Cryptocurrencies in the Crossfire: Understanding the Impact of the Israel-Palestine War

As clashes intensify between Israel and Palestine, HAYVN Research explores the conflict’s broader potential impact on digital asset markets.

Cryptocurrency’s interface with geopolitical turmoil extends from inflation hedges to censorship-resistant transactions, playing a multifaceted and nuanced role amidst instability.

This analysis explores the potential impacts of the ongoing Israel-Palestine war on cryptocurrency markets. Our core analysis will focus on conceptualizing and evaluating the downside risks to crypto liquidity amid geopolitical tensions.

We will specifically discuss stablecoin vulnerability to outflows as rising Treasury yields increase the opportunity cost of holding crypto. However, prudent policy decisions around stimulus financing could mitigate liquidity declines. Alternative options like budget reallocation may provide regional aid without exacerbating crypto capital flows.

After establishing this liquidity risk perspective, the report provides an overview of how Bitcoin and other asset classes have historically performed during conflicts for context. We analyze past reactions, inflation risks, and geopolitical factors to derive useful lessons and illuminate areas requiring further investigation.

This enables readers to better comprehend potential impacts and avoid being caught off guard by further escalations in the current or future conflicts. As cryptocurrencies increasingly integrate with the global financial system, developing rigorous frameworks to analyze their shifting roles during episodes of upheaval becomes critical. This exploration aims to catalyze that vital process by looking in the right places and distilling key insights to guide additional research.

Crypto Market Recap

Cryptocurrency markets faced evolving headwinds over the past week tied to both escalating geopolitical tensions and intensifying legal pressures in the industry. These dual risks have fueled a downer mood and downward price momentum, though some potential tailwinds around ETF approvals remain on the horizon.

The rapidly expanding war between Israel and Palestine has been an overhang on investor sentiment. As missile strikes intensify and military forces mobilise, risk appetite has diminished. Further escalation poses threats to regional stability and economic activity. Media narratives around terror groups exploiting crypto financing channels have also resurfaced, injecting negative attention. Moreover, broader risk of restrictive policies has emerged as Middle Eastern regulators combat illicit financing

Governments facing external threats and social tensions often harden financial oversight. This could jeopardize the liberalization momentum seen in the region’s “crypto hub” aspirations. If major economies like the UAE recalibrate digital asset strategies, it could critically impact adoption trends.

These rising geopolitical uncertainties have aligned with pre-existing monetary tightening headwinds to create a pronounced risk-o” mood. According to core tenets of behavioral finance, investors do not always act rationally but are influenced by cognitive biases and emotions:

One key bias is narrative instinct – human psychology is wired to construct narratives from news events and extrapolate those stories into the future. When faced with negative geopolitical narratives around conflict and terrorism, investors intuitively anchor on worst-case outlooks.

The affect heuristic is also relevant – emotionally charged news events like missile strikes or militant clashes can spur knee-jerk fear reactions that overwhelm rational calculus. These innate biases contribute to risk-o” herd behavior as investors’ animal spirits get swept up in market manias or panics.

Behavioural finance models like prospect theory show that investors are loss averse and give disproportionate weight to downside risks rather than potential upside. This fuels overreactions and flights to safety amid negative headlines or uncertainty.

Asset prices frequently overreact to salient news events before partially recovering. However, the depth of misconduct uncovered also signals genuine risks that speculative excess has distorted network valuations. Trust must be re-earned through transparency and accountability. Until then, technicals may remain vulnerable to headline whims due to fragile investor psychologies.

Currently, the geopolitical narratives and tightening monetary policy appears to be driving some capital rotation into safe havens. However, behavioral biases frequently lead to excessive, irrational pessimism that is ultimately reversed once stability returns.

The high-profile trial of FTX founder Sam Bankman-Fried has continued to cast a pall over the industry’s reputation. As proceedings dissect systemic issues plaguing the broader ecosystem, related asset volatility has emerged. For example, Solana saw notable declines after repeated mentions during testimony. This indicates that legal scrutiny of the space remains an overhang on values.

How the Israel-Palestine War Could Influence Crypto Liquidity

The latest flare up of violence between Israel and Palestinians in Gaza carries significant geopolitical risks that could spill over into the cryptocurrency ecosystem. The magnitude of potential impact will depend largely on how the United States elects to financially support Israel in this conflict.

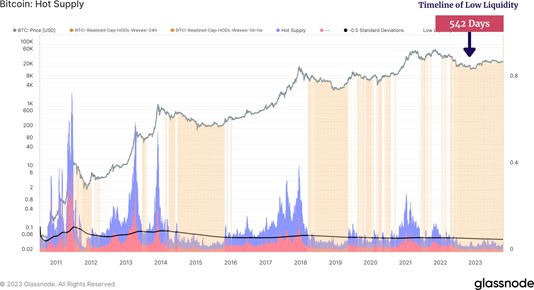

Crypto markets are already facing headwinds from a risk-o” investment environment of high inflation and rising interest rates. On-chain data reflects these liquidity pressures, with Bitcoin’s Hot Supply – the volume transacted within the past week – remaining below its long-term average minus 0.5 standard deviations for over 540 days now. This on-chain liquidity metric indicates very subdued transaction activity, bearing similarities to previous bear market regimes in 2014-15 and 2018-19.

Additional US military support for Israel funded through debt expansion could put further upward pressure on Treasury yields, accelerating capital outflows from cryptocurrencies into fixed income assets. However, prudent fiscal policy decisions by US lawmakers could mitigate or avoid exacerbating current crypto market dynamics. Overall, while on-chain data shows crypto liquidity is already constrained, prudent stimulus policy could avoid worsening outflows amid geopolitical tensions.

Investor Behavior in Wartime: Rotating to Safety

Economic principles around investor risk appetite and asset valuation provide useful frameworks for analyzing how the Israel-Palestine war may influence cryptocurrency prices. During periods of uncertainty like wartime conflict, investors tend to become more risk-averse, seeking to minimize potential losses by rotating into asset classes perceived as safe havens.

US Treasury bonds have historically served this role during past military engagements and geopolitical crises. If Treasury yields rise due to US deficit spending on Israeli aid, the opportunity cost of holding higher-risk cryptocurrencies also increases. Investors are likely to shift capital accordingly based on relative return profiles between asset classes.

However, the magnitude of cryptocurrency price impact is difficult to quantify definitively, even if capital outflows accelerate. Unlike traditional assets like bonds or equities, cryptocurrency valuations do not have clear fundamental underpinnings.

Prices are driven primarily by speculative market demand rather than measurable cash flows or earnings. This makes predicting the scale of potential sell-offs in response to exogenous shocks like geopolitical conflicts very challenging. Any analysis should be cautious about making concrete price forecasts, rather than simply directing attention to likely incentive shifts between asset classes.

Stablecoin Vulnerability: Can Markets Withstand Regional Strife?

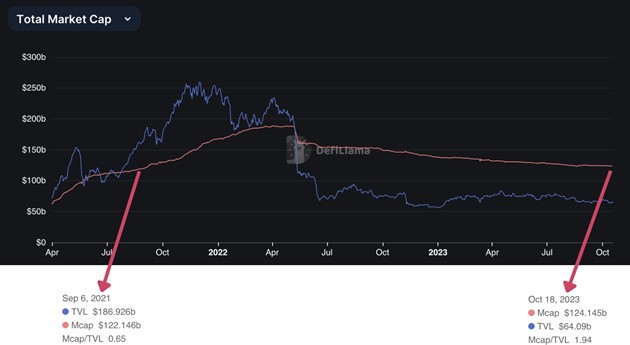

Stablecoins may face particular downside risks from rising Treasury yields given recent market trends. Over the past 18 months, stablecoin capitalization has declined from around $170 billion to under $125 billion as of September 2022, a level not seen since September 2021. A key driver has been rotation into Treasuries and other fixed income assets amid rising interest rates.

As yields on “risk-free” US government bonds exceed near-zero stablecoin savings rates offered in DeFi protocols, investors are incentivized to rotate into higher-yielding fiat savings.

Several interrelated mechanisms underlie this yield-driven rotation into fixed income:

Opportunity Cost: When interest rates on traditional assets like Treasury bills and bonds rise, they offer investors a more attractive risk-free return. This creates an opportunity cost for investors considering high-risk investments like cryptocurrencies or DeFi assets. They may prefer the relatively stable returns of traditional assets over the volatility of cryptocurrencies.

Liquidity Concerns: High interest rates can make borrowing more expensive, which can be detrimental to businesses and individuals. In the context of DeFi, it may become costlier for borrowers to take out loans or leverage their positions. This can lead to concerns about liquidity in DeFi platforms, as borrowing becomes less attractive and investors may want to reduce their exposure to these riskier assets.

Reduced Liquidity: As investors shift their capital to more traditional, less volatile assets, it can result in reduced liquidity in the cryptocurrency and DeFi space. Lower liquidity can lead to more significant price swings and potentially more pronounced market turbulence, which can deter risk-loving investors.

If the Israel-Palestine war results in expansionary US fiscal policy and further rising Treasury yields, it could accelerate this rotation out of stablecoins. However, the extent of impact is again difficult to quantify definitively. Addressing uncertainty and verifying assumptions around capital flows out of stablecoins should take priority over making numeric market predictions. And other exogenous factors beyond geopolitics are also driving crypto sentiment, making isolation of a single conflict’s impact challenging.

Policy Pathways to Bolster Crypto Markets

Rising US government debt and Federal Reserve interest rates have already fueled outflows from cryptocurrencies this year. However, there are policy alternatives for funding Israeli military aid that could avoid exacerbating this dynamic. Rather than issuing large amounts of new Treasury bonds, financing could be achieved by re-allocating existing aid budgets, increasing taxes, or cutting other spending priorities. Each option carries its own economic and political trade-offs. Nevertheless, they demonstrate pathways for providing emergency Israeli assistance without worsening the yield incentives pulling capital out of crypto markets.

Even in a scenario of Treasury yield increases, the composability and innovation potential of decentralized finance may offer risk mitigation. Protocols introducing on-chain US Treasuries could allow stablecoin yields to remain competitive, providing investors an alternative to shifting back into traditional fixed income markets.

However, this “Treasuries as collateral” model for DeFi faces adoption obstacles and the constraint of still requiring regulatory approval before viability. Further research is warranted on incentive structures and technical barriers.

In essence, financial support for Israel tied to expansionary fiscal policy would risk accelerating cryptocurrency price declines. But the ultimate market impact is contingent on multiple mediating factors beyond just war stimulus.

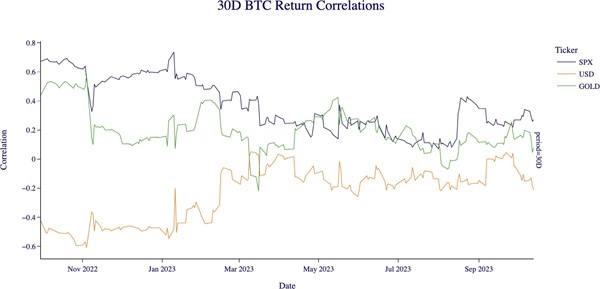

Treating interest rates as the only economic variable risks oversimplification. For example, higher yields may strengthen the US dollar, which has shown a positive correlation to Bitcoin prices in past markets. A weaker growth outlook from prolonged conflict could also influence Fed rate hike timing. Focusing too narrowly on Treasury yields misses important macroeconomic linkages. There may also be higher-order effects like impacts on lending activity or wage growth that subsequently influence crypto asset valuations.

Incorporating a range of scenarios and alternative funding options allows for more nuanced conclusions. Assessing relative likelihoods can also ground analysis without overstating precision. Ultimately, while economic theory provides a useful framework, direct market predictions involve significant uncertainty. The intention should be illuminating areas of potential risk rather than portraying any outcome as predetermined.

Crypto and Conflicts

Bitcoin and Other Asset Reactions Amid Geopolitical Tensions

The latest escalation in the long-standing Israel-Palestine war adds further uncertainty to already turbulent global markets. On October 7th, the largest armed clash between Israel and Hamas in 50 years broke out. This geopolitical crisis comes amid a challenging backdrop of high inflation and interest rates weighing on risk assets like cryptocurrencies.

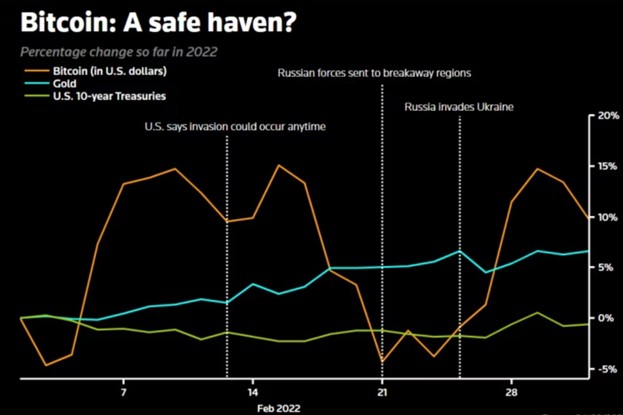

Many have regarded Bitcoin as a potential safe-haven asset akin to “digital gold.” However, its performance during this recent clash challenges that narrative. Both Bitcoin and Ethereum declined as tensions flared up, contrasting with resilience shown during 2020 US-Iran tensions and the 2022 Russia-Ukraine war.

Further escalation risks accelerating energy price inflation, intensifying expectations of tighter monetary policy – a key headwind for crypto markets. It is important to monitor energy trends closely given historical precedent that oil spikes tend to spark a wave of risk-off selling.

Cryptocurrencies exhibited initial volatility but have since rebounded as the crisis remains contained so far. Israel has already moved to freeze Hamas-linked crypto accounts identified as funneling terror funds, but broader impacts on the asset class remain uncertain.

Geopolitical events like the recent Russia-Ukraine war present significant challenges for investors attempting to time markets or predict outcomes. The highly fluid nature of geopolitics generates uncertainty and volatility across assets, including cryptocurrencies.

While historical data provides some useful context, each conflict has unique characteristics and pivotal uncertainties that make short-term forecasting precarious. Escalations or de-escalations in tensions can shift market sentiment rapidly.

Acute phases of geopolitical tension, such as the current clashes between Israel and Hamas, typically produce an initial “flight to safety” reaction across assets.

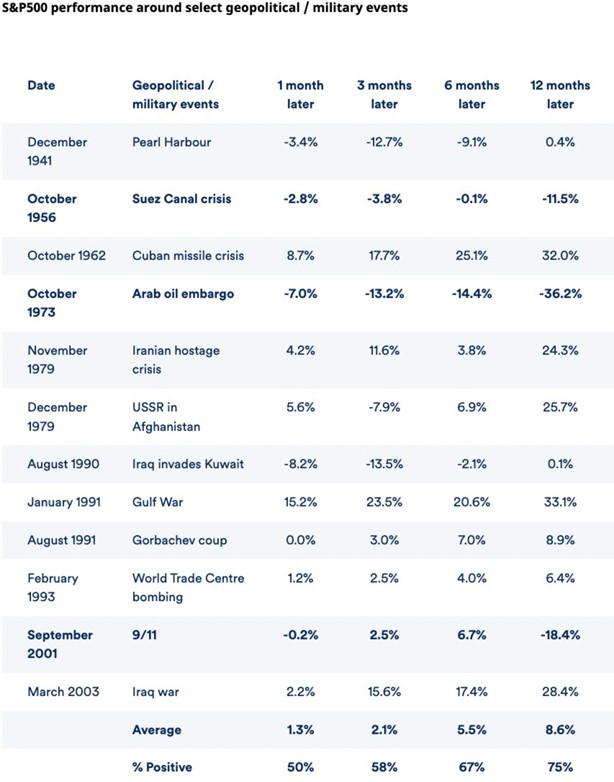

Some assets often face selling pressure, evidenced by some drawdowns reaching up to -3% to -13% in the 3 months following a major conflict.

In fact, investors flock to safe haven assets like gold, Treasuries and the dollar during periods of uncertainty. This motivates a temporary reallocation away from comparatively riskier assets like stocks and cryptos.

Bitcoin’s growing reputation as “digital gold” has provided some insulation from broader market movements, but prevailing risk-off sentiment still weighs on prices. However, per Mean Reversion theory, markets tend to bounce back and regain an upward trajectory over longer timeframes.

The data shows that in instances where geopolitical tensions were present, the S&P 500 index nonetheless posted positive returns over the subsequent 3 month period in 58% of cases on average. This suggests that while geopolitics can contribute to market volatility in the near-term, equity markets have historically proven resilient to geopolitical shocks over a 3 month time horizon.

Furthermore, returns normalize to 8.6% – in line with broad equity market returns – in the 12 months following acute geopolitical shocks. This aligns with the adaptive market hypothesis, whereby market participants collectively process new information before reaching an equilibrium.

The scale of the war is a key variable determining the recovery timeline. Larger multi-national wars cause more severe disruptions to economic activity and global supply chains, undermining profitability and asset valuations. Conversely, isolated clashes have more localized impacts, enabling faster normalization as the events fade into the background.

Cryptocurrencies have only been tested by limited modern conflicts so far. The 2022 Russia-Ukraine war provides one case study, where Bitcoin saw a 17% reversal after an initial spike.

There is also a case for opportunistic buying during war-induced capitulation. Assets become undervalued relative to fundamentals given heightened risk aversion. Dollar cost averaging into these “geo-dips” can yield strong returns once stability returns.

Of course, this requires strong risk management and conviction in the asset’s long-term viability. Overall, while volatility arises in the short-term, historical data and economic frameworks suggest markets often shrug off geopolitical instability over the medium to long term.

The 2022 Russia-Ukraine war offers limited insights into how cryptocurrencies perform during acute geopolitical crises due to conflating market dynamics. In the build-up to Russia’s invasion, major cryptocurrencies like Bitcoin and Ethereum initially rallied, potentially pricing in heightened geopolitical risks.

Digital assets then saw double-digit percentage drawdowns in the weeks following the invasion as investor risk appetite evaporated. On the surface, this closely correlated with the performance of traditional barometers like the S&P 500, challenging notions of crypto as an uncorrelated asset class during financial turmoil.

Meanwhile, classic safe-haven assets including gold and Treasuries posted gains.

But zooming out, the subsequent crypto downturn was clearly exacerbated by structural fragilities like the LUNA/UST implosion and FTX bankruptcy. Isolating the war’s causal impact from these idiosyncratic factors is methodologically difficult.

Correlation does not necessarily imply causation. That said, Bitcoin’s initial ability to rally on news of impending conflict does lend some credence to its burgeoning reputation as “digital gold” – a flight-to-safety asset amid geopolitical instability.

Though crypto’s high beta to macro conditions was also highlighted, Russia’s motivations behind the invasion also have downstream implications. Experts cite rising geopolitical assertiveness to counterbalance NATO as a key driver behind Russia’s actions. This great power competition could raise instability and sanctions risks, weighing on global growth.

The invasion also signals reduced geopolitical risk aversion. Rising tensions between rivals like China and Taiwan could ripple through markets. Political instability appears set to remain elevated relative to the previous decade’s period of low volatility between major powers. This backdrop of uncertainty and fragility favors safe haven assets, at least initially. Though as markets price in risks, mean reversion dictates assets which often overshoot then stabilize over the medium term. Hence, sell offs induced by acute phases of conflict may present opportunistic accumulation zones from a contrarian standpoint.

Wars and conflicts also threaten to exacerbate inflation and disrupt supply chains. Commodity price shocks in particular can accelerate input costs and trigger production bottlenecks. Energy and food inflation could place further burdens on consumers and businesses worldwide.

Conferring to a detailed thread by Bob Elliot, the CIO at UnlimitedFnds, we can see how most portfolios are poorly constructed for periods of geopolitical conflict which create rising inflation, strain resources, and hamper growth.

Wars and Portfolios

Wars inherently strain resources and lift inflation, as productive capacity is diverted towards destructive rather than value-adding ends. Input costs also rise as key materials are utilized for military applications. According to monetarism, currency debasement accelerates to finance escalating government expenditures.

Historically, bonds have faced falling real yields as issuance rises to fund conflicts while rates are suppressed to control debt servicing costs. However, expanded debt burdens the fiscal stability long-term. Stocks also suffer from uncertainty before recovering as victory odds improve.

This exemplifies how markets exhibit an initial flight to safety reaction, as geopolitical uncertainty rises, in line with the historical performance of the S&P 500. However, as the conflict trajectory becomes clearer, markets tend to recover per the uncertainty aversion principles of prospect theory. Nonetheless, each conflict possesses unique contours influencing the recovery timeline.

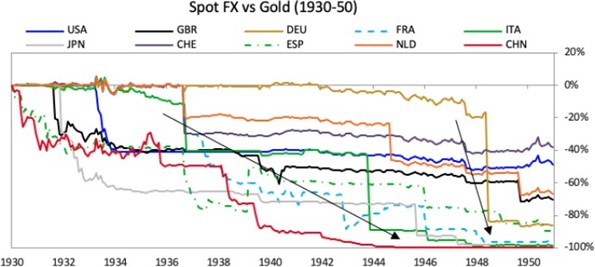

While gold was not floating in the US during certain wartime periods, looking at other countries provides useful insights.

Many countries saw significant currency devaluations relative to gold, suggesting gold would have provided a good inflation hedge and store of value amid currency debasement risks.

Government bonds face declining real yields as debt monetization rises to fund wars. This fiscally unsafe trajectory weighs on bonds long-term despite initial rate suppression. Regarding crypto, its reputation as a non-sovereign asset could attract in unstable regions. But tails risks around government bans should be monitored.

Mainstream adoption in large markets also enhances legitimacy and stability. Geopolitics is likely to be a persistent driver of crypto volatility.

Inflationary Pressures and Interest Rates During Wartime Conditions

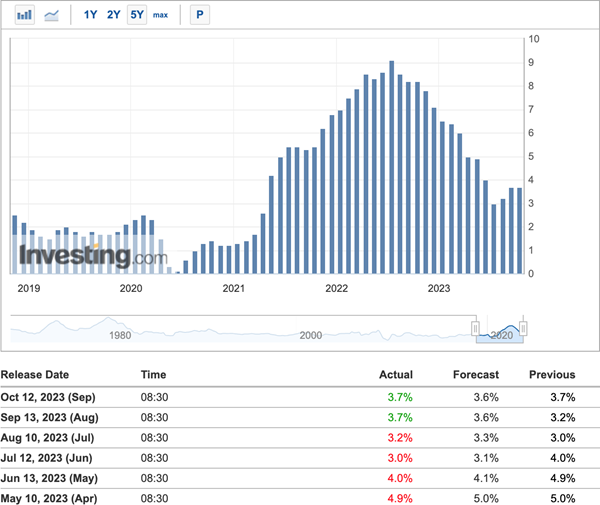

The upcoming CPI release will provide critical insights on inflation trends, influencing Fed policy amid geopolitical tensions between Israel and Palestine.

Markets currently expect steady rates near-term per recent guidance. However, a significant conflict escalation could upend Fed projections by accelerating inflation, forcing additional tightening and sparking a decline.

This week’s CPI print offers important clarity on inflation amid the Fed’s ongoing tightening cycle to restrain rising prices. The past CPI report showed slight uptick, keeping the Fed on its rate hike path. But downside surprises in the data could signal peaking inflation, allowing the Fed to moderate its stance.

Markets currently anticipate the Fed will hold rates steady near-term. Fed fund futures show an 89% probability that rates remain unchanged at the November 1st FOMC meeting. For the December 13th meeting, odds of no hike stand at 70%.

Nevertheless, a sizeable flare-up in Israel-Palestine hostilities has potential to alter the Fed’s policy trajectory by accelerating inflation if energy and commodity prices spike materially higher.

In this scenario, the Fed may hike rates more aggressively than projected to counter intensifying inflationary pressures. As mentioned earlier, conflicts strain resources as productive capacity shifts to destructive ends, reducing aggregate supply and lifting prices. Oil and food costs also typically rise amid Middle East strife as they gain a geopolitical risk premium.

If energy and agricultural commodities spike, this filters into production, transportation and CPI according to cost-push theory. Firms raise prices to protect margins as input costs increase. More expensive oil also directly lifts CPI through its household energy weighting and pass-through effects. Overall, this intensifies inflation momentum. As the mandated inflation targeter, the Fed comes under pressure to tighten policy to counter rising prices, even if previous projections suggested steadier rates.

Per the Fisher equation, the Fed must hike nominal rates to lift real rates alongside accelerating inflation. But tighter policy slows growth by increasing debt servicing costs. Slower growth then depresses equity valuations based on discounted cash flow models.

In this environment, higher-risk cryptocurrencies like altcoins would likely see more pronounced drawdowns versus Bitcoin. This follows capital asset pricing model logic around beta to systematic risk.

In short, risk assets would likely sell off as rates rise while Bitcoin’s nascent safe haven narrative could be tested. Overall, monitoring for inflationary spillovers from geopolitics remains prudent despite current steady policy pricing.

Geopolitics will remain an inherent source of crypto volatility. The rapidly escalating war between Israel and Palestine injects further uncertainty into cryptocurrency markets already facing myriad risks. However, by leveraging interdisciplinary frameworks spanning geopolitics, economics, and behavioral finance, investors can contextualize likely impacts amid the complexity.

Key Takeaways

- Prolonged turmoil poses threats, but history shows markets exhibit resilience after digesting risks. Patience and perspective are virtues during volatility.

- Bitcoin’s safe-haven narrative could be tested if oil supply disruptions accelerate inflation. But performance remains contingent on evolving macro backdrops.

- Expansionary fiscal policy and higher Treasury yields may accelerate stablecoin outflows as fixed income becomes more attractive.

- Multiple mechanisms like opportunity cost and liquidity concerns could drive this rotation from stablecoins into Treasuries.

- On-chain Treasuries could help stabilize lending markets if geopolitical tensions push government bond yields higher.

- Alternative policy options like budget reallocation may provide regional aid without exacerbating crypto capital outflows.

- Holistic analysis is required on the complex interplay between conflict, fiscal policy, yields, and cryptocurrency flows.