stance, with VARA’s 2024 Marketing Regulations ensuring transparency in digital asset promotions, fostering a trusted environment for both builders and investors in the space.

UAE’s Regulatory and Technological Leadership

Looking at the global regulatory picture, the UAE is positioning itself as a leader in digital finance. An example of this was the recent regulatory approval of AE Coin, the first AED-pegged stablecoin, fully backed by reserves held in the UAE. With a market cap projected to reach $500 million by 2026, AE Coin is well-positioned in digital payments in the region, particularly in e-commerce and remittances.

The fact that AE Coin is licensed by the Central Bank and offers multi-factor authentication is significant, as it implies a regulatory process with defined reserve requirements, custody protocols, and full on-chain transparency. These aspects align the instrument with the expectations of both payment users and institutional allocators, which will help drive adoption.

UAE’s Clear Regulations Drive Ripple’s Expansion

The UAE’s regulatory clarity extends beyond AE Coin. Ripple Payments launched in the UAE in 2024, integrating stablecoins, crypto and fiat for seamless cross-border transactions. Again, this initiative aligns with the UAE’s vision to become a global fintech hub, with stablecoin transactions already accounting for 15% of cross-border payment volume in the region.

Such global expansion efforts by Ripple and other core industry players are in no small part related to regulatory hurdles elsewhere. Despite the more pro-digital assets administration in the US, the SEC has delayed decisions on several crypto ETFs for blue-chip digital assets, including XRP and Solana. This hands a competitive advantage to jurisdictions like Canada and the UAE, where product launches may occur sooner than in the US.

From Payment Rails to Financial Foundations

Stablecoins are increasingly embedded in the day-to-day machinery of global financial flows. With their usage volumes now rivalling major card networks and their adoption spreading across both private and public sectors, the question is no longer whether stablecoins will play a role in future finance, but how jurisdictions will shape that role.

With US dollar stablecoins alone projected to reach a combined market capitalization of $2 trillion by 2028 (from only $150 billion in 2024), it suggests that stablecoins are evolving beyond the realm of payments as infrastructure matures.

One area of growing interest is the role of stablecoins in digital asset portfolios, where they can function as base collateral, liquidity buffers and yield-bearing instruments in DeFi strategies. More recently, they are also being considered alongside regulated investments.

Regulatory guidance on stablecoins will prepare the ground for compliant investment products tied to digital assets in the UAE and elsewhere. Such strategic clarity will have a multiplier effect by lowering barriers to entry for international firms, de-risking innovation and allowing locally domiciled products, whether payments platforms or investment vehicles, to scale more quickly.