Crypto Afterlife? Binance’s ‘Will Function’ and Reserves Push Secure the Future

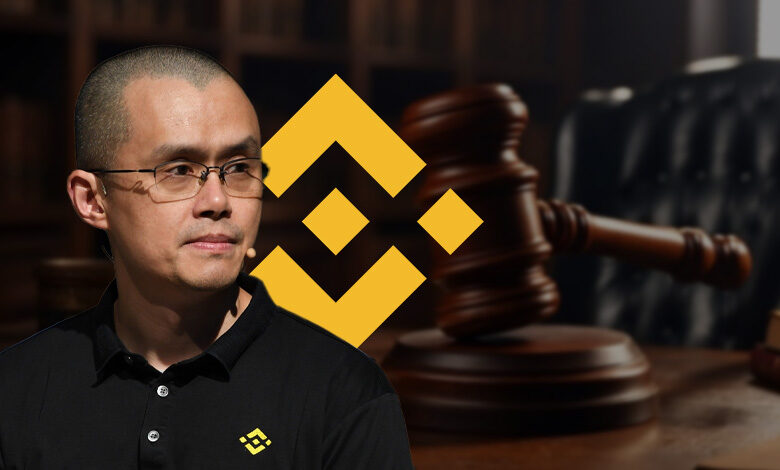

Changpeng Zhao (CZ), founder and former CEO of Binance, is encouraging crypto platforms to implement inheritance features following Binance’s latest update that introduces an emergency contact and asset transfer system. Taking to X (formerly Twitter), CZ said: “Every platform should have a ‘will function’—so that when someone is no longer around, their assets can be distributed to designated accounts according to specified proportions.”

He further suggested that regulations be revised to allow minors to hold crypto accounts—not to trade, but to receive inherited funds. “They can be restricted from trading, but should be allowed to receive funds,” he added.

His remarks come on the heels of Binance’s June 12 platform update, which includes a new inheritance feature enabling users to name an emergency contact who can claim their assets in case of death. The system alerts the designated contact if a user has been inactive for an extended period, allowing them to begin the inheritance process.

Crypto Community Reacts to Binance’s Emergency Feature

Members of the crypto community welcomed the new functionality, with many emphasizing the importance of planning for digital asset inheritance.

X user CryptobraveHQ praised the update as “really thoughtful,” noting that over $1 billion in crypto reportedly goes unclaimed each year due to unexpected deaths and the absence of inheritance mechanisms.

Some users, however, pointed out limitations. Uniswap12 stressed the broader value held in Binance accounts, beyond just financial assets. “Binance accounts hold tokenized wealth and intangible value, such as articles, social presence and community influence,” he wrote, adding, “This is even more important to me than cash assets,” and proposing that accounts themselves be transferable—similar to inheriting phone numbers.

Others agreed that inheritance planning should be a priority in Web3. X user Ghazi remarked that it’s “a reality we can’t ignore,” while another user, Binn, applauded the feature as progress toward decentralization. “Users will feel more secure knowing their digital wealth can be passed on,” he said.

Proof of Reserves: Binance Sets the Standard

The inheritance function isn’t the only area where Binance is taking the lead on user protection. The exchange also tops the industry when it comes to Proof-of-Reserves (PoR)—a method used to demonstrate that all user funds are fully backed. According to a recent analysis by CryptoQuant, Binance consistently maintains a Reserve Ratio above 100%, with timely monthly reports.

This strong performance places Binance ahead of major competitors like OKX, Bybit, Kraken, and Coinbase. While OKX and Bybit also show consistent ratios above 100%, Binance’s reporting frequency and transparency set it apart. In contrast, Coinbase has yet to publish a single Proof-of-Reserves report—raising questions about transparency from a platform of its scale.

Together, the PoR and inheritance tools reflect a broader push by Binance to strengthen trust and user protection in the crypto space, setting benchmarks others may feel pressured to follow.