Spot Bitcoin ETFs Surge with Record $631M Daily Inflows

Spot Bitcoin ETFs have been experiencing a surge in investor interest, setting new records for daily net inflows.

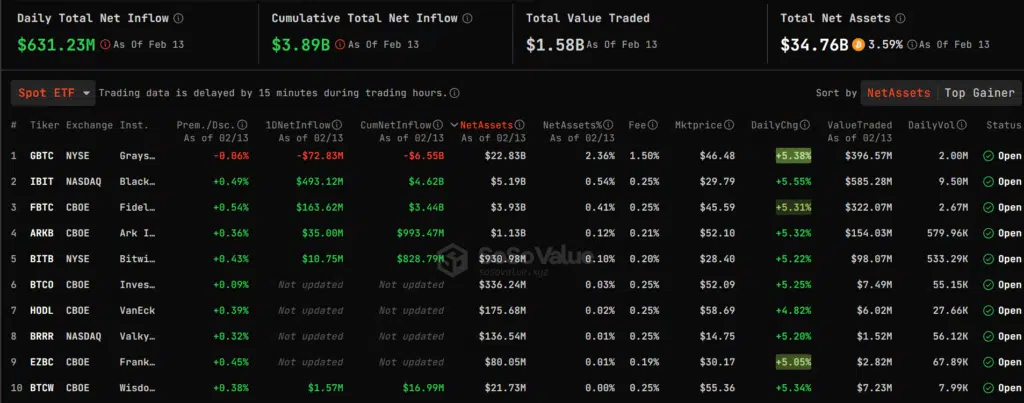

On February 13th, these ETFs attracted over $631 million, coinciding with a decrease in outflows from Grayscale’s converted GBTC.

Excluding GBTC, nine spot Bitcoin ETF issuers witnessed $704 million in inflows, demonstrating a growing demand for exchange-traded funds backed by cryptocurrencies. Among these issuers, BlackRock dominated with 70% of the day’s influx, totaling $493 million.

As a matter of fact, that day marked a historic high for spot Bitcoin ETFs, with the 13th consecutive day of net inflows since trading commenced on January 11th, following approval from the U.S. SEC.

Initially, Grayscale’s GBTC saw significant outflows in the first few trading days after its conversion into a spot BTC ETF, with over $4 billion leaving the fund. However, recent data indicates only $72 million in net outflows for GBTC. Despite this, Grayscale still holds over 467,000 BTC for its GBTC ETF, compared to other issuers amassing over 216,000 BTC in less than three months.

These ETFs have collectively recorded $4 billion in inflows since launch, according to analysts.

The rise in demand for spot Bitcoin ETFs has coincided with a surge in BTC market prices. Bitcoin reached a 25-month high, surpassing $51,000 for the first time since December 2021. This increase in demand has been attributed to the influx of buyers driven by the availability of ETFs.

In fact, the simplified reason behind Bitcoin’s surge is the increase in buyers than sellers, which is driving the market upwards. Bitcoin has surged over 20% in the last week, reclaiming a $1 trillion market capitalization, positioning itself among the top assets globally.

In a separate development, Apollo data reveals that spot Bitcoin ETFs have attracted more net inflows in the last four days of trading than in the entire first four weeks. Ten ETFs generated 43,300 Bitcoin worth $2.3 billion in inflows over the past four days, outpacing the initial weeks’ performance.

Additionally, four spot Bitcoin ETFs, excluding Grayscale, have joined the “billionaire club,” with Bitwise’s Bitcoin ETF BITB being the latest to achieve this milestone. Bitwise’s performance has been particularly notable, being the only crypto-native investment fund among the top providers.

Moreover, BlackRock’s iShares ETF (IBIT) fund became the first Bitcoin ETF to surpass $5 billion in assets under management on February 13th, now holding a total of 105,280 BTC.

The bullish feel surrounding spot Bitcoin ETF flows is widely seen as a key driver behind Bitcoin’s recent rally, as evidenced by its breach of the $50,000 mark on February 12th.

Will the market keep rising?