Luke Dashjr’s Controversial Stance: Ordinal Inscriptions and Bitcoin’s Evolutionary Debate

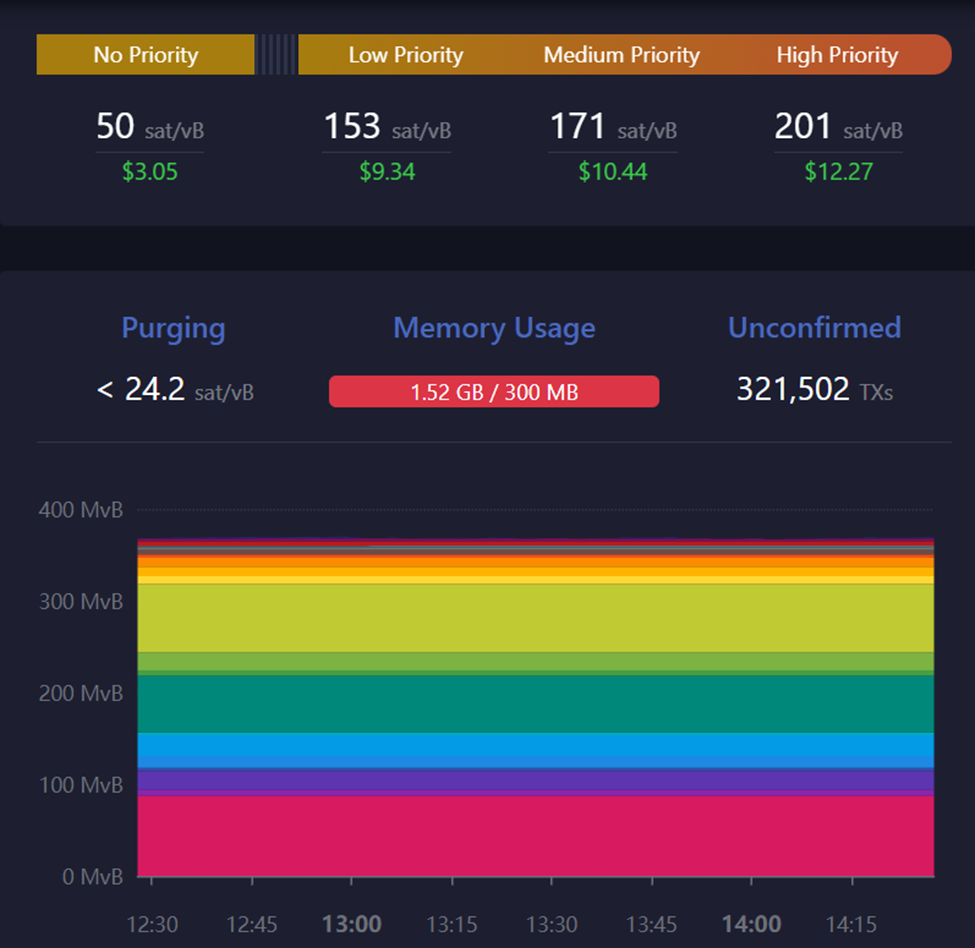

As Bitcoin surpasses $43,000, and unconfirmed transactions surge on the Bitcoin blockchain, the debate surrounding Bitcoin ordinal inscriptions and network congestion has reignited. On December 22, around 320,000 valid transactions were awaiting confirmation by the Bitcoin network, marking a 2-fold increase (106%) from the count observed at the beginning of December (around 155,000 transactions), according to Mempool.space data.

As we approach 2024, the Bitcoin community finds itself at a pivotal crossroads. Conversations regarding Ordinal inscriptions, block size limitations, and the steady rise in transaction fees are exacerbating an evident division. With debates intensifying and transaction backlogs mounting, the idea of a potential fork is gaining traction. By mid-December 2023, the term “bitcoin fork” had reached its peak in Google Trends scores worldwide, signaling a heightened level of interest and apprehension within the community.

For the past decade, Luke Dashjr, Bitcoin Core developer, has played a pivotal role in Bitcoin’s development and open-source software. Recently, his opposition to certain developments within the Bitcoin ecosystem has garnered attention. He’s been critical of Ordinal inscriptions and NFTs on the Bitcoin platform, considering them harmful to the protocol, akin to spam that should have been addressed since 2014.

In a recent post on X, Dashjr highlighted the exploitation of a vulnerability within Bitcoin Core through the implementation of “Inscriptions.” Dashjr argued that this vulnerability is being utilized for spamming the blockchain. He suggested the possible employment of “covert” ASIC Boost techniques by Antpool and emphasized the community’s ability to oust miners by changing the Proof of Work (PoW) algorithm.

Despite various projects like OnChain Monkey, Ordinal Punks, and Taproot Wizards introducing the Inscriptions framework on the Bitcoin blockchain, Dashjr specifically singled out Ordinals as a significant element in the ecosystem that could become obsolete if the upcoming Bitcoin improvement, v27, is implemented next year.

Bitcoin Ordinals and Network Vulnerabilities

Bitcoin Ordinals is a protocol enabling unique identification and supplementary data inscription for individual satoshis, the smallest Bitcoin denomination. This inscription process involves assigning a distinct identifier to each satoshi along with extra information. Each satoshi receives a serial number based on its mining sequence, termed an “ordinal.” The inscribed data encompasses various content like images, videos, text, etc., effectively crafting exclusive and limited digital assets on the Bitcoin blockchain, akin to non-fungible tokens (NFTs).

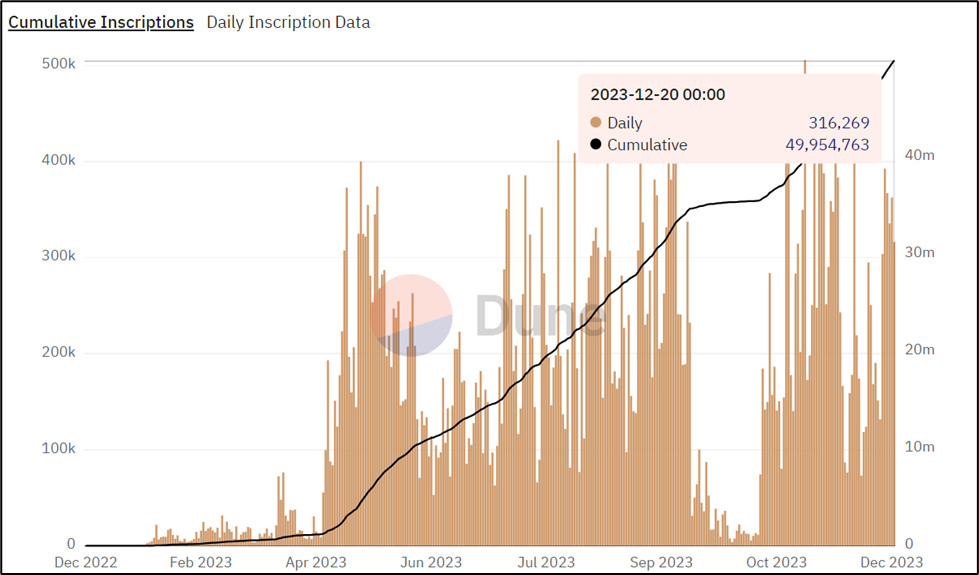

On December 20, the total number of ordinals inscriptions was 49,954,763 of which were 42,611,469 BRC-20 events, according to Dune Analytics data.

Introduced in January 2023, the Bitcoin Ordinals protocol has sparked both enthusiasm and debate within the cryptocurrency community. Advocates are excited about its potential, while critics raise concerns. Detractors argue that Ordinals might strain Bitcoin’s network capabilities and scalability due to the additional storage and processing demands they impose.

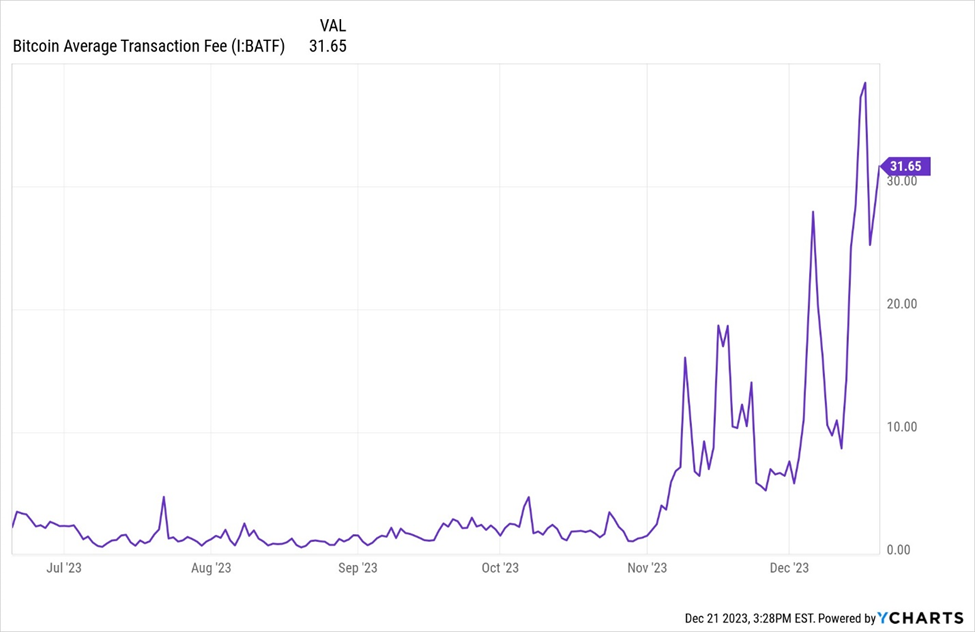

The substantial data tied to Ordinal inscriptions and the resultant increase in demand for block space could lead to escalated fees and network congestion. In fact, accompanying the recent surge in unconfirmed Bitcoin transactions, bitcoin average transaction fee has increased by more than 3-fold within 10 days, from 8.96$ on December 12 to 31.65$ on December 21, according to YCHARTS data. Furthermore, some assert that Ordinals represent a misapplication of the Bitcoin network, consuming its scarce resources by necessitating extra storage and computational power.

Bitcoin Vulnerability

Since 2013, Bitcoin Core has enabled users to set a limit on the additional data size in transactions they transmit or mine, referred to as “datacarriersize”. Dashjr contends that Inscriptions exploit this by disguising data as program code, sidestepping the limit. This tactic worsens existing issues within the Bitcoin ecosystem, evident in the backlog of over 320,000 unconfirmed transactions as of December 22, according to Mempool.space data. As a result, transaction fees soar due to heightened competition for block space. These larger inscription transactions drive memory usage beyond the allocated 300mb threshold. Moreover, transactions with fees lower than $3.05 are being deprioritized in the network.

Dashjr emphasized that this issue has already been resolved in Bitcoin Knots v25.1, although its resolution was delayed due to disruptions in his workflow toward the end of the previous year. Despite the fix in Bitcoin Knots, the forthcoming v26 release of Bitcoin Core remains susceptible. The Bitcoin Core developer expressed hope that a conclusive solution will be implemented before the launch of v27 next year.

Similar scenarios occurred earlier. When Ordinals gained traction in May, Binance halted bitcoin withdrawals due to a surge in unconfirmed transactions reaching 400,000, overwhelming Bitcoin’s network.

Opinions vary widely. Critics like Dashjr warn of risks posed by such innovations, while Ordinals’ proponents view them as a blockchain evolution. Jason Fang, managing partner and co-founder of Sora Ventures, disagrees and asserts that Bitcoin adheres to its original consensus while allowing for innovative layers, a stance aligned with Satoshi’s open-source philosophy that fosters experimentation. Fang acknowledges Inscriptions’ momentum, noting their ability to boost miner profits and adoption despite the challenges.

Dashjr’s Controversial Remarks and Engagements

In various interactions, Dashjr made controversial remarks. He mentioned filtering specific transactions in his operated pool “Ocean Mining pool”, criticized Ordinals enthusiasts, and highlighted their potential legal consequences. Responding to a user, he bluntly stated that scamming in the name of Bitcoin harms everyone.

Engaging with Adam Back, Dashjr discussed the difficulty in stopping Ordinals and highlighted the potential scenario where bad actors could bribe miners to attack Bitcoin. He proposed that if miners were to engage in malicious activities, the community could effectively render their hardware useless by changing the PoW algorithm. Moreover, Dashjr theorized about Antpool’s mining behavior, linking it to the use of old ASICs incompatible with Segwit, which, in his opinion, might lead to the creation of entirely empty blocks.

However, Dashjr’s comments have drawn criticism and mockery on social media platforms like X (formerly Twitter), with Taproot Wizard founder Udi Wertheimer sharing screenshots of Dashjr’s statements and expressing disdain for his viewpoints. “Cat-eater [Luke Dashjr] actually believes that if bitcoin miners don’t censor inscriptions for him, he’ll just change the proof of work algorithm and put them out of his business … he’s deranged,” commented Wertheimer.

Ordinals Fad turns into Windfall Profits for Miners

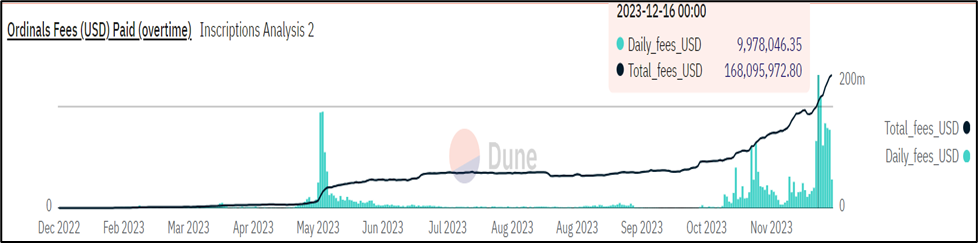

While the Ordinals have caused debates within the community, they’ve proven to be lucrative for Bitcoin miners. The exponential increase in daily income from fees, soaring to $63 million, demonstrates the financial windfall miners are experiencing, almost quadrupling the two-year average.

According to data from Dune Analytics, miners generated almost $10 million in transaction fees from Ordinals on December 16, and another $8.3 million the next day. The total amount of transaction fees from Ordinals accumulated by miners during 2023 is $172,354,463 as of December 22. This surge underscores heightened engagement and enthusiasm surrounding Ordinals.

Moreover, this surge in profits for miners has translated into a significant boost for Bitcoin mining stocks, outperforming the price performance of Bitcoin itself. Stocks like Marathon Digital, Riot Platform, and Cleanspark have rallied notably, showcasing their resilience and profitability amid this trend. In 2023, Marathon’s shares and Riot’s shares have increased by around 500% and 400%, respectively.

Overall, this data emphasizes the tangible economic implications of Ordinal inscriptions on the Bitcoin blockchain, impacting transaction fees, miner profits, and the performance of associated mining stocks.

Balancing Innovation and Integrity in Bitcoin’s Evolution

Regarding the potential changes to Bitcoin’s protocol suggested by Dashjr, it’s a contentious proposal. On one hand, it demonstrates the power and autonomy the Bitcoin community holds in steering the network’s direction, potentially deterring malicious behavior by miners. However, the idea of changing the proof of work algorithm raises concerns about network disruption, eroding miner confidence, and the risk of further centralization.

As for Ordinal inscriptions, the discussion showcases the inherent conflict between innovation and preservation within the Bitcoin ecosystem. Supporters advocate for innovation, diversification, and expanded utility, while opponents prioritize protocol integrity, avoiding network bloat, and preventing potential community division.

Ideally, a balance must be struck between innovation and the core principles of Bitcoin. It’s essential to foster innovation while safeguarding the network’s integrity and security. Constructive discussions and compromises should guide protocol changes, ensuring they align with the ethos of decentralization and user consensus that underpins Bitcoin’s success.