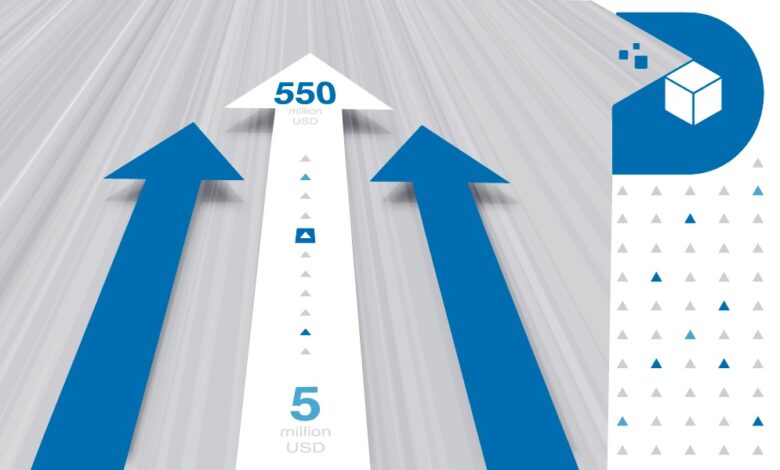

DIFX Cross Asset Digital Exchange grows to 550 million USD in assets UM with Fireblocks

Digital Financial Exchange (DIFX), a centralized cross-asset digital exchange, grows its assets under management from 5 million USD to 550 million USD after integration with award-winning digital asset and crypto technology platform, Fireblocks.

Our team can focus on serving clients

Jeetu Kataria CEO of DIFX states, “I knew since our launch in 2020 that choosing the right crypto custody infrastructure partner was essential to our success and that achieving a strong return on investment was critical for our new trading platform. With Fireblocks, our team can focus on serving clients instead of manually managing digital assets.”

Thousands of crypto businesses use Fireblocks’ platform to access DeFi and Web3 applications and leverage the company’s suite of tools for securing custody of funds, managing their crypto and digital asset operations, tokenizing assets and building new Web3-compatible products and services.

In 2020, Fireblocks launched MPC-CMP, an open and free-to-use MPC protocol to improve the transaction speed for secure digital asset transfer by 800%.

Fireblocks provides custody and tools increasing trading efficiency

After three months of intense research, DIFX chose Fireblocks because it was the only end-to-end solution that offered a secure direct custody technology alongside tools for increasing trading efficiency and automating operational processes and policy workflows. For example, the Ethereum Gas station utilized by DIFX sets gas fee limits by automating and batching ETH transactions to minimize fees and manual refuelling.

Furthermore, both the DIFX Spot exchange and MT5 platform leverage Fireblock’s direct custody technology to ensure the safety and security of both traditional and digital assets. The implementation serves as an additional bridge in connecting the digital and traditional assets as per the mission of DIFX and gives that extra layer of security desired by millions of traders across the globe.

Saving in operational expenses

The results speak for themselves. Since rolling out Fireblocks, DIFX has scaled at a remarkable rate. As Kataria explains, “We grew from 5 million USD assets in custody in 2020 to 550 million assets in custody today after rolling out Fireblocks in Spring of 2021. This is an increase of 10,900 per cent. In addition, we are saving around 100,000 USD per year in operational expenses using Fireblock’s policy engine and authorization workflows and 40,000 USD yearly in ERC-20 gas fees.” DIFX noted that many clients prefer to transact on DIFX because it is secured by Fireblocks MPC Wallet.

Providing the flexibility to adapt and scale

Michael Shaulov, CEO and Co-Founder, of Fireblocks, said, “We are always pleased to see clients such as DIFX benefit and grow from the products and services we offer. At the end of the day, we strive to provide clients like DIFX with the flexibility to adapt and scale their businesses and enable them to easily and securely bring digital asset products to market. We look forward to working alongside DIFX as they continue to adapt and innovate in this fast-paced industry”