Bitcoin Surges Beyond $41K, Highest Since April in Pivotal Momentum

Bitcoin‘s resurgence beyond the $41,000 mark for the first time this year marks a pivotal moment, riding a wave of momentum fueled by multiple factors.

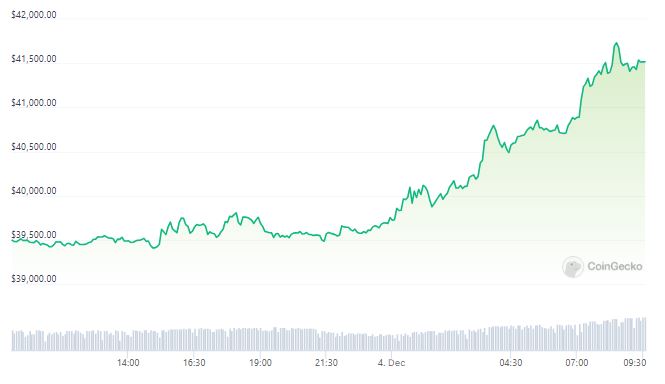

As enthusiasm swells around potential U.S. interest rate cuts and the imminent approval of U.S. stock market traded bitcoin funds, the world’s largest cryptocurrency hit a staggering $41,522 on Monday.

Source: CoinGecko

This surge, its highest since April 2022, signifying a major shift from the gloom that had shrouded crypto markets post the collapse of FTX and other crypto businesses in 2022.

According to Reuters, Justin d’Anethan, the Head of Business Development for Asia-Pacific at Keyrock, a digital assets market-making firm, remarked that the recent 50% rally since mid-October signals a decisive departure from the bearish sentiment of 2022 and early 2023.

He pointed out evidence of institutional buying throughout November as an indicator of renewed interest, suggesting that while reversals are plausible, the lows around $16,000 a year ago likely marked the bottom.

Microstrategy (MSTR.O), a significant Bitcoin investor, also disclosed a staggering $593 million in additional bitcoin purchases during November, underlining growing confidence in the cryptocurrency.

Simultaneously, riskier investments and interest-rate sensitive assets like gold have experienced substantial rallies, signaling market confidence in the U.S. Federal Reserve’s expected shift from rate hikes to cuts in early 2023.

The anticipation surrounding the U.S. Securities and Exchange Commission‘s decision not to contest a court ruling, which found the agency’s rejection of an exchange-traded fund application unjustified, has bolstered hopes for an eventual ETF approval.

The potential advent of a spot bitcoin ETF could potentially lure cautious investors into the crypto space through the stock market, injecting fresh capital into the sector.

It is worth noting that Ethereum’s native coin, Ether, also hit a 1-1/2 year high on Monday, surging to $2,253. However, both Bitcoin and Ether are still significantly below their 2021 record highs, hovering above $60,000 and $4,000, respectively.

The current surge in cryptocurrencies hints at renewed positivity, but whether this momentum will persist into 2024, setting the stage for a bullish market, remains an open question.

On another note, during Monday’s Asian session, the price of gold soared to a new record high, surpassing the significant milestone of $2,100.