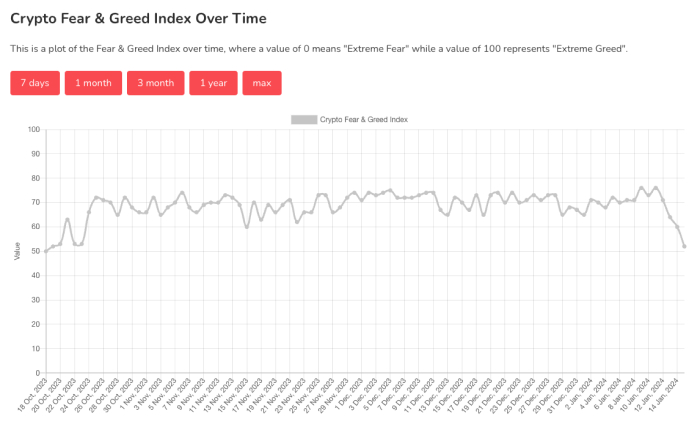

The crypto market sentiment, as reflected by the ‘Crypto Fear and Greed Index,’ has shifted to “neutral” for the first time since October 2023, following almost three consecutive months in the “greed” phase.

The index, a key indicator of crypto market sentiment, made this transition just days after the U.S. Securities and Exchange Commission (SEC) approved 11 spot bitcoin exchange-traded funds (ETFs).

Last week, the sentiment recorded a rather greedy score of 71, only to get to a neutral 52 as of Monday, January 15, 2024.

While prices experienced an immediate surge post-SEC approval, the market has since stabilized. Interestingly, Bitcoin remained largely unaffected by the decision, whereas Ethereum and other altcoins witnessed a significant rise.

The decision by Vanguard not to support spot BTC ETFs may have also contributed to investor sentiment, and Senator Elizabeth Warren’s criticism of the SEC’s approval could have further influenced market perception.

How Does the Crypto Fear and Greed Index Work?

As mentioned, the Crypto Fear and Greed Index, designed to manage emotional behavior in the crypto market, has entered the “neutral” phase after spending months in the “greed” territory.

At the time of reporting, the Index measured 52. On one end of the index is “extreme fear,” signaling a buying opportunity, while “extreme greed” at the other end suggests a market correction.

The index operates on a scale from 0 to 100, with zero indicating “extreme fear” and 100 indicating “extreme greed.”

It is worth noting that this sentiment metric calculates market sentiment based on factors such as volatility (25%), market momentum or volume (25%), social media (15%), dominance (10%), and trends (10%). Surveys are also considered, although the index has temporarily suspended this data source.

Investors, fueled by anticipation of regulatory shifts and the eagerly awaited approval of spot BTC ETFs, exhibited a “greedy” sentiment over the past three months. Historical values of the index indicate a peak score of 67, reflecting increased greed.

As the SEC’s deadline for approving the first spot BTC ETF in the U.S. approached, investor greed intensified, reaching a score of 71 last week.

The recent shift to a “neutral” sentiment signals a potential reevaluation of market dynamics amidst regulatory developments.

As market sentiment hovers in the ‘neutral’ territory, investors remain vigilant for further regulatory developments and potential shifts in the crypto landscape, which are bound to uncover the in the next few weeks.