Standard Chartered: Sovereigns Quietly Load Up on Bitcoin, $500K Target in Sight

Sovereign and government-affiliated entities ramped up their indirect exposure to Bitcoin in Q1 2025 by increasing their stakes in MicroStrategy (MSTR), according to a new report from Standard Chartered. The bank views this trend as reinforcing its bold forecast that Bitcoin will hit $500,000 before Donald Trump leaves office in 2029.

“The latest 13F data from the U.S. Securities and Exchange Commission (SEC) supports our core thesis that Bitcoin will reach the $500,000 level before Trump leaves office as it attracts a wider range of institutional buyers,” wrote Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, in a report shared with The Block. “As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in BTC.”

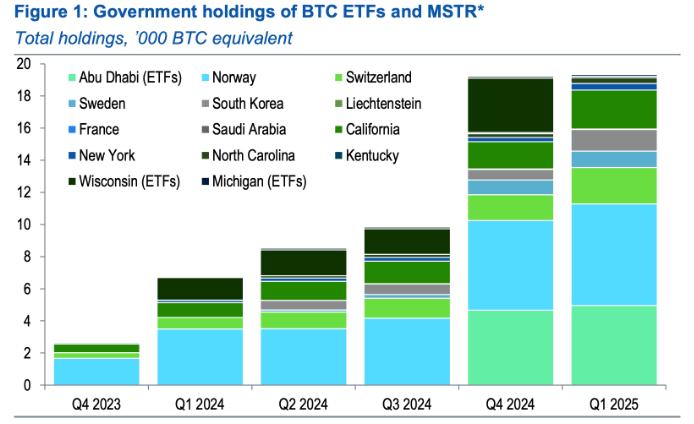

Kendrick pointed out that while direct spot Bitcoin ETF holdings were “disappointing” in the first quarter, rising MSTR ownership was “very encouraging,” especially among government-linked investors. The Q1 13F filings showed that the State of Wisconsin Investment Board exited its entire 3,400 BTC-equivalent position in BlackRock’s IBIT ETF. In contrast, Abu Dhabi’s Mubadala increased its IBIT exposure slightly to 5,000 BTC equivalent from 4,700.

But the bigger story, according to Kendrick, lies in the growing sovereign appetite for MicroStrategy. “We believe that in some cases, MSTR holdings by government entities reflect a desire to gain Bitcoin exposure where local regulations do not allow direct BTC holdings,” he said.

Among those increasing their MSTR exposure were Norway’s Government Pension Fund, the Swiss National Bank, and South Korean state institutions—each adding around 700 BTC equivalent. U.S. state retirement funds in California, New York, North Carolina, and Kentucky added a combined 1,000 BTC equivalent. Sweden and Liechtenstein made modest increases, while France and Saudi Arabia entered positions for the first time, albeit with small allocations.

“The quarterly 13F data is the best test of our thesis that BTC will attract new institutional buyer types as the market matures, helping the price reach our USD 500,000 target level,” Kendrick emphasized. “When institutions buy Bitcoin, prices tend to rise.”

This isn’t Kendrick’s first bullish call. Just last month, he admitted that his earlier $120,000 target for Q2 2025 was “too low,” and revised his year-end projection to $200,000, citing $5.3 billion in U.S. spot BTC ETF inflows over just three weeks.

Standard Chartered’s analysis also suggests that Bitcoin is now increasingly viewed as a macro hedge, rather than a high-volatility tech asset. “It is now all about flows,” Kendrick said. “And flows are coming in many forms.”

Beyond Bitcoin, Kendrick predicts BNB will hit $2,775 by 2028, Avalanche (AVAX) will reach $250 by 2029, and XRP will climb to $12.50 by 2028. He recently trimmed his Ethereum outlook to $4,000 for 2025. He also projects stablecoin markets to grow significantly, reaching $2 trillion by 2028.